.@equitablegrowth last week: The coronavirus recession highlights the importance of automatic stabilizers 1/ equitablegrowth.org/the-coronaviru…

Economic suffering is generally a result of the depressed level of economic activity, not the rate of change, and continues long after the official recession ends. 3/

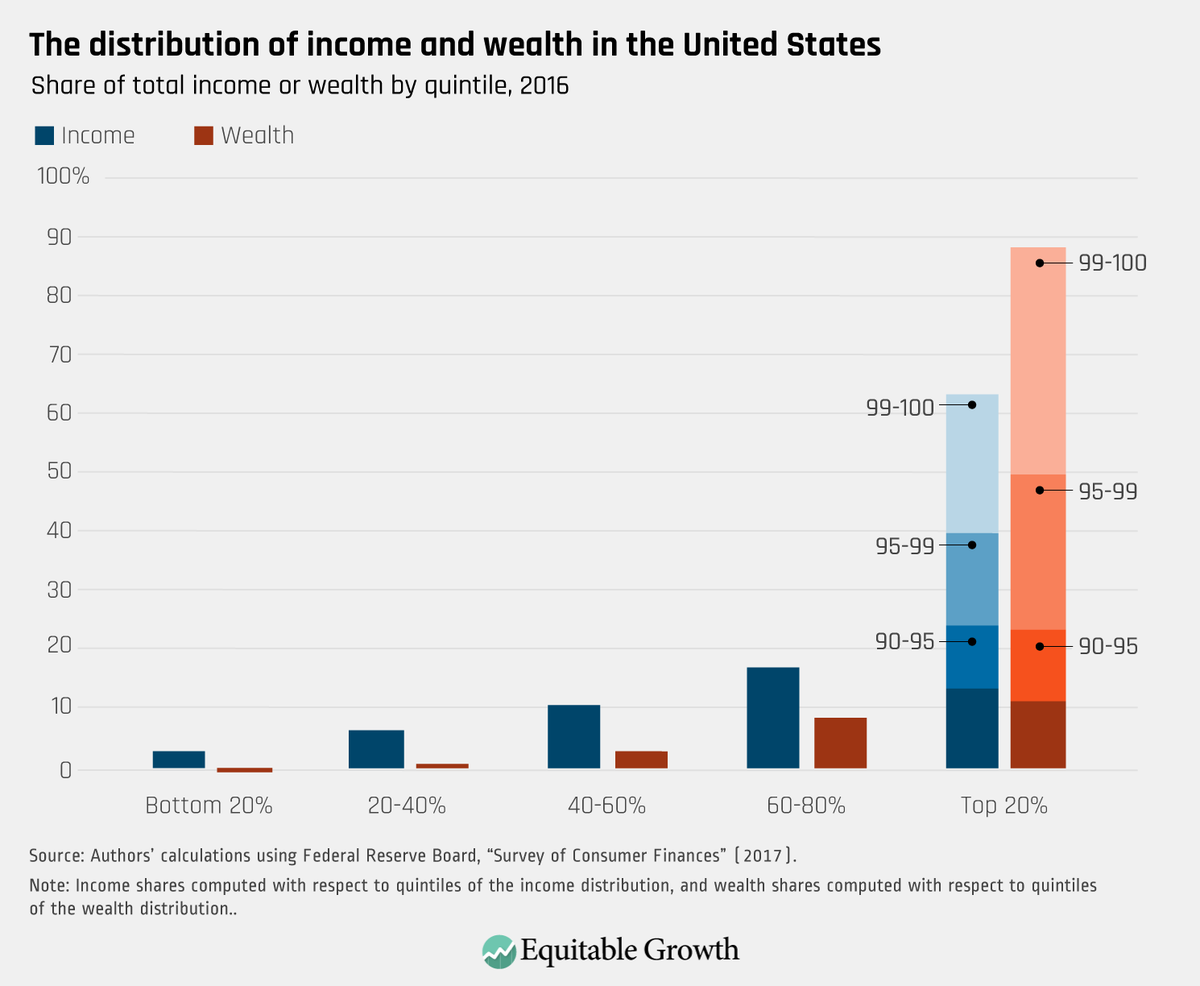

Defining recessions in terms of aggregate economic indicators obscures disparate experiences for different populations. 4/

The Great Recession formally ended in June 2009, but the unemployment rate for White workers peaked in October 2009, the unemployment rate for Black workers peaked in March 2010, and the unemployment rate for women peaked even later. 5/

The policy response to a recession can provide direct relief, moderate the decline in economic activity, and accelerate the recovery. 6/

Importantly, our focus in providing this relief should be on well-being or living standards, not economic activity itself. Public policies can increase living standards even as they reduce economic activity. These types of policies are highly desirable! 7/

The coronavirus recession shares many similarities with previous recessions but is also different in some key ways. First, this recession occurred with unprecedented speed due to the sudden emergence and spread of the novel coronavirus. 8/

Second, the virus has made economic activity more dangerous. Third, because the recession was caused by a virus, the decline in economic activity has occurred alongside an increase in morbidity and mortality. 9/

Nobody knows for sure how long the coronavirus recession will last or exactly how severe it will be. The uncertainty that would exist when confronting any recession is compounded by the uncertainty about the nature and consequences of the coronavirus itself. 10/

Automatic stabilizers support household incomes and spending during recessions. Crucially, they also continue as long as they are needed. If the recession is deeper and longer, then the response grows. If the recovery is quicker, then the response shrinks. 11/

Congress should expand and improve automatic stabilizers to address the coronavirus recession. For more see #RecessionReady from @equitablegrowth and @hamiltonproj. 12/12 equitablegrowth.org/recession-read…

• • •

Missing some Tweet in this thread? You can try to

force a refresh