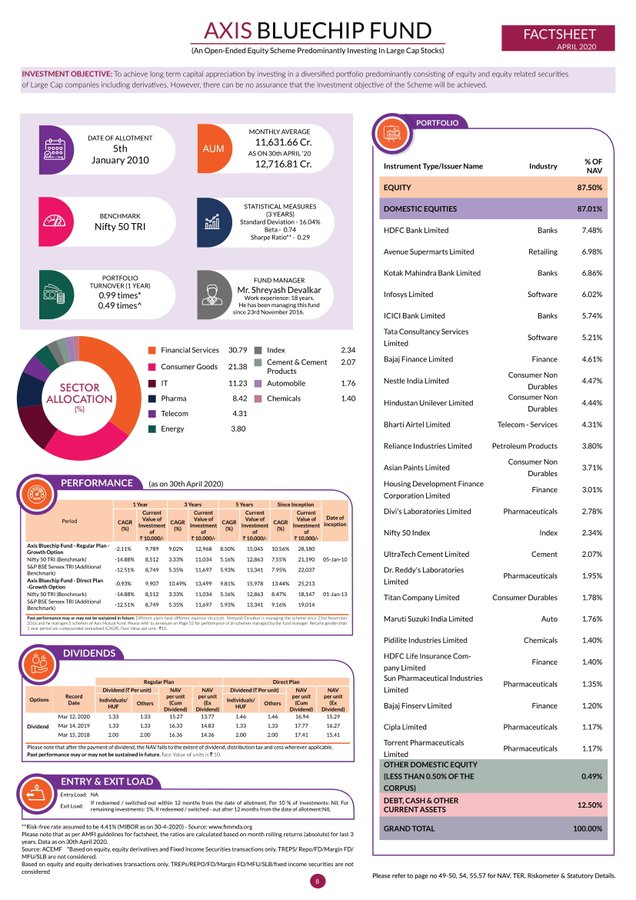

A thread on "How to read a Factsheet of Equity Scheme"

#mutualfunds

AUM: Asset Under Management is the total amount of money being managed under the scheme.

Portfolio Turnover: Portfolio turnover is a measure of how frequently assets within a fund are bought and sold by the managers.

Tip: You can get more details regarding the number of shares held by scheme in each company by downloading Monthly Portfolio Disclosure from AMC website.