The Ergodicity Problem in Economics

At the risk of being hyperbolic, I think it is one of the most important papers ever published in economics.

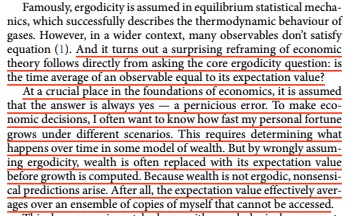

look at one individual’s trajectory across time

look at a bunch of individual’s trajectories at a single point in time

If yes: ergodic.

If not: non-ergodic.

This has led to the belief in "irrationality" and "biases" as a way to explain human behavior deviating from what economic models predict

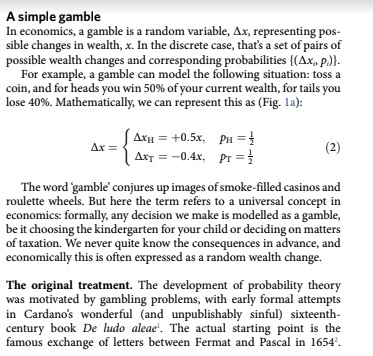

Start with an economic decision with no uncertainty:

You may choose between a job that offers $12,000 per year or $2,000 per month.

Which do you pick?

We care about our ROI when we make taking a job or making an investment, not how the average person does.

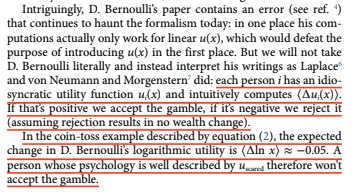

One group was playing an additive game (more ergodic)

The other group was playing a multiplicative game (less ergodic)

Playing conservative in the multiplicative game would maximize wealth in that game.

Playing more aggressive in the additive game would maximize wealth there.

No biases needed!

Much of what we call "risk aversion" is rational avoidance of non-ergodic games like Russian Roulette.