However, after submitting 4 guarantee letters

As this news made waves, Amaya’s share price was sent tumbling.

Ferdyne’s guarantee letter was suddenly dropped alongside KBC’s. A new bid was submitted for the two remaining investors, guaranteeing $3.4 billion.

The owner of H&S is Stanley Choi. H&S was his share in the New Leader Fund, the company that

With all the doubts over the proposed Amaya takeover, Bloomberg spoke to Choi at the time to quiz him over his commitment to the deal. Choi stated that he supported Baazov and he was not at all concerned about what had

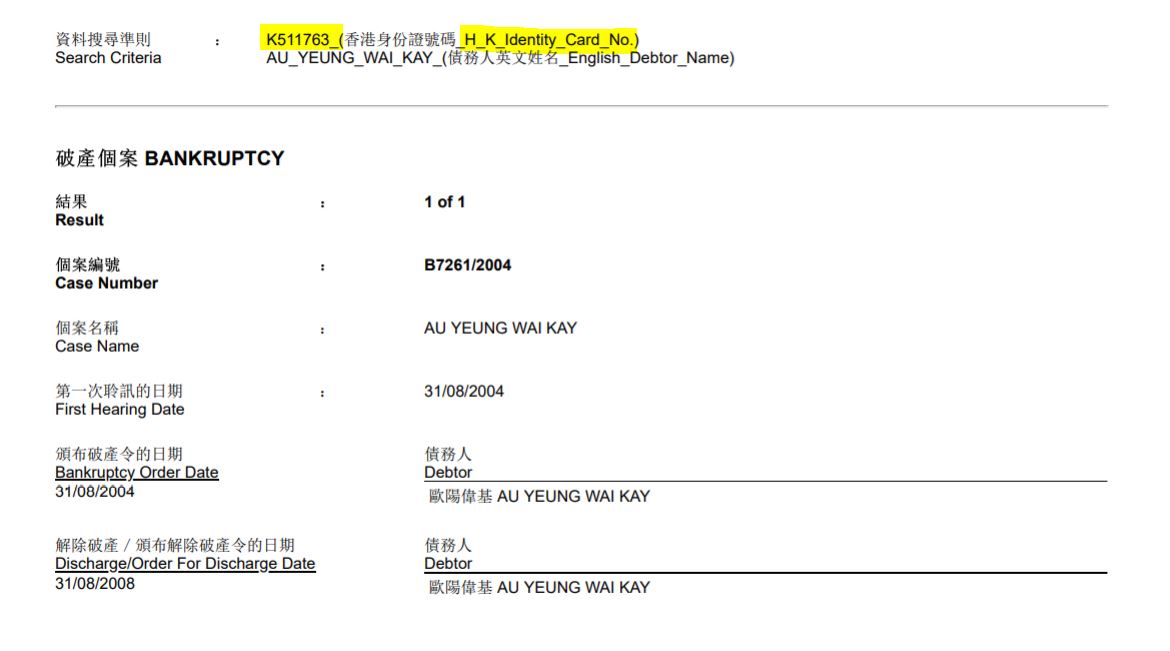

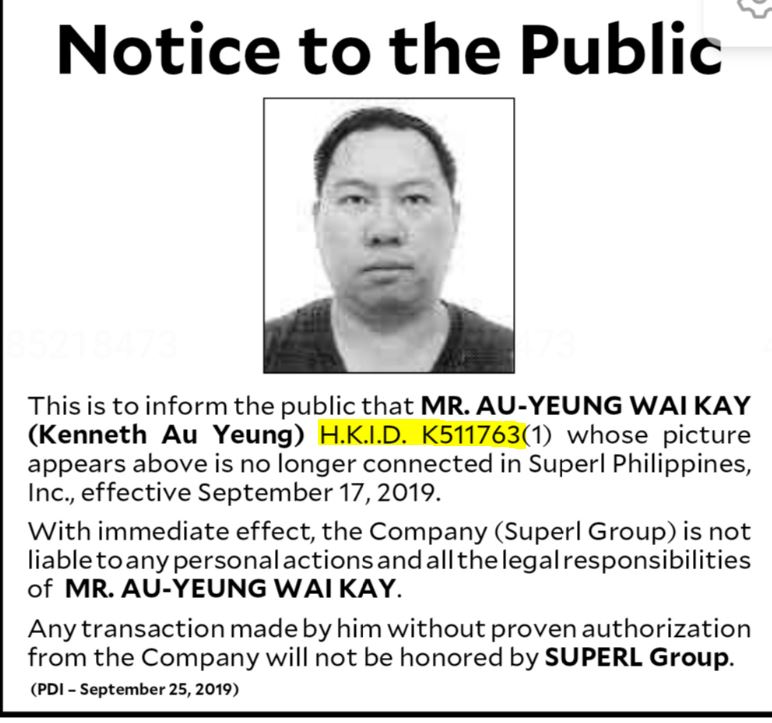

Could Choi really afford his share of the investment? It was difficult to prove as H&S is a private company so their financial records aren’t public. However, Andrew Webb, a Hong Kong-based corporate governance

The other investor, Goldenway was another little known Hong Kong company and not a major player in finance.

Alarm bells were ringing all over. The bid was bizarre and made no sense at all. One of the original investors didn’t exist. Another of them denied all knowledge of their involvement.

Later the insider trading court case went ahead but part way through it, the charges were stayed (not dropped) due to