(WP out w/ @nberpubs and presented at @BrookingsEcon Spring 2020 BPEA. Ungated link scholar.harvard.edu/stansbury/rese…)

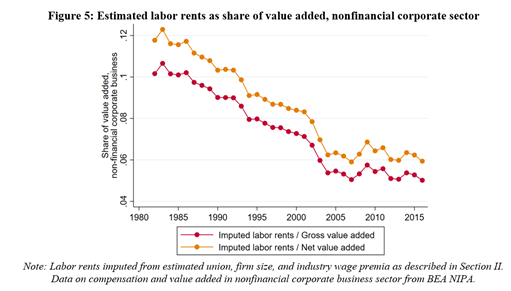

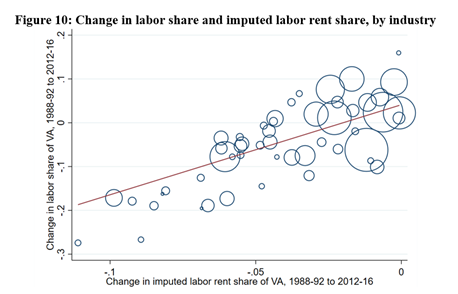

(1) the entirety of the decline in the labor share,

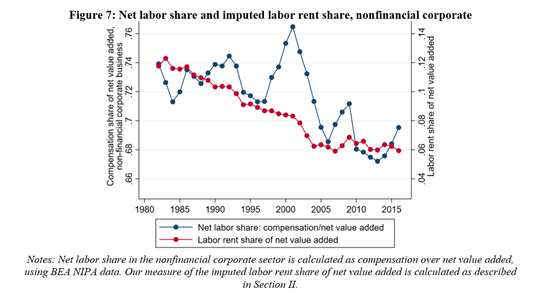

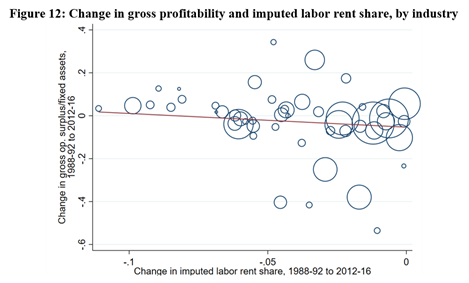

(2) much of the increase in corporate valuations, profitability, & measured markups,

(3) a large share of the fall in the NAIRU

[2/N]

If firms have some monopoly power & earn rents, worker power means workers receive a share of rents. As worker power falls, rents are redistributed from labor to capital, leading to ⬇️labor share, ⬆ profitability & Q [5/N]

On the basis of most models, you'd expect a decline in worker power to lead to a fall in the NAIRU... [11/N]

What about those explanations? [14/N]

(1) the labor share decline has been bigger in US than other countries, & (2) trends in Q, profitability, markups are hard to explain under perfect comp, suggesting a role for country-specific non-competitive factors [15/N]

(1) declining worker power can explain aggregate trends in labor share, Q, profitability, markups equally well,

[17/N]

*defining monopsony as arising from elasticity of LS to firm

- Worker power has more explanatory power than concentration for labor share, profitability & Q

- Much of labor share⬇️was in manufacturing (where, w/ globalization,⬆️monopoly power seems unlikely)

[18/N]

