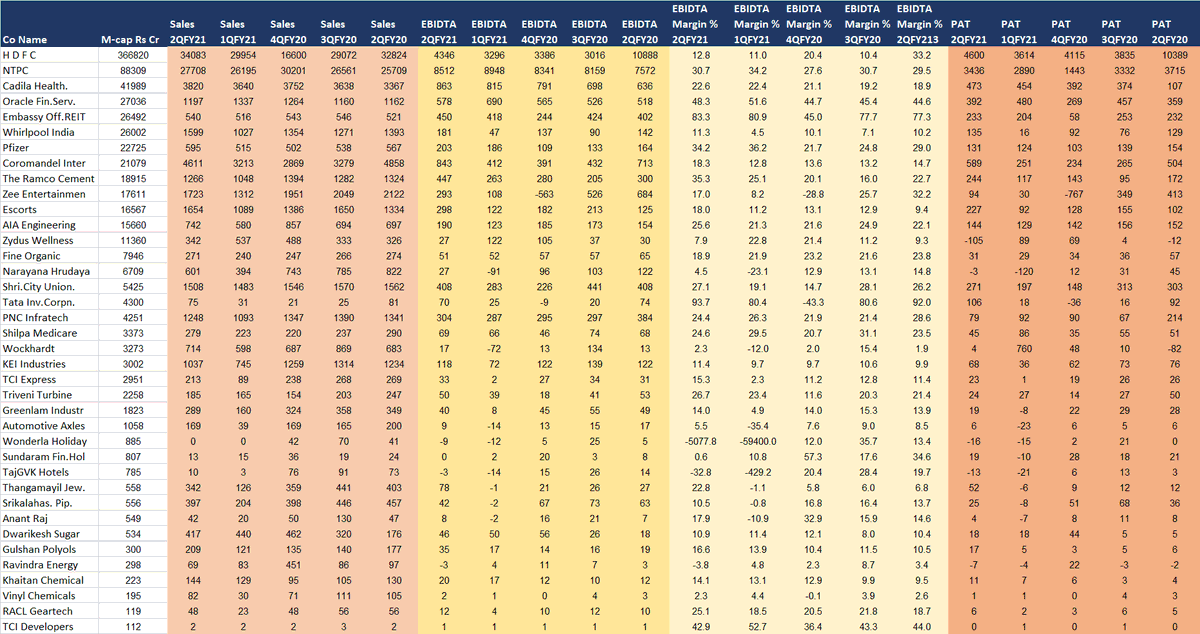

All results declared on 29th June 2020 #excelgiri

V Good

Bharat Dynamics: sales up 64%, ebidta up 2.3x, pat up 1.5x (16x p/e, 2.3 p/e) (q is whether this will be consistent)

N R Agarwal: sales down 7%, ebidta up 86%, margins18.7% vs 9.3%, pat 37 cr vs 14 cr (29% roce, 4 p/e)

V Good

Bharat Dynamics: sales up 64%, ebidta up 2.3x, pat up 1.5x (16x p/e, 2.3 p/e) (q is whether this will be consistent)

N R Agarwal: sales down 7%, ebidta up 86%, margins18.7% vs 9.3%, pat 37 cr vs 14 cr (29% roce, 4 p/e)

All results declared on 29th June 2020 #excelgiri

V GOOD

Linc Pen &Plast: sales down 5% but ebidta up 48%, margins 11% vs 7%, pat 5 cr vs 1 cr (15x)

7 years sales 300 to 400 cr

Margins 5% to 10%

Cfo highest in 2019

V GOOD

Linc Pen &Plast: sales down 5% but ebidta up 48%, margins 11% vs 7%, pat 5 cr vs 1 cr (15x)

