Today I will share the core of #TBRchapter1 – The History of

Money

The previous tweets can be found here

theory.

– Dennis Lockhart, Chairman of the board of the Federal

Reserve Bank of Atlanta (2012)

#TBRchapter1

– Paul Volcker (2013)

#TBRchapter1

#TBRchapter1

#TBRchapter1

built their empires around a monetary system based on gold.

Maintaining the value of one’s currency was key to keeping

power. Soldiers were kept happy by regular payments of wages in gold and silver coins.

#TBRchapter1

was debased.

#TBRchapter1

commonly known as the bezant, was used widely throughout

Europe and the Mediterranean. The bezant was possibly the most successful means of payment in world history. These gold coins existed from 491 to 1453

#TBRchapter1

the bubonic plague and a series of fijinancial crashes hammered Europe, the role of the bezant as money was replaced by silver coins in many European countries.

#TBRchapter1

#TBRchapter1

most important advantage is that it forces governments to be

disciplined in their fiscal policy because they cannot turn on

the printing press to finance budget deficits.

#TBRchapter1

inflation for almost two hundred years up until the dissolution

of the gold standard in 1914

#TBRchapter1

and often the only way – to pay for a war

#TBRchapter1

continued apace, leading to the creation of a massive credit

bubble in the 1920s. This led eventually to the market crash of

1929, after which the world economy collapsed and fell into a

deep economic crisis

#TBRchapter1

substantial like gold or silver, banks can create virtually limitless amounts of money by creating new loans. All money is created in the form of credit. If all loans were to be paid off,

all money would disappear

#TBR

#TBRchapter1

Appendix I). Central bankers, however, continue to claim that

this time, all will be well. If turning on the printing presses would lead to prosperity, then Africa would not be a poor continent

#TBRchapter1

portion of all outstanding liabilities as available reserves. In 1900 this was around 30%, and has now declined to just 3%.

Fractional banking started at the end of the Middle Ages

#TBRchapter1

#TBRchapter1

#TBR

way, which did indeed stimulate the French economy. Law eventually got himself into trouble pursuing another business

opportunity. In 1717, he founded the Mississippi Company.

#TBRchapter1

#TBRchapter1

#TBRchapter1

Because of all this newly printed money, people began to distrust paper money. The French government quickly implemented some strict new rules. Maximum prices were set to curb inflation ..

gold instead of paper money when selling goods. In a last attempt to protect the paper money system, all trade in precious metals was forbidden as of 13 November 1793

#TBRchapter1

#TBRchapter1

#TBRchapter1

#TBRchapter1

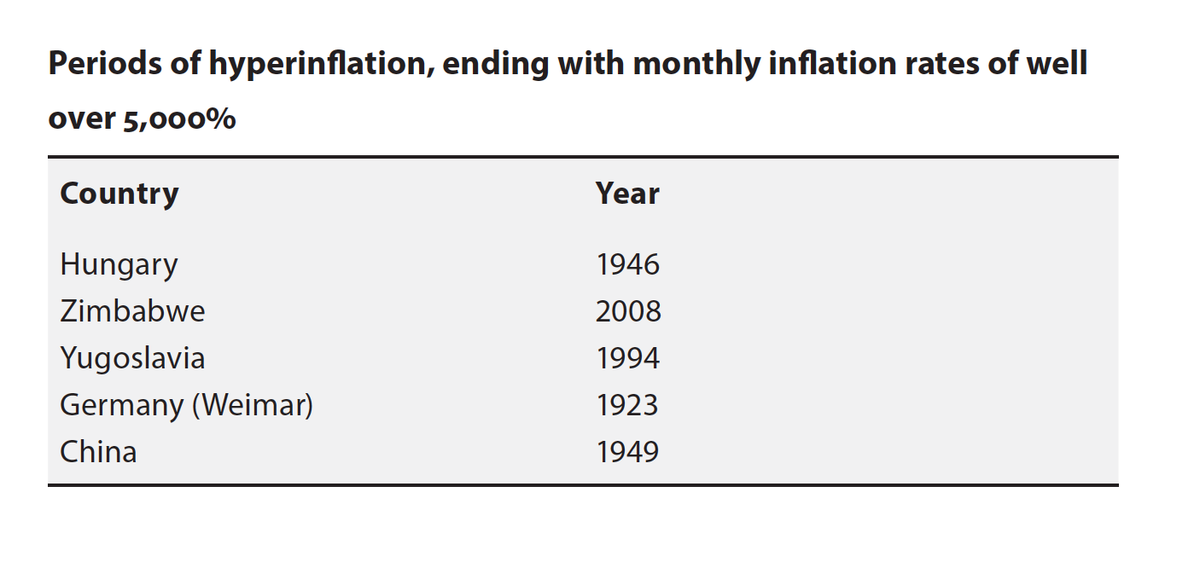

of over 50% within a year. Hyperinflation is so harmful because money loses its value and power. We could well call it the death of money.

#TBRchapter1

and people revert almost immediately to bartering. A good example of the dangers of fiat money is the hyperinflation

that scourged Germany’s Weimar Republic in the beginning

of the 1920s.

#TBRchapter1

#TBRchapter1

consequence, central banks such as the Fed and the ECB create over one trillion dollars (5tr now!?-wm) in new money every year in order to support their governments. And still, they claim they are fighting inflation.

en.cdfund.com/download-the-b…