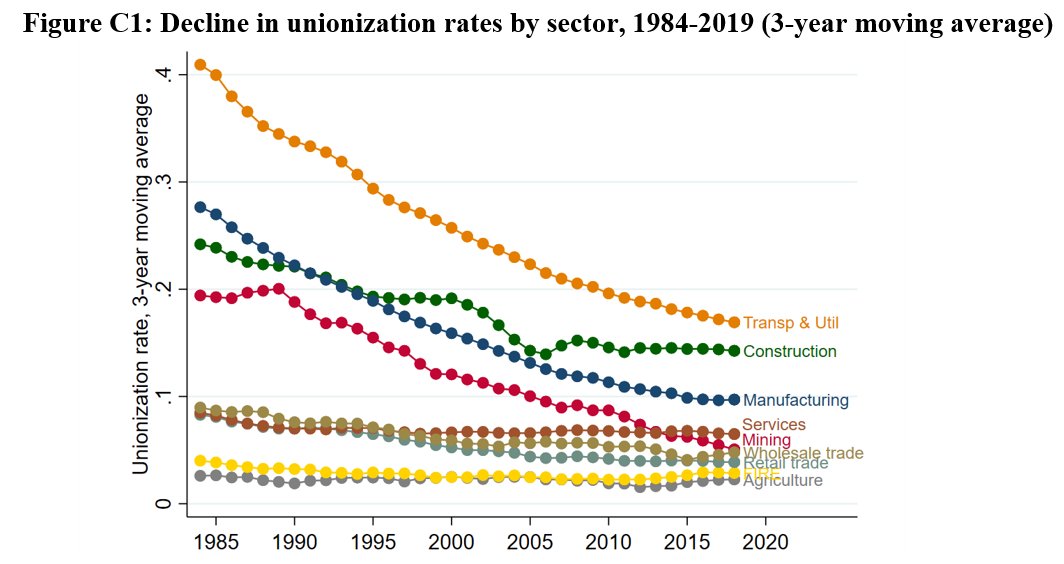

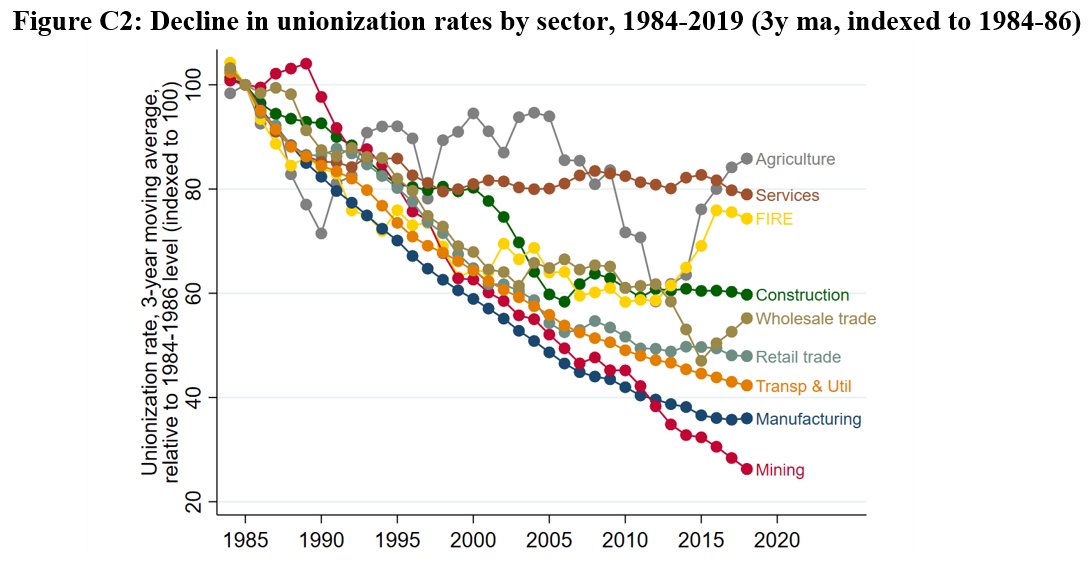

(4) There is more direct evidence of a broad-based decline in worker power than of a large aggregate increase in monopoly or monopsony power

[19/N]

The evidence is quite compelling that institutional changes, causing a decline in worker power, have been at the root of many of the major macro trends in the American economy over recent decades....

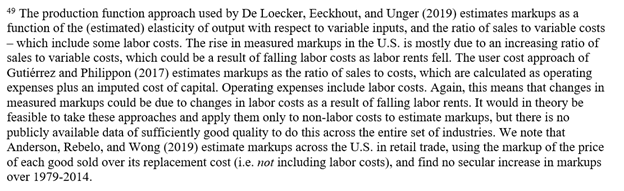

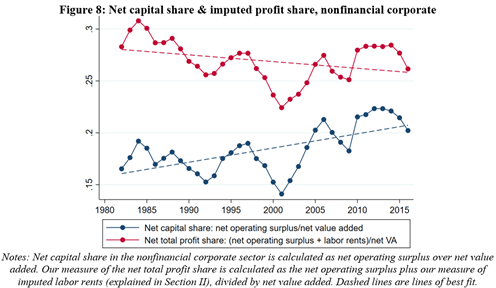

[21/N]