What is asset manager capitalism? (How) does index fund dominance change the political economy of corporate governance?

This has taken me forever. It's a first working paper, focused on the United States. Brief summary below. 1/

osf.io/preprints/soca…

This has taken me forever. It's a first working paper, focused on the United States. Brief summary below. 1/

osf.io/preprints/soca…

The #CorpGov literature remains in thrall to what I call the Berle-Means-Jensen-Meckling ontology: Shareholders, while dispersed and weak, are the owners and principals of the corporation.

The rise of asset managers has pulled the empirical rug from under the BM-JM ontology. 2/

The rise of asset managers has pulled the empirical rug from under the BM-JM ontology. 2/

The table summarizes

- the evolution of the US investment chain

- the hallmarks of historical corporate governance regimes

It shows the similarities (green) and differences (red) btw Hilferding’s late 19th century ‘finance capitalism’ and what I call asset manager capitalism. 3/

- the evolution of the US investment chain

- the hallmarks of historical corporate governance regimes

It shows the similarities (green) and differences (red) btw Hilferding’s late 19th century ‘finance capitalism’ and what I call asset manager capitalism. 3/

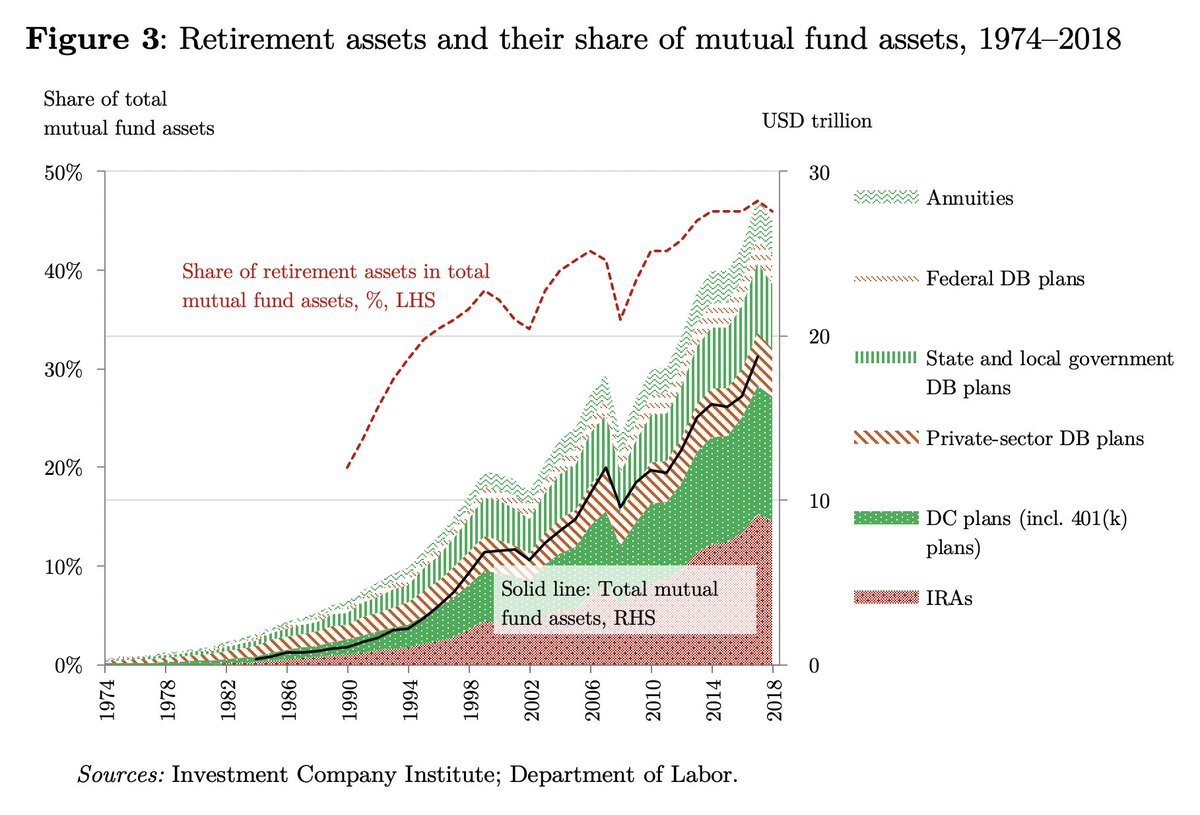

The story of the ‘Great Re-Concentration’ can be read off this figure: a 70y period during which shareholdings shifted from households to pension funds and, more recently, to asset managers.

Note that the household category includes hedge fund and private equity assets. 4/

Note that the household category includes hedge fund and private equity assets. 4/

Phase I of the Great Re-Concentration (1936–2000) was driven by tax rules for mutual funds, retirement legislation, and financial regulation that fed the growth of asset management.

Since 2000, the dominant dynamic has been consolidation within the asset management sector. 5/

Since 2000, the dominant dynamic has been consolidation within the asset management sector. 5/

Most of the action over the last 15 years was in ETFs. Today this is a global oligopoly in which three firms – BlackRock (39%), Vanguard (25%) and SSGA (16%) – have a combined market share of 80%.

For more on index funds, see the work by the amazing @UvACORPNET team. 6/

For more on index funds, see the work by the amazing @UvACORPNET team. 6/

The political economy of asset manager capitalism:

(1) Firm level: Cost of engagement -> @pdjahnke

(2) Sector level: Common ownership -> @joseazar, @martincschmalz

(3) Macro level: Shareholders ⚡️the economy

(4) Politics: Maximizing assets under management.

Details -> paper 8/

(1) Firm level: Cost of engagement -> @pdjahnke

(2) Sector level: Common ownership -> @joseazar, @martincschmalz

(3) Macro level: Shareholders ⚡️the economy

(4) Politics: Maximizing assets under management.

Details -> paper 8/

Asset manager capitalism is a corp gov regime without historical precedent. The Berle-Means-Jensen-Meckling ontology does not map onto asset managers at all. We’re in completely uncharted territory. Shareholders have never been more powerful, and yet… 9/

… the case against socializing shareholdings has never looked weaker.

Speaking of efficiency: This is the least efficient paper I’ve ever written: 5 years of reading and revising, 1 draft paper. I hope people find useful things in it. Your feedback will be very welcome. END/

Speaking of efficiency: This is the least efficient paper I’ve ever written: 5 years of reading and revising, 1 draft paper. I hope people find useful things in it. Your feedback will be very welcome. END/

• • •

Missing some Tweet in this thread? You can try to

force a refresh