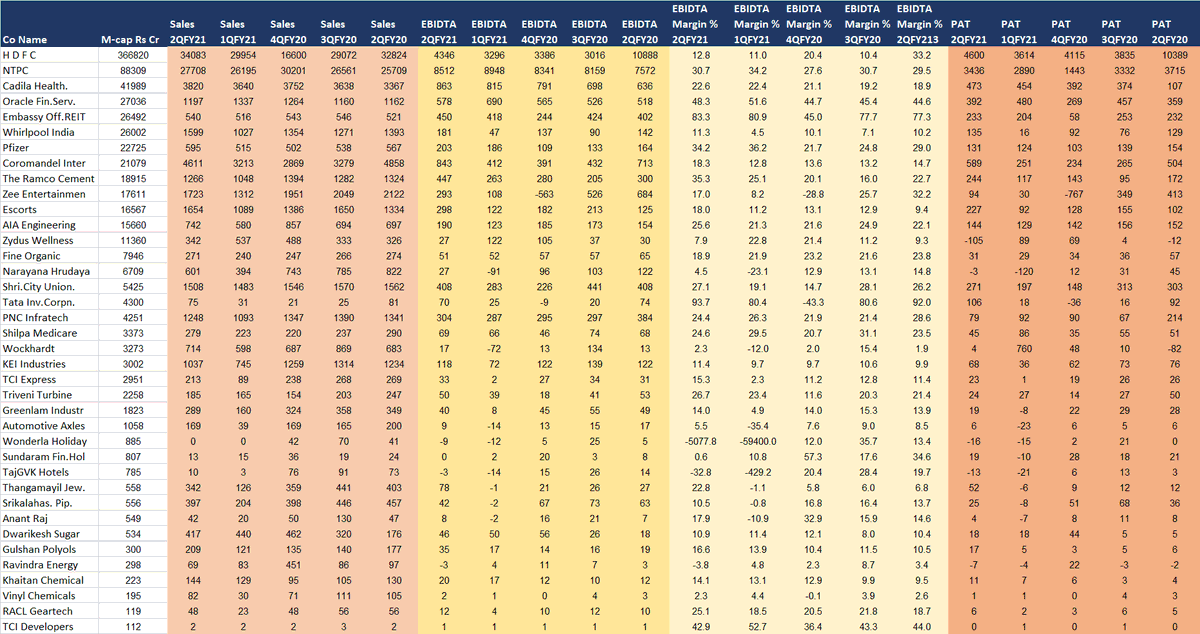

All results declared on 14th July 2020 #excelgiri

#resultsxray with @AnilSinghvi_ on @ZeeBusiness

PS: Use data at ur own discretion

GOOD

ICRA: Sales up 4%, ebidta up 19%, PAT up 32% (27x p/e, 3.7x p/b)

#resultsxray with @AnilSinghvi_ on @ZeeBusiness

PS: Use data at ur own discretion

GOOD

ICRA: Sales up 4%, ebidta up 19%, PAT up 32% (27x p/e, 3.7x p/b)

All results declared on 14th July 2020 #excelgiri

WASH-OUT QUARTER

Oberoi Realty June end

Sales down 80%, EBIDTA down 75%, PAT down 81%

TTM P/E 22, P/B 1.6x

Century Textiles June end

Sales down 34%, EBIDTA down 89%, reports a net loss at 40 cr (TTM P/B 1)

WASH-OUT QUARTER

Oberoi Realty June end

Sales down 80%, EBIDTA down 75%, PAT down 81%

TTM P/E 22, P/B 1.6x

Century Textiles June end

Sales down 34%, EBIDTA down 89%, reports a net loss at 40 cr (TTM P/B 1)

All results declared on 14th July 2020 #excelgiri

WASH-OUT QUARTER

Delta Corp June end

Sales down 74%, reports an ebidta loss at 33 cr, net loss as well

Online skill gaming reports net revenue of 48cr vs 35cr last year

Casino gaming division 0 revenue. Vs run rate of 160-180cr

WASH-OUT QUARTER

Delta Corp June end

Sales down 74%, reports an ebidta loss at 33 cr, net loss as well

Online skill gaming reports net revenue of 48cr vs 35cr last year

Casino gaming division 0 revenue. Vs run rate of 160-180cr

All results declared on 14th July 2020 #excelgiri

WEAK

Fineotex Chem March end

Sales down 13%, ebidta down 12.5%, reports a net loss of 6.3 cr

WEAK

Fineotex Chem March end

Sales down 13%, ebidta down 12.5%, reports a net loss of 6.3 cr

PHUUUUS RESULTS

Rel. Indl. Infra June end

Stock has moved from Rs 162 to Rs 458 (52-week high 480)

Sales down 36%, ebidta down 42%

M-cap 692 cr, June qtr pat at Rs 1 cr

March 2010 pat at 22 cr and now at Rs 8 cr

TTM P/E 71x

Investments at 266 cr, net fixed assets at 65 cr

Rel. Indl. Infra June end

Stock has moved from Rs 162 to Rs 458 (52-week high 480)

Sales down 36%, ebidta down 42%

M-cap 692 cr, June qtr pat at Rs 1 cr

March 2010 pat at 22 cr and now at Rs 8 cr

TTM P/E 71x

Investments at 266 cr, net fixed assets at 65 cr

PHUUUUS RESULTS

Khadim March end

Sales down 23%, ebidta loss at 8 cr, net loss 20 cr

Borrowings increased from 109 cr to 287 cr

M-cap 210 cr, margins fallen from 11% to 4% (7% in 2019 – so don’t blame covid alone)

Khadim March end

Sales down 23%, ebidta loss at 8 cr, net loss 20 cr

Borrowings increased from 109 cr to 287 cr

M-cap 210 cr, margins fallen from 11% to 4% (7% in 2019 – so don’t blame covid alone)

PHUUUUS RESULTS

Natl. Peroxide March

Sales down 31%, ebidta down 60%, pat down 83% (37x p/e)

62% margins in June 2018 and now at 20% (last quarter was negative)

Opto Circuits March

Sales down 43%, ebidta loss 1.1 cr vs profit at 14.2 cr, net loss at 116.4 cr vs profit of 11 cr

Natl. Peroxide March

Sales down 31%, ebidta down 60%, pat down 83% (37x p/e)

62% margins in June 2018 and now at 20% (last quarter was negative)

Opto Circuits March

Sales down 43%, ebidta loss 1.1 cr vs profit at 14.2 cr, net loss at 116.4 cr vs profit of 11 cr

• • •

Missing some Tweet in this thread? You can try to

force a refresh