7 years sales 300 to 400 cr

Margins 5% to 10%

Cfo highest in 2019

All results declared on 29th June 2020 #excelgiri

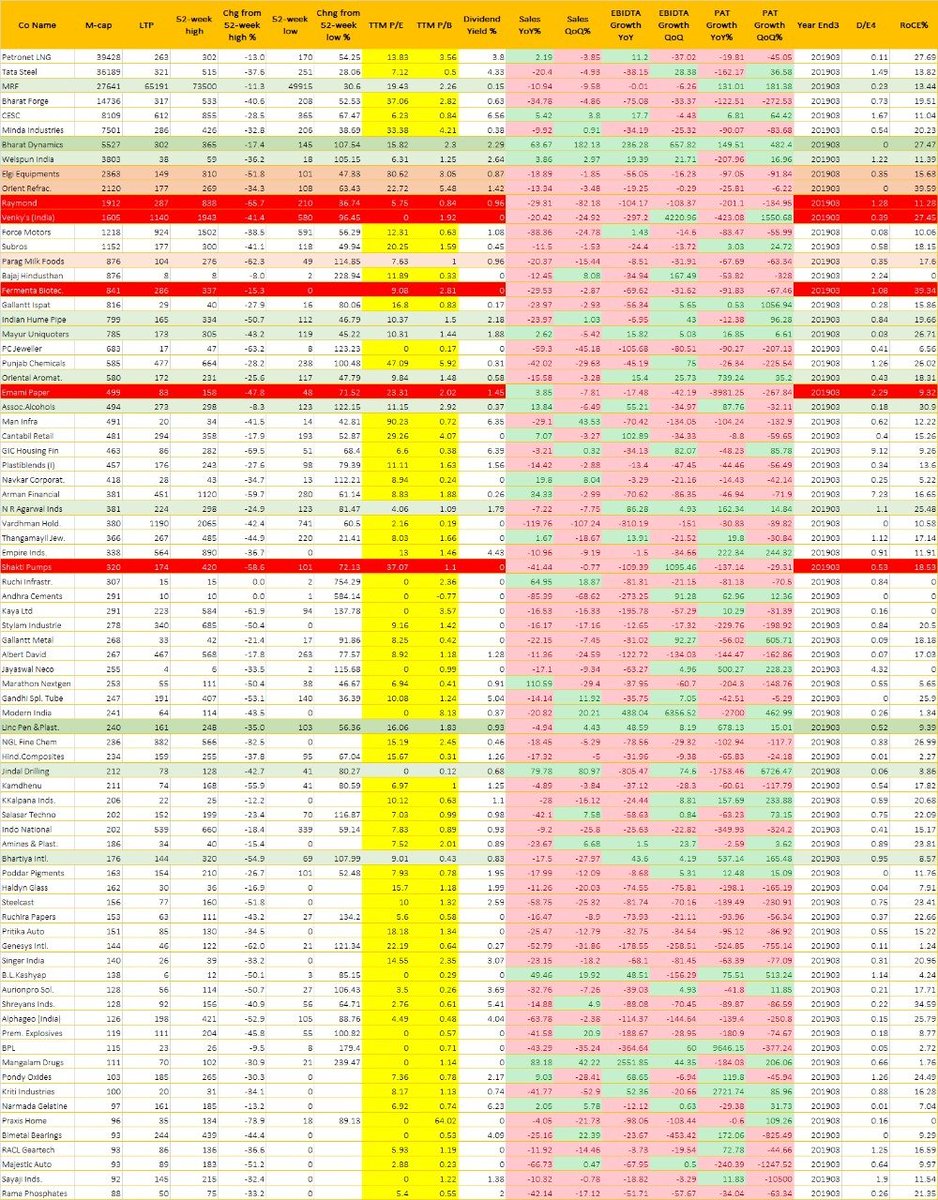

Phuus

Raymond: sales down 30%, ebidta loss of 7 cr vs profit of 167 cr (1.3 d/e)

Venky’s India: sales down 20%, ebidta loss of 118 cr vs profit of 60 cr

Shakti Pumps: sales down 41%, ebidta loss of 3 cr vs profit of 28 cr

Phuus

Raymond: sales down 30%, ebidta loss of 7 cr vs profit of 167 cr (1.3 d/e)

Venky’s India: sales down 20%, ebidta loss of 118 cr vs profit of 60 cr

Shakti Pumps: sales down 41%, ebidta loss of 3 cr vs profit of 28 cr

All results declared on 29th June 2020 #excelgiri

Phuus

NGL Fine Chem: sales down 18%, ebidta down 78%, reports net loss (15x)

