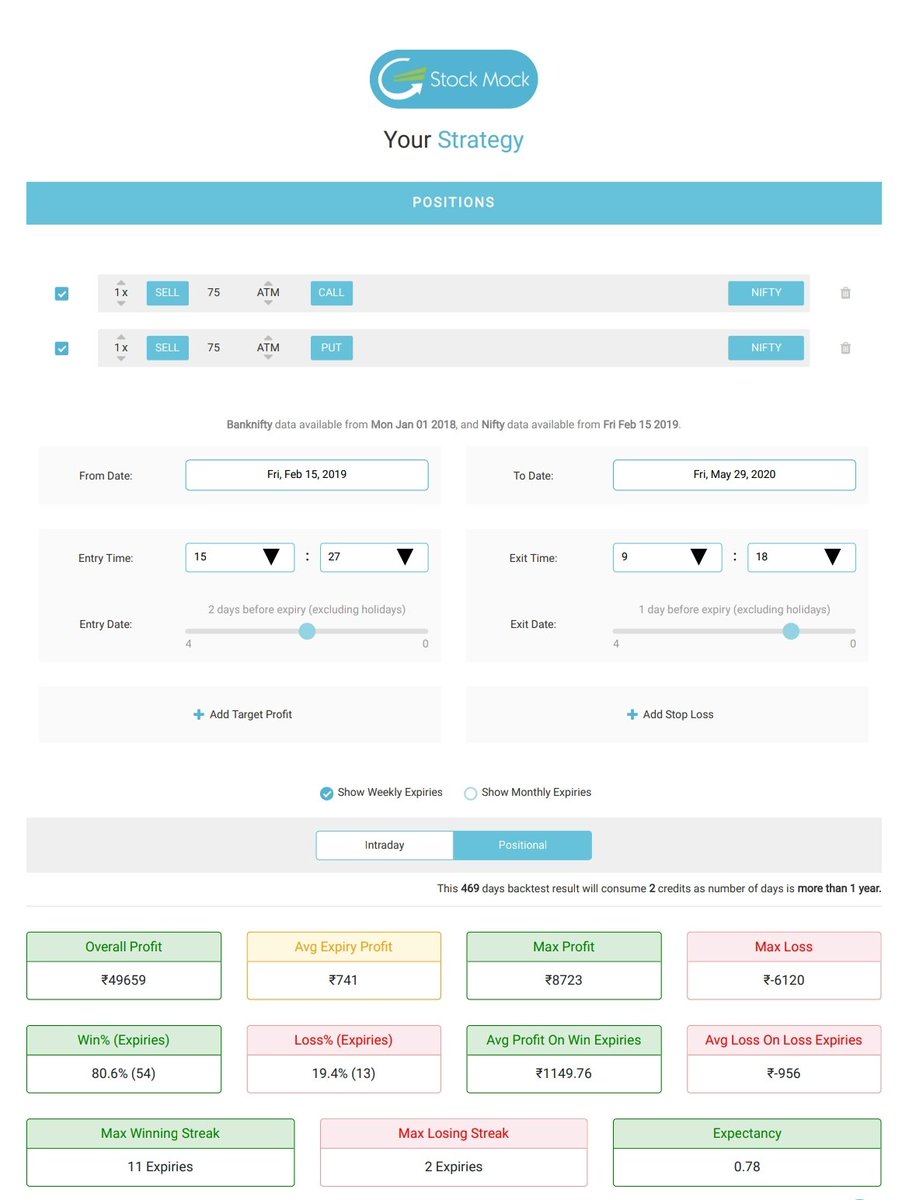

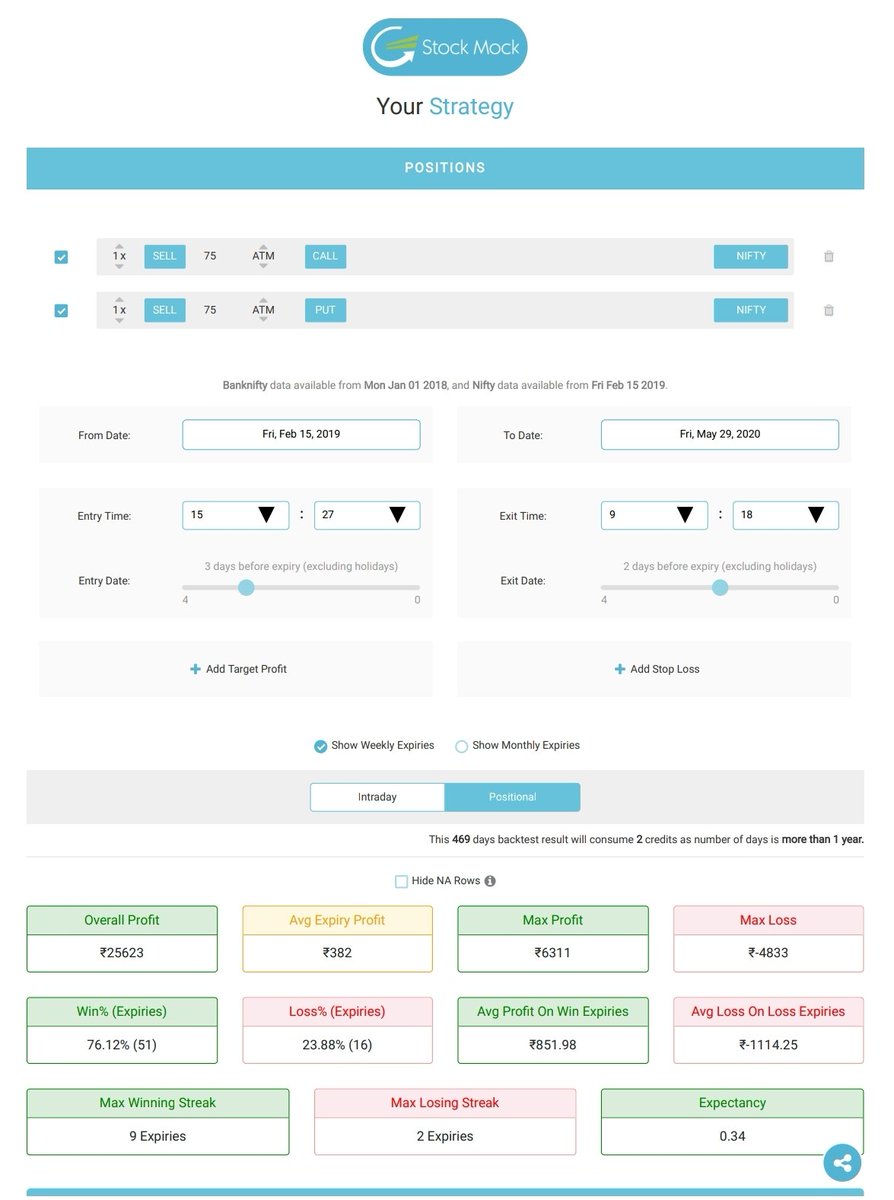

1. Took short straddle on 3 days before expiry that is mostly Monday at 3.27pm and square of next day at 9.18am

1. Mon to Tue positional strategy gave 25k profit. ROI 16%

2. Tue to Wed positional strategy gave 49k profit. ROI 32%

Remove 8% profits for slippages and charges, still getting 40% returns trading just 2 days.

Historical performance cannot guarantee future results