As it is the case for many things in life, even bad luck can turn out to be incredible opportunity in hindsight.

It also helps me instill in myself why the risk you truly care about cannot be measured.

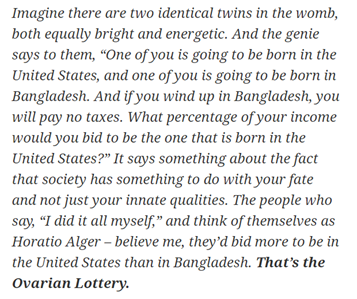

Let me elaborate what shareholders in Bangladesh are going through to make my point.

Why did Bangladesh outperform all the regional countries?

1. All the stocks were given a floor price below which prices cannot fall. The floor price was determined by calculating average closing price of previous five trading days...

But hey, at least market doesn’t fall.

2. After following this floor price rule for a few days, they thought market was “non-essential”...

The market finally re-opened in the beginning of June. But the floor price rule still exists.

Like Buffett, I am bullish on America. But I am very very sympathetic to permabears even in the US.

Anything that damages this core thesis may matter much more than your valuation multiples or any short-term noises.

Looking at Bangladesh, I know what happens when you don't have the core elements of the LT bull case.

So, while I haven’t acted on any of permabears warnings, I am never too eager to ridicule them.