6.5% margins from 26% reported in March 2017

Fermenta Biotec: ebidta down 69%, pat down 92%

Majestic Auto: sales down 66%, net loss of 28 cr

Phuus

NGL Fine Chem: sales down 18%, ebidta down 78%, reports net loss (15x)

6.5% margins from 26% reported in March 2017

Fermenta Biotec: ebidta down 69%, pat down 92%

Majestic Auto: sales down 66%, net loss of 28 cr

All results declared on 29th June 2020 #excelgiri

Good

Mayur Uniquoters: sales up 2.5%, ebidta up 16%, margins at 25% vs 22% (27% roce, 11 p/e)

Welspun India: ebidta up 20%; reports at profit of 86 cr vs loss of 80 cr (6.3 p/e, 1.25 x pb)

CESC: sales up 5%, ebidta up 18% (6x)

Good

Mayur Uniquoters: sales up 2.5%, ebidta up 16%, margins at 25% vs 22% (27% roce, 11 p/e)

Welspun India: ebidta up 20%; reports at profit of 86 cr vs loss of 80 cr (6.3 p/e, 1.25 x pb)

CESC: sales up 5%, ebidta up 18% (6x)

All results declared on 29th June 2020 #excelgiri

Good

Assoc.Alcohols: sales up 14%, ebidta up 55%, pat up 87% (11x)

Thangamayil Jew: ebidta up 14%, pat up 20% (8x)

Mangalam Drugs: sales up 83%, ebidta 7 cr vs nill,, pat at 5 cr vs loss of 6 cr

Good

Assoc.Alcohols: sales up 14%, ebidta up 55%, pat up 87% (11x)

Thangamayil Jew: ebidta up 14%, pat up 20% (8x)

Mangalam Drugs: sales up 83%, ebidta 7 cr vs nill,, pat at 5 cr vs loss of 6 cr

All results declared on 29th June 2020 #excelgiri

Not Bad

Force Motors: sales down 38% but ebidta up 1.5% (margins at 11.3% Vs 6.8%), PAT down 83% due to one-off (12x p/e)

Indian Hume Pipe: sales down 23% but margins at 14.5% vs 12% (20% roce, 10x p/e)

Not Bad

Force Motors: sales down 38% but ebidta up 1.5% (margins at 11.3% Vs 6.8%), PAT down 83% due to one-off (12x p/e)

Indian Hume Pipe: sales down 23% but margins at 14.5% vs 12% (20% roce, 10x p/e)

All results declared on 29th June 2020 #excelgiri

Weak

Minda Ind: sales down 10%, ebidta down 35%; margins at 9.1% Vs 12.5% (33x p/e, 4.2 p/b)

NOCIL: EBITDA down 40%; OPM at 17.07% vs 25%; PAT down 40%

Orient Refractories: ebidta down 20%, pat down 26% (22x p/e, 40% roce)

Weak

Minda Ind: sales down 10%, ebidta down 35%; margins at 9.1% Vs 12.5% (33x p/e, 4.2 p/b)

NOCIL: EBITDA down 40%; OPM at 17.07% vs 25%; PAT down 40%

Orient Refractories: ebidta down 20%, pat down 26% (22x p/e, 40% roce)

All results declared on 29th June 2020 #excelgiri

Weak

Elgi Equipments: ebidta down 56%, PAT down 97% (30x p/e, 3x p/b)

Parag Milk: sales down 20%, pat down 67% (7.5x p/e)

Emami Paper: ebidta down 18%, margins 11.3% vs 14.2%, net loss of 31 cr

Weak

Elgi Equipments: ebidta down 56%, PAT down 97% (30x p/e, 3x p/b)

Parag Milk: sales down 20%, pat down 67% (7.5x p/e)

Emami Paper: ebidta down 18%, margins 11.3% vs 14.2%, net loss of 31 cr

• • •

Missing some Tweet in this thread? You can try to

force a refresh