This is a great point, @MichaelWWara. I think we're mostly on the same page here.

https://twitter.com/MichaelWWara/status/1267578610069540864

Your main disagreement lies not with me but with @AirResources, which designated cap-and-trade as responsible for half of California's 2030 climate policy. There's no way this market is going to do that.

To the extent you and I differ, it's on the potential space for reform. You are 100% right that the politics aren't there for cap-and-trade to make this heavy of a lift. But to stabilize the market—or even turn it into a tax at today's prices? I guess I'm more optimistic.

Modest reform is still a big deal if you think we need a reliable revenue stream to support key environmental programs, even if the carbon price isn't allowed to rise very much in the decade ahead.

More important, however, is what your insights mean for policy strategy going forward. Right now @AirResources is telling neighboring western states to join its cap-and-trade program on promise of deep decarbonization that will be too cheap to meter. Is that sound advice?

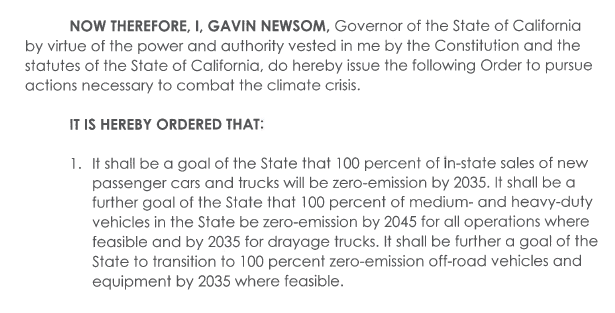

What matters most in California is getting the economy back on track while we double down on regulatory strategies like building decarbonization, 100% clean electricity, and a build-out of EV infrastructure.

That's the California model to copy—the legacy of efforts like SB 100, AB 1493, and decades of clean energy regulatory leadership. (Others have noticed, including @GovInslee, who did so much to advance this approach in the Democratic Primary.)

If carbon pricing can play a supporting role in climate policy, that's great. I think it can. But even then it'll be dwarfed by the standards, investment, and justice paradigm that's coalescing at the federal level: vox.com/energy-and-env…

Meanwhile, I'm struck by the fact that time and time again, the environmental justice community recognizes climate policy problems before others are willing to speak up. @cejapower and its members were on this page 10 years ago. Let's all reflect on that tonight.

(To be clear, I'm proud to have worked together with @MichaelWWara and @cejapower on these issues—it's not my place to represent EJ views, but as far as I'm concerned he's been a big part of the solution on that front.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh