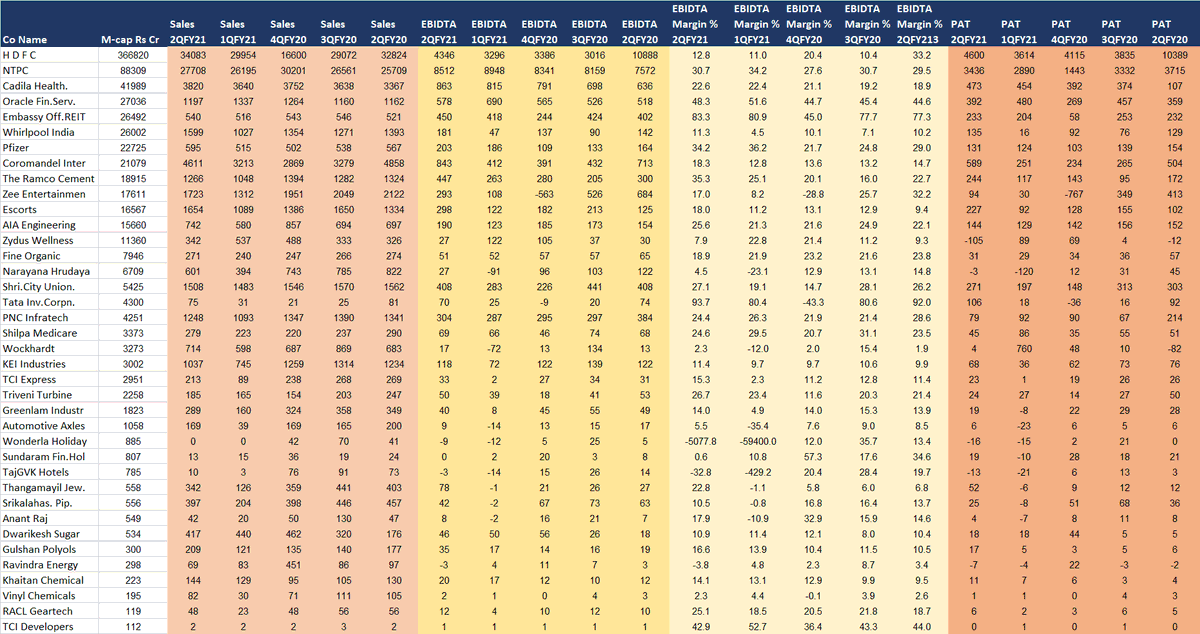

All results declared on 25th June 2020 #excelgiri

Apollo Hosp: Good

Ashok Leyland: better vs exp

CONCOR: mixed; sales down but margins improve

Apollo Hosp: Good

Ashok Leyland: better vs exp

CONCOR: mixed; sales down but margins improve

All results declared on 25th June 2020 #excelgiri

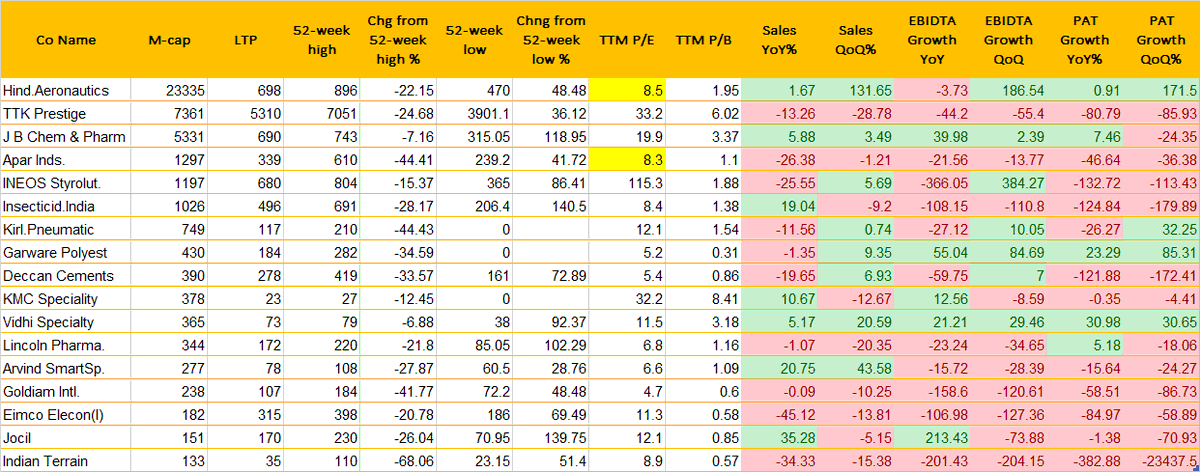

Good

JB Chem: ebidta up 40%

Garware Polyest: ebidta up 55%, pat up 23%

INEOS Styrolut: ebidta 22 cr vs loss earlier (but 115x ??)

Not bad

HAL: sales flat (high TR needs to watched – 11500 cr)

Good

JB Chem: ebidta up 40%

Garware Polyest: ebidta up 55%, pat up 23%

INEOS Styrolut: ebidta 22 cr vs loss earlier (but 115x ??)

Not bad

HAL: sales flat (high TR needs to watched – 11500 cr)

All results declared on 25th June 2020 #excelgiri

Weak

TTK Prestige: ebidta down 44%, pat down 80% (June qtr mein kya hoga)

Apar Ind: ebidta down 21%, PAT down 46%

Deccan Cements: ebidta down 60%

Kirl.Pneumatic: ebidta down 27%

Arvind Smart: pat down 15%

Goldiam Int: ebidta loss

Weak

TTK Prestige: ebidta down 44%, pat down 80% (June qtr mein kya hoga)

Apar Ind: ebidta down 21%, PAT down 46%

Deccan Cements: ebidta down 60%

Kirl.Pneumatic: ebidta down 27%

Arvind Smart: pat down 15%

Goldiam Int: ebidta loss

All results declared on 25th June 2020 #excelgiri

Ugly

Insecticides India: reports an ebidta loss

Eimco Elecon: reports an ebidta loss

Indian Terrain: reports an ebidta loss; sales down 35%

Ugly

Insecticides India: reports an ebidta loss

Eimco Elecon: reports an ebidta loss

Indian Terrain: reports an ebidta loss; sales down 35%

• • •

Missing some Tweet in this thread? You can try to

force a refresh