New from us—Facedrive: A $1B+ ESG Stock Promotion with a Hollow Core Business, Flailing Business Pivots and Multi-Million Dollar Payments to an Opaque BVI Entity; 95% Downside

hindenburgresearch.com/facedrive/

(1/x)

hindenburgresearch.com/facedrive/

(1/x)

recently went public with the core premise of being an “eco-friendly” ride hailing app allowing users to select electric vehicle or hybrid options.

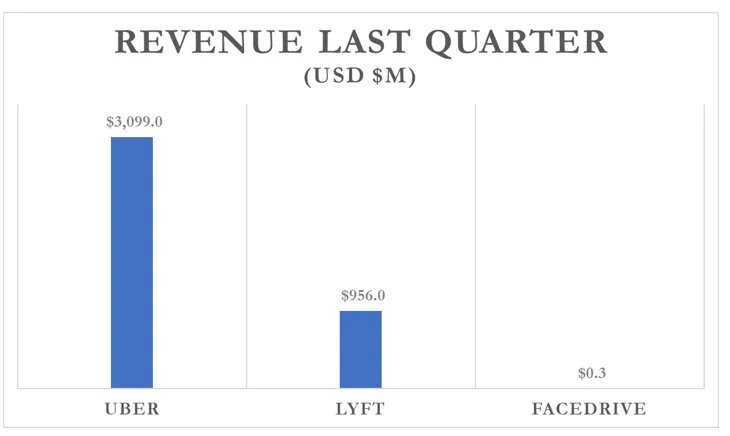

EV excitement has fueled the stock to a ludicrous $1.4 billion market cap and an absurd 908x revenue multiple.

EV excitement has fueled the stock to a ludicrous $1.4 billion market cap and an absurd 908x revenue multiple.

's already-limited Canada-based ridesharing business appears to have been dramatically impaired by COVID.

While the company claims 13,000 registered drivers on the platform, we estimate current active drivers at ~500-600 total, suggesting a 95% overstatement.

While the company claims 13,000 registered drivers on the platform, we estimate current active drivers at ~500-600 total, suggesting a 95% overstatement.

Facedrive has very few users, minimal resources, and no sustainable differentiator in ridesharing.

Uber or Lyft could easily add electric vehicle options if they ever felt it worthwhile to eliminate Facedrive’s supposed ‘niche’.

Uber or Lyft could easily add electric vehicle options if they ever felt it worthwhile to eliminate Facedrive’s supposed ‘niche’.

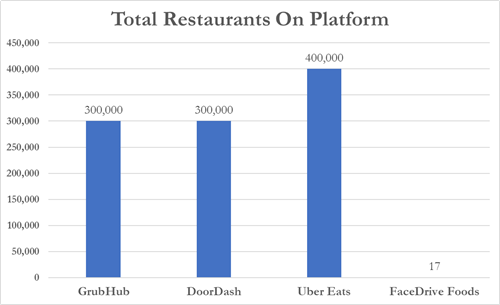

Rather than focusing on tackling just one resource-intensive highly competitive market like ridesharing, recently entered a second—food delivery.

We found Facedrive’s platform has a total of 17 restaurants compared to UberEats' 400,000 and GrubHub's 300,000

We found Facedrive’s platform has a total of 17 restaurants compared to UberEats' 400,000 and GrubHub's 300,000

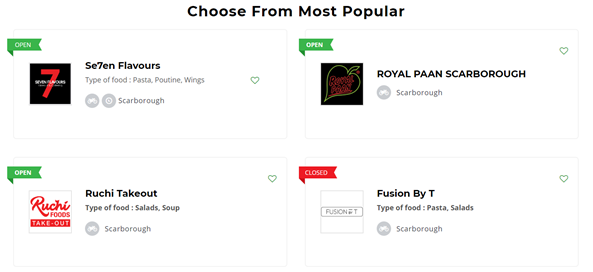

We called several of the “most popular” restaurants on the Facedrive Foods page. One didn't seem to have a working phone number, and two said they don’t use Facedrive anymore.

