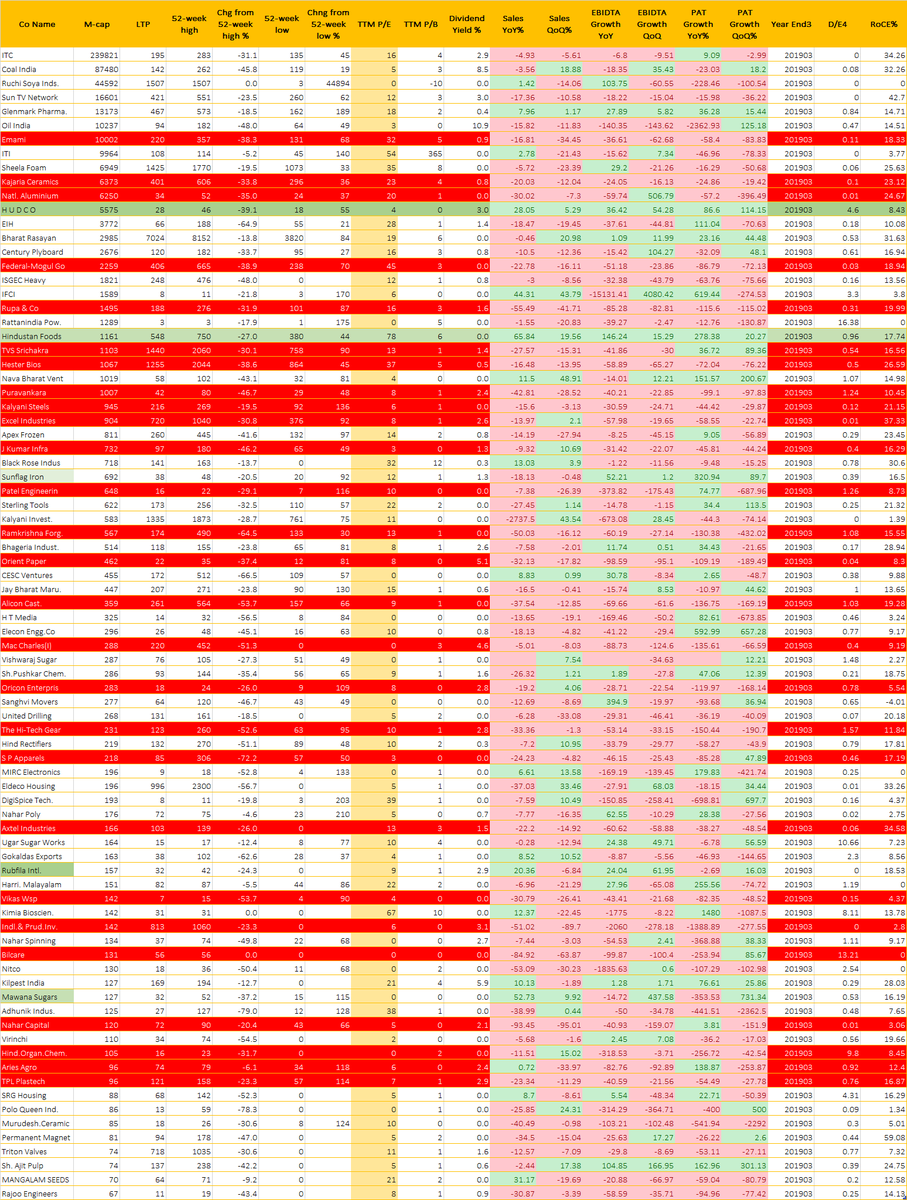

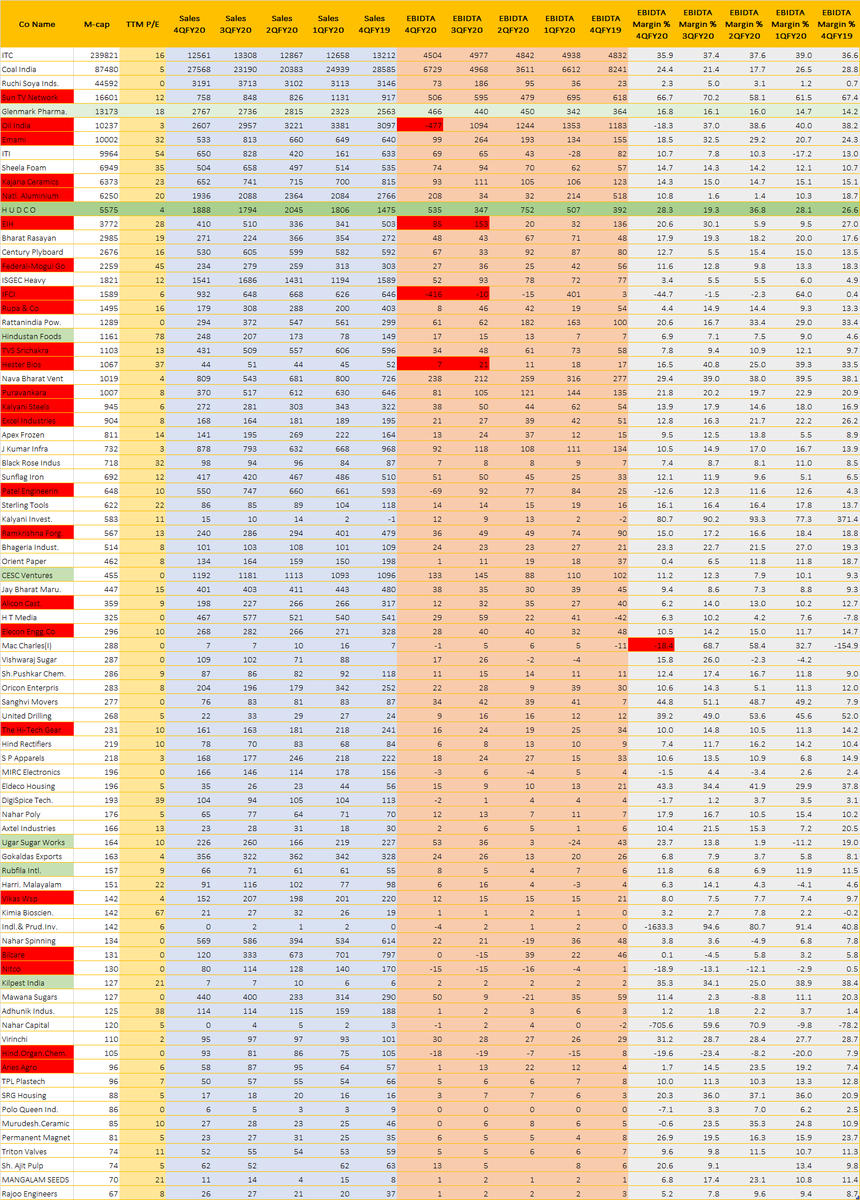

Over 200 results declared 😅

Pataka Results

Hudco: sales up 28%, pat up 87% (4x)

West coast paper: sales up 40%, pat doubles (3.8x, 30% roce)

Good

ITC: special dividend

Glenmark: ebidta up 28%, pat up 36% (18x)

Hind Food: sales up 65%, ebidta up 146% (78x)

CESC Ventures: ebidta up 30% (cmp 171, BV 876)

Rubfila Intl: sales up 20%, ebidta up 25% (9x, 18% roce)

Not Bad

Sheela foam: sales donw 6%, margins 14.7% vs 10.7% (35x)

Bharat rasayan: sales & ebidta flat, pat up 23%

Sunflag iron: sales down 18% but ebidta up 52%

Ugar sugar: margins 24% vs 19%

Weak

Coal India: ebidta ⬇️ 18%, pat ⬇️ 23%

Sun TV: sales ⬇️ 17%, ebidta ⬇️ 18%

Oil India: sales ⬇️ 16%, ebidta loss of 477 cr (3x…crude bounced back)

Emami: ebidta ⬇️ 37%, pat ⬇️ 58%

ITI: pat down 47% (54x??, 3.8% roce)

Weak

Kajaria: ebidta down 25%

Eih: sales down 19%, ebidta down 37%

Century Plyboard: sales down 10%, ebidta down 15%

