[Thread]

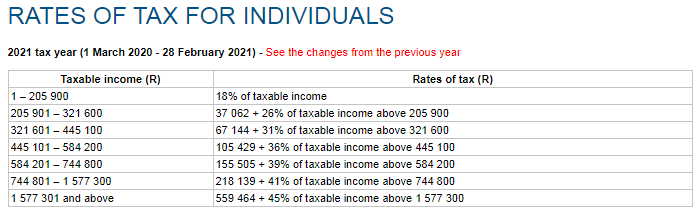

So in short, income tax is a percentage of your income which you pay over to SARS.

That means the more income you earn, the higher your tax % will be.

This is for the 2021 tax year (the one which ends 28 Feb 2021)

Your taxable income also determines what the cool kids call your "marginal tax rate" - that's just the percentage listed in the row you find yourself in.

For someone with total taxable income of R250k for the year, the 2nd row applies (and marginal tax rate will be 26%)

Using the table:

Tax = R37,062 + 26% of taxable income above R205,900

Tax = R37,062 + 26% of R44,100

Tax = R48,528

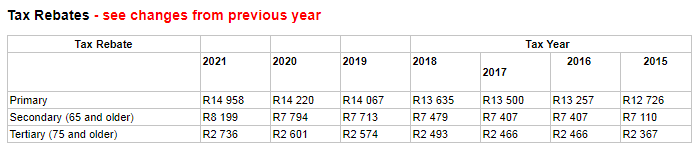

This is money that SARS gives you back.

The value of the annual rebate is also listed on the SARS website -> sars.gov.za/Tax-Rates/Inco…

If you over 65 and 75, you get additional rebates.

Let's stick with a under 65 year old for our example. From the table above, they get a rebate of R14,958.

This means their total tax is:

R48,528 - R14,958 (rebate)

= R33,570

R33,570/R250,000 = 13.4%

And at this point I would also like to clear up what seems to be a pretty common misconception

Someone earning more than R1.5 Million DOES NOT pay 45% tax.

E.g. let's say there's a big cheese with taxable income of R2 Million.

Using the tax tables, they will pay R734,721 in tax

Effective tax rate = 36.7%

It's still a massive tax bill, but they not paying 45% tax.

So now all that's left to figure out is what makes up your taxable income?

- A Salary

- Rental income (after deducting related expenses)

- Interest above R23,800 (for under 65) - (see here sars.gov.za/Tax-Rates/Inco…)

- Dividend income from REIT Investments

- 40% inclusion of Capital Gains (see below)

Examples of allowable deductions:

- Contributions to an RA

- Contributions to a Pension/Provident fund

- Contributions to a SARS registered charity