Facedrive even joined the COVID-hype train, launching a COVID contact tracing app. We reached out to their partner on the project who confirmed what appears to be overstatements of the projects’ publicly stated progress.

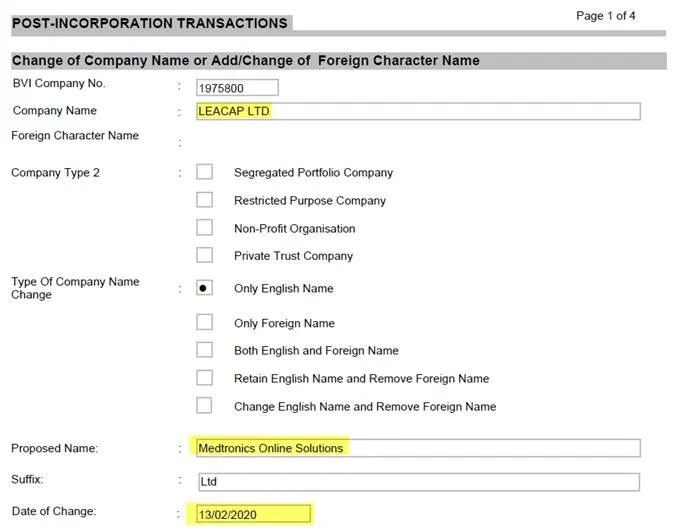

has spiked on a slew of buzzword-laden press releases, helped by stock promoters who received payment through an opaque newly-renamed BVI-registered entity.

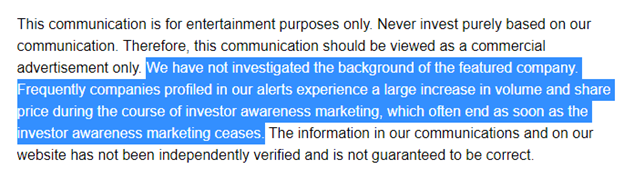

The site admits in its disclaimers that stocks it touts often plunge after their promotion cycle ends

The site admits in its disclaimers that stocks it touts often plunge after their promotion cycle ends

In June 2020, paid $8.2M to an opaque newly named BVI entity for 1 month of “marketing” services.

This is the largest promotion payment we have ever seen and was greater than Facedrive’s entire operating budget over the last year.

This is the largest promotion payment we have ever seen and was greater than Facedrive’s entire operating budget over the last year.

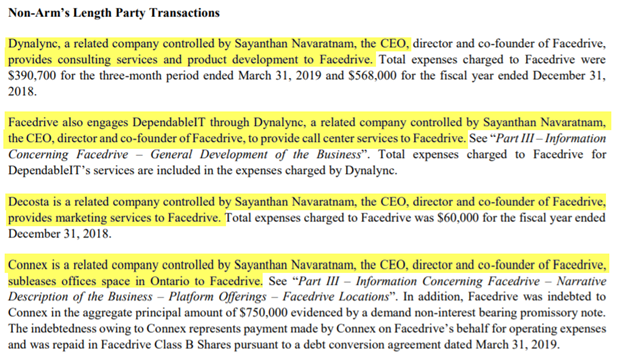

Additionally, the company has engaged in multiple related party transactions. Its 2019 filing statement detailed paying 4 entities controlled by its CEO, representing approximately 24% of its 2019 operating expenses.

We do not think 's core business is viable & we find its “marketing” and related party spends to be alarming.

We have serious doubts about the veracity of the company’s claims relating to its ill-conceived side projects that appear hastily thrown together for PR value

We have serious doubts about the veracity of the company’s claims relating to its ill-conceived side projects that appear hastily thrown together for PR value

's CEO has a history that bodes poorly. He was Chairman/CEO of another a public company, Creative Vistas, which saw its shares precipitously plummet by ~99%.

We believe this “story” stock is heading toward a hard repricing, as we see de minimis overall value in the company’s operations.

Our 1-year price target for is CAD $0.70, representing 95% downside

hindenburgresearch.com/facedrive/

Our 1-year price target for is CAD $0.70, representing 95% downside

hindenburgresearch.com/facedrive/

• • •

Missing some Tweet in this thread? You can try to

force a refresh