Business growth is the driver of market cap (stock) growth.

Pretty tough for a low growth mature business (no matter how cheap) to embark on a monster run.

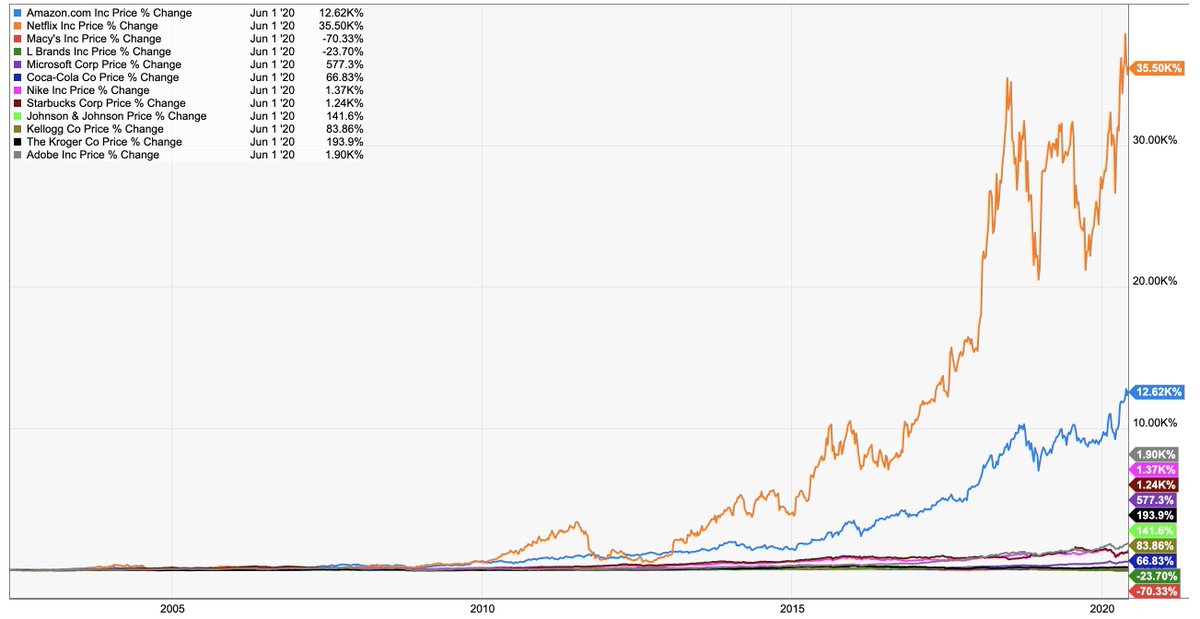

Look at the 10-year returns of the 'overvalued/bubble' stocks and now check out the performance of the 'bargain/value' stocks!

Chart from @ycharts

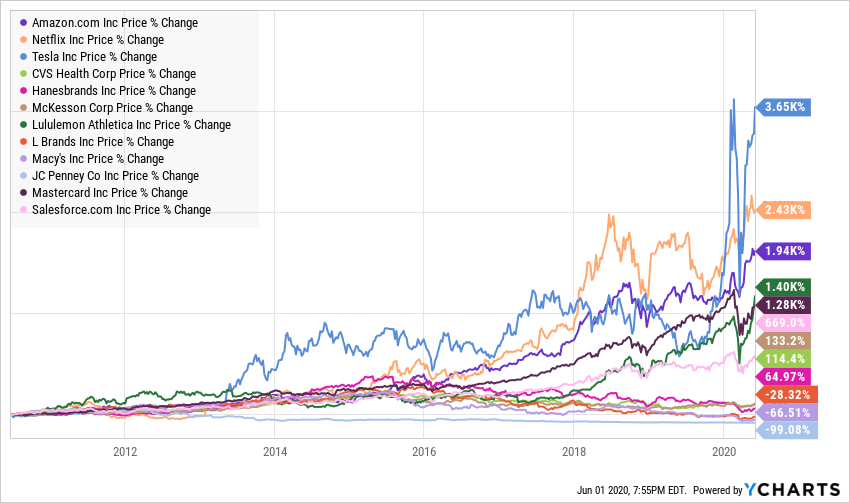

Look at the returns of the rapidly growing, 'overvalued' stocks and now compare those with the returns from the 'safe, undervalued, high cash flow' stocks.

What do you see? What would you rather own?

Chart from @ycharts