Don't worry, a thread is coming 😇

If you're not familiar with his work, you can skip this - I don't think you'll quite get the rich flavor of Mike's ideas (though it's a great, short summary for those who know his general pitch)

The topics Mike discusses require some understanding of finance, but the implications are MASSIVE and not at all limited to finance

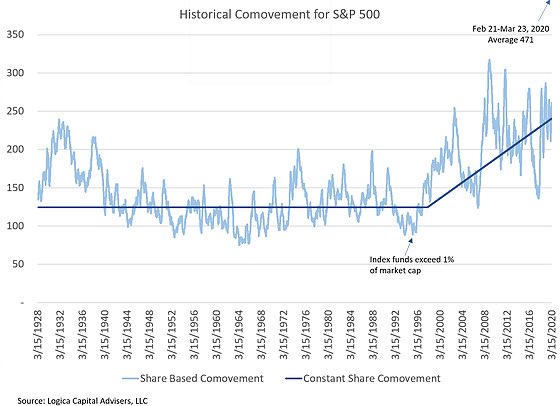

The #DDTG phenomenon, Robinhood traders,"stonks always go up," $HTZ / $CHK rallying in bankruptcy, etc - it's ALL related to this

Mike notes that $GDXJ, the ETF tracking junior gold miners, traded at a 💥25% DISCOUNT💥 to its net asset value (NAV)

I.e. if they held $100 of value, you could buy for $75

See his paper, Policy in a World of Pandemics, Social Media and Passive Investing, for more: logicafunds.com/policy-in-a-wo…

This is just the tip of the iceberg (and it's not actually an earth-shattering realization - discounts to NAV happen sometimes due to illiquidity)

For those not versed in the lore around indexation, some dogma:

* You piggyback on aggregate decisions of the whole investing universe

* You do not transact or affect the market

* Not all companies captured in indices

* If the market is 100% passively indexed, no one studiously sets prices (this is the case well before 100%, but we'll get there)

And the big one:

* OF COURSE they transact & affect the market! Duh! 🤦♂️

That's right - prices magically rose *WITHOUT ANY TRANSACTIONS*

You see, indices aren't actually market cap-weighted in the US, usually. They're *float* weighted, meaning, based on shares AVAILABLE

So if I'm an index fund trying to buy based on market cap, once I get big enough, I'm gonna have a hard time - no shares!

* I own $90 / 90 shares

* Public owns $10 / 10 shares

* Entire index's market cap is $500

* Ergo, index needs 1/5 weighting of Company A

* If fund has $100 to deploy, they need $20 to be Company A

* But wait, they can only buy 10 shares ($10 now)

* Fund buys 10% of float (1 share) at $1/share

* Remaining holders aren't selling

* Fund NEEDS those shares, raises bids until they get them

* Now aggregate market cap AND Company A market cap went UP. Say C.A. is now 50% of total. Need MOAR

There is no price I will sell at, yet this fund NEEDS me to sell to meet their weighting algorithm

Prices now go ~infinite

Remember the Dot Com bubble? Contra conventional wisdom, Mike says the relevant factor wasn't tech but tightly-held, recently IPO'd (incidentally, tech) companies

Nothing about index funds, float-weighting, etc.

fool.com/investing/gene…

Mike has mentioned elsewhere the difficulties of actually *determining* the realistic float. Say, Company A holding shares of Company B while comtemplating a takeover. Will not sell for any reason. Is that float? 🤷♂️

* Markets sometimes do extremely irrational things

* Algorithmic, price-insensitive buying is the most irrational of all. All in the name of "free money" from piggybacking on the entire discretionary investing universe - the most rational of all pursuits!

overcast.fm/+aAHu8AYkU

open.spotify.com/episode/0l2hhc…

tl;dw, Was it rational for Greece to adopt the Euro in light of its subsequent crisis due to monetary inflexibility? If not, are voters adequately equipped to guide MMT? (No)