ISGEC Heavy: ebidta down 33% (12x)

TVS Srichakra: sales down 27%, ebidta down 42% (13x)

Weak

Puravankara: sales down 42%

Kalyani Steels: sales down 15%, ebidta down 30% (6x, roce 21%)

J Kumar Infra: ebidta down 32%

Sterling tools: sales down 27%, ebidta down 15%

Jaybharat Maruti: sales, ebidta down 15% (15x)

Weak

Elecon eng: ebidta down 41%

S P Apparels: ebidta down 46%

TPL Plastech: ebidta down 40%

UGLY

Nalco: ebidta down 60%; 10.8% vs 18.7%

Federal-Mogul Go: ebidta down 51%, pat down 87% (45x)

Rupa & co: sales down 55%, ebidta down 85% (16x)

Hester Bios: ebidta down 58%, pat down 72% (37x)

UGLY

Excel Ind: ebidta down 58%, margins 12.8% vs 26.2%

Patel Eng: ebidta loss of 70 cr

Ramkrishna Forging: sales down 50%, ebidta down 60% (13x)

Orient paper: sales down 32%, ebidta down 99%

UGLY

Alicon Cast: sales down 38%, ebidta down 70%

Mirc elec: ebidta loss

Vikas wsp: pat down 82%

Nitco: sales down 53%, ebidta loss

Hind organic chem: ebidta loss continue

Aries Agro: ebidta down 83%