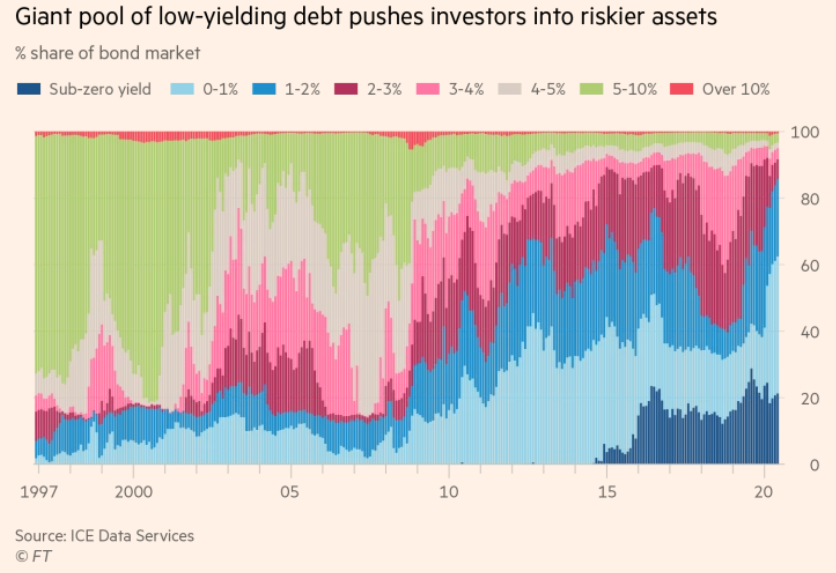

A majority of global 60T$ bonds yield near-zero to negative rate

@FT article says "investors blame the Federal Reserve". on.ft.com/39z1lHv

But that is wrong

Zero long-term rate reflects structural imbalances in the global economy ...

The problem only got worse since then and hence the downward pressure on long-term rate continued

The Fed cannot raise long-term, or "natural rate", as it is sometimes called

This would require serious re-tooling of the economy

The Fed cannot help much here

Central banks cannot cure this disease

For possible causes and cures of the disease, see scholar.harvard.edu/files/straub/f…