Information in the mining industry is opaque and highly fragmented. Despite its massive growth, investors still find entry into the space challenging.

aniccaresearch.tech/blog/the-alche…

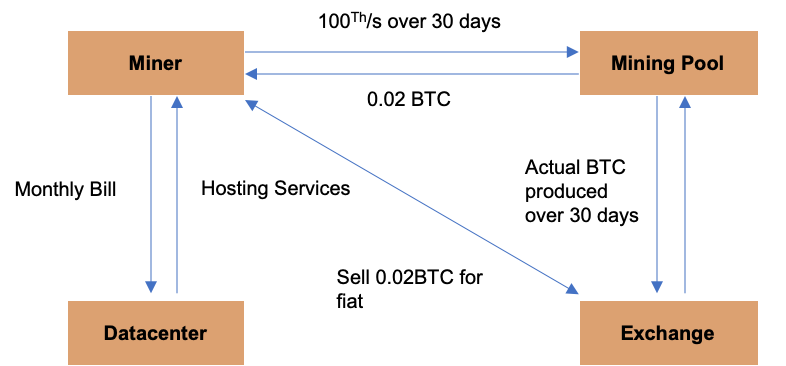

These deals will happen more frequently as more exchanges / financial services vertically integrate with mining pools.

Special thanks to @derek_hsue @nic__carter @tarunchitra @tpacchia @fishkiller @Weinaynay @QWQiao @tzhen for edits and feedback, and especially @hasufl for taking time during vacation to read this (twice!) ♥️