Here I am starting tread on data driven trading . That means we will trade Based on past data .

I captured Nifty's 13 Years of the data for this study .

We will assume whatever has happened in past will also happen in future .

here we go -

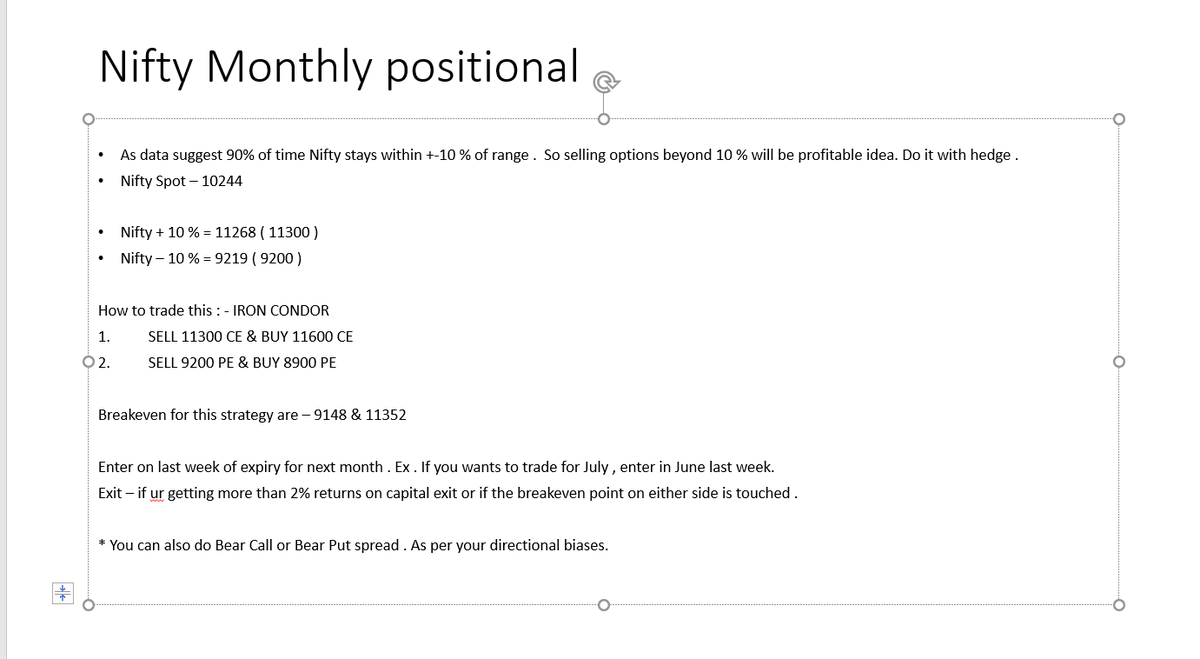

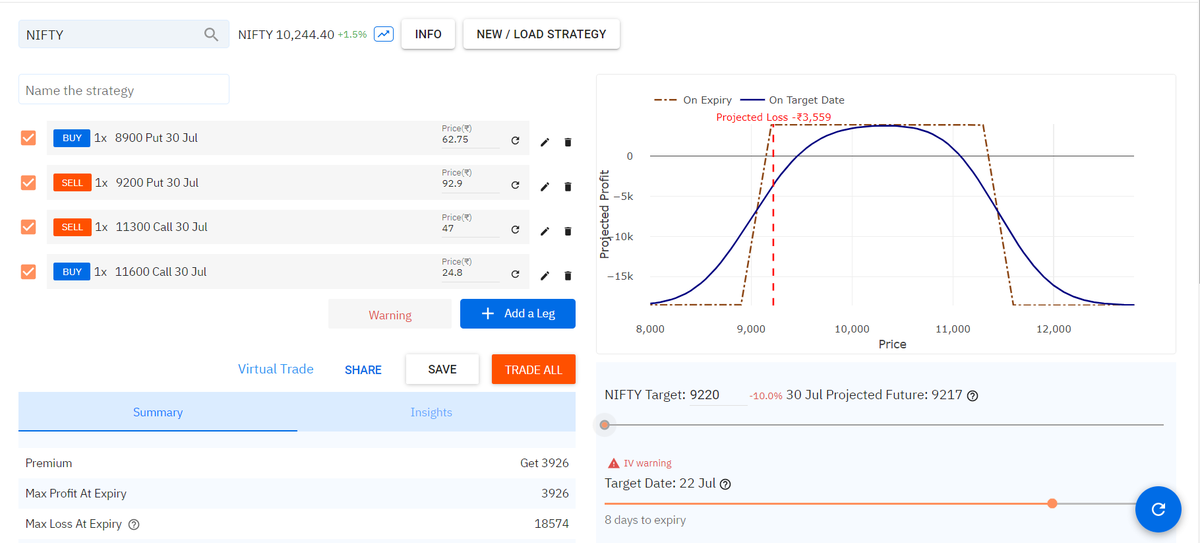

Enter on last week of expiry for next month . Ex . If you wants to trade for July , enter in June last week.

Exit – if ur getting more than 2% returns on capital exit or exit/adjust if the break even point on either side is touched .

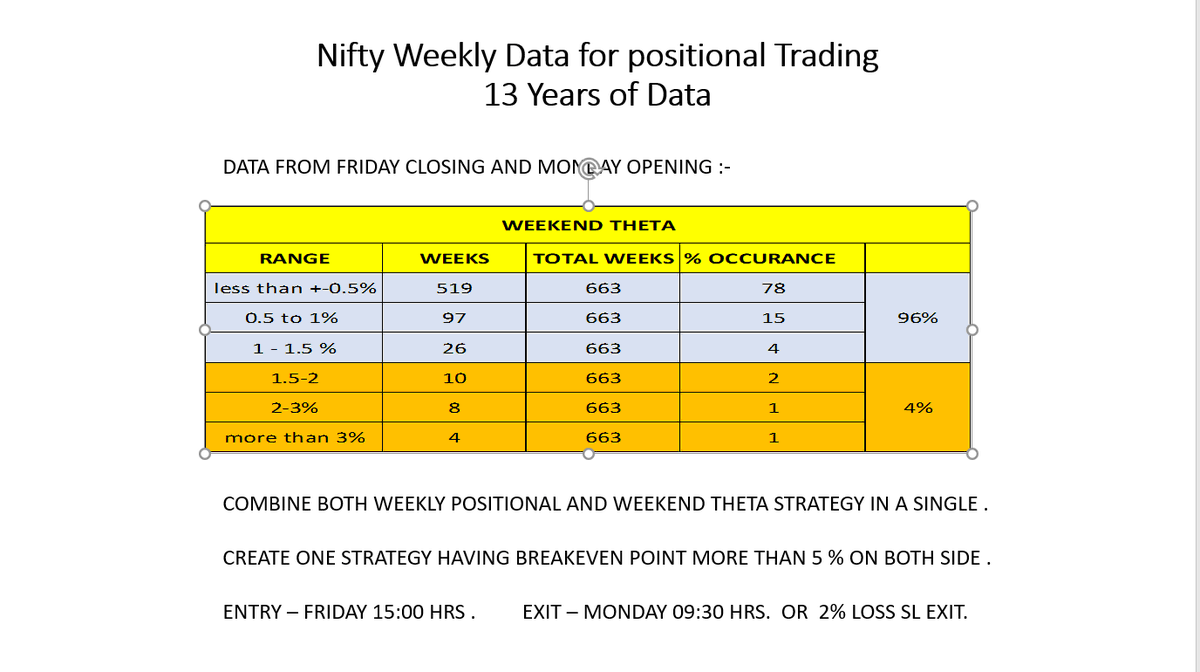

Next is weekly data : -

1. Weekly options are very volatile as compared to monthly .

2. If ur getting 1% return on your strategy just exit and relax

3. If ur getting Max 1-2 % loss on your strategy , just exit and relax .

Risk :- BIG GAP UP OR GAP DOWN .

Iron condor

Ratio spreads on both call and put side .

Bear Call and Bull Put spread based on view .

Always create risk defined strategies .

CREATE ONE STRATEGY HAVING BREAKEVEN POINT MORE THAN 5 % ON BOTH SIDE .

ENTRY – FRIDAY 15:00 HRS . EXIT – MONDAY 09:30 HRS. OR 2% LOSS SL EXIT.

RISK - BIG GAP-UP / GAP DOWN

This thread ends here . Please feel free to ask for any doubts . Retweet it if you liked .