medium.com/@skanda_97974/…

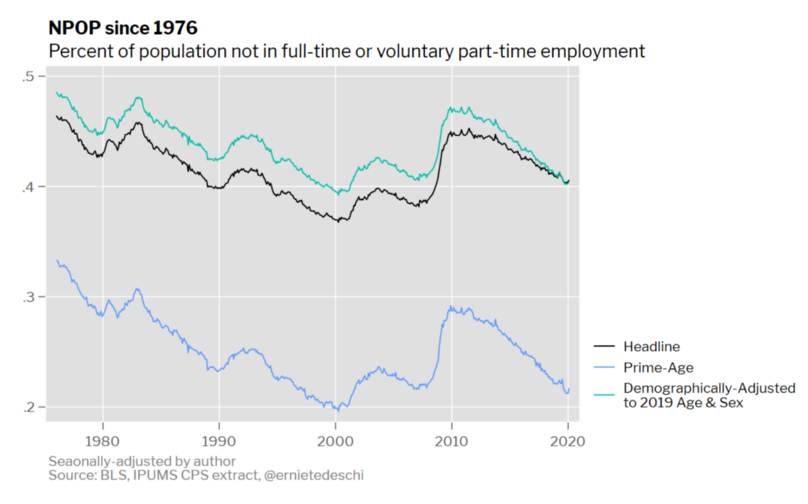

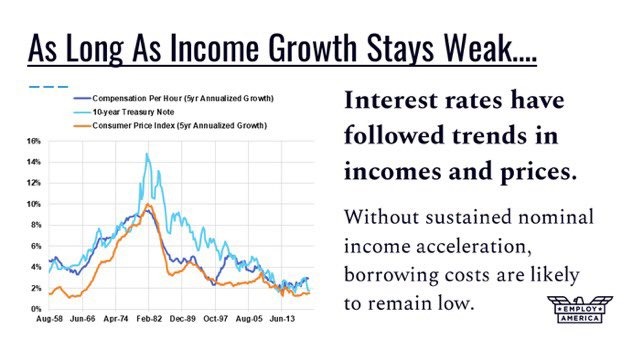

To start with, the Fed really should look beyond consumer price inflation if they want to escape the asymmetric costs posed by the zero lower bound...

blogs.tslombard.com/road-to-inflat…

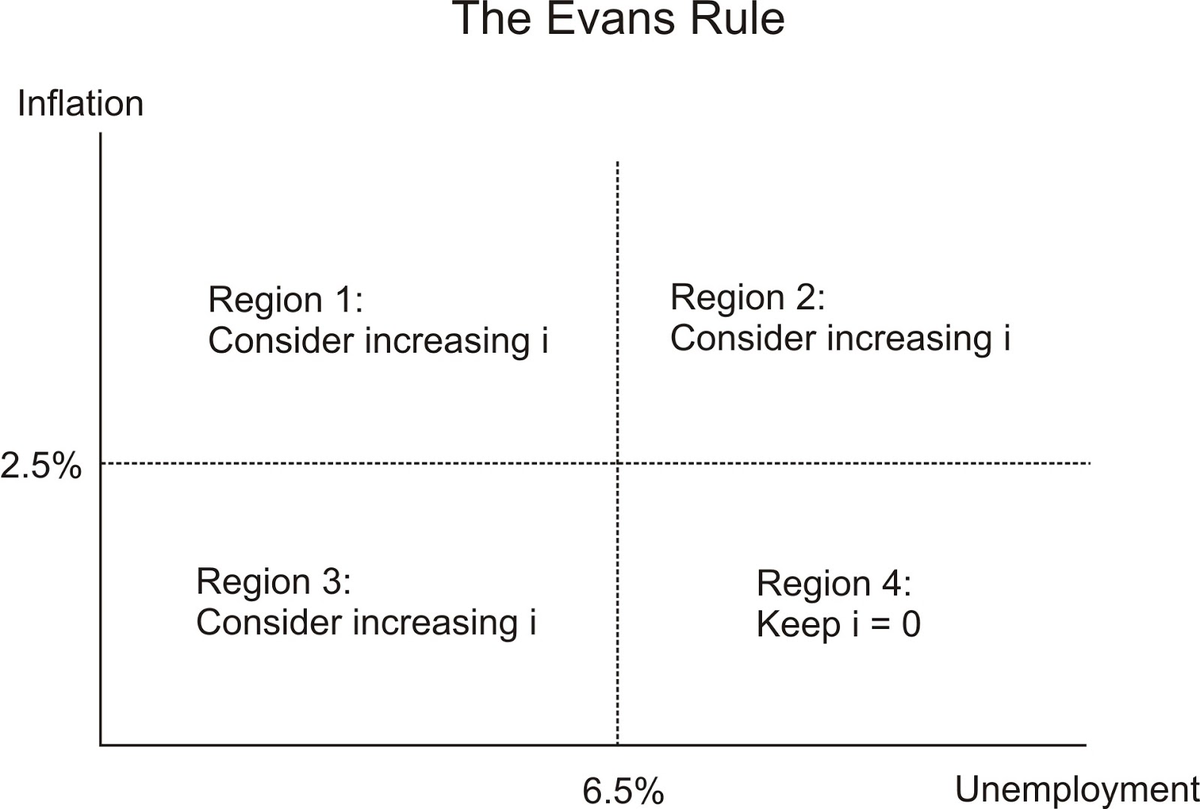

The Evans Rule took a defensive approach to forward guidance but if the Fed wants to sustainably escape the trap of low nominal income growth and inflation, it ought to set an affirmative goal

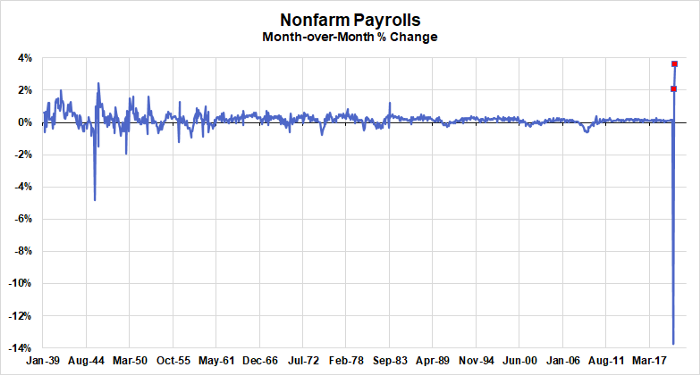

nytimes.com/2020/05/19/ups…

medium.com/@employamerica…