All results declared on 24th June 2020 #excelgiri

Good

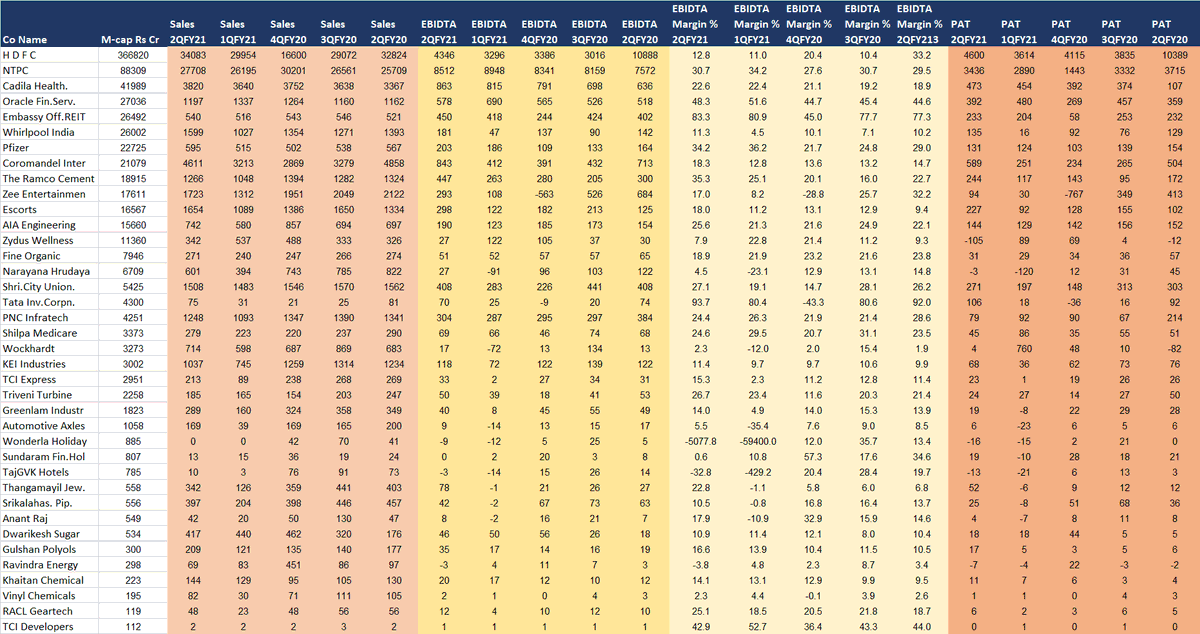

Sharda cropchem: margins 18.7% vs 10.3% QoQ

Bannari Amm.Sug: sales up 69%, ebidta up 33%

H.G. Infra Engg: ebidta up 15% (8x)

Not Bad

PNC Infra: sales up 6% (5x)

Esab India: ebidta up 3% (30x)

Indoco: ebidta up 17% (80x)

Good

Sharda cropchem: margins 18.7% vs 10.3% QoQ

Bannari Amm.Sug: sales up 69%, ebidta up 33%

H.G. Infra Engg: ebidta up 15% (8x)

Not Bad

PNC Infra: sales up 6% (5x)

Esab India: ebidta up 3% (30x)

Indoco: ebidta up 17% (80x)

All results declared on 24th June 2020 #excelgiri

Weak Results

Asahi India Glass: sales ⬇️17%, ebidta ⬇️25%

India cements: ebidta ⬇️61%

Tide water oil: sales ⬇️17%, ebidta ⬇️29%

India Glycols: ebidta ⬇️12%,pat ⬇️33%

Astra micro: margins 8.4% Vs 25% QoQ (vs 17% yoy)

Weak Results

Asahi India Glass: sales ⬇️17%, ebidta ⬇️25%

India cements: ebidta ⬇️61%

Tide water oil: sales ⬇️17%, ebidta ⬇️29%

India Glycols: ebidta ⬇️12%,pat ⬇️33%

Astra micro: margins 8.4% Vs 25% QoQ (vs 17% yoy)

All results declared on 24th June 2020 #excelgiri

Weak Results

Sanghi Ind: sales ⬇️20%, pat ⬇️40%

Sandesh: sales ⬇️24%, pat ⬇️37%

The Anup Eng: ebidta ⬇️13%, pat ⬇️25%

Weak Results

Sanghi Ind: sales ⬇️20%, pat ⬇️40%

Sandesh: sales ⬇️24%, pat ⬇️37%

The Anup Eng: ebidta ⬇️13%, pat ⬇️25%

All results declared on 24th June 2020 #excelgiri

Ugly Results

Shriram EPC: sales ⬇️62%, ebidta loss

Indo rama: ebidta losses continue big

IG Petro: ebidta ⬇️56%, pat ⬇️78%

Monte Carlo Fas: sales ⬇️73% qoq, nil ebidta vs 106 cr qoq

Kakatiya Cement: sales ⬇️28%, ebidta loss

Ugly Results

Shriram EPC: sales ⬇️62%, ebidta loss

Indo rama: ebidta losses continue big

IG Petro: ebidta ⬇️56%, pat ⬇️78%

Monte Carlo Fas: sales ⬇️73% qoq, nil ebidta vs 106 cr qoq

Kakatiya Cement: sales ⬇️28%, ebidta loss

All results declared on 24th June 2020 #excelgiri

Ugly Results

Timex Group: ebidta loss

Punjab Alkalies: sales down 27%, ebidta donw 95%

Ugly Results

Timex Group: ebidta loss

Punjab Alkalies: sales down 27%, ebidta donw 95%

• • •

Missing some Tweet in this thread? You can try to

force a refresh