July was yet another very strong month for my portfolio and quite frankly, I am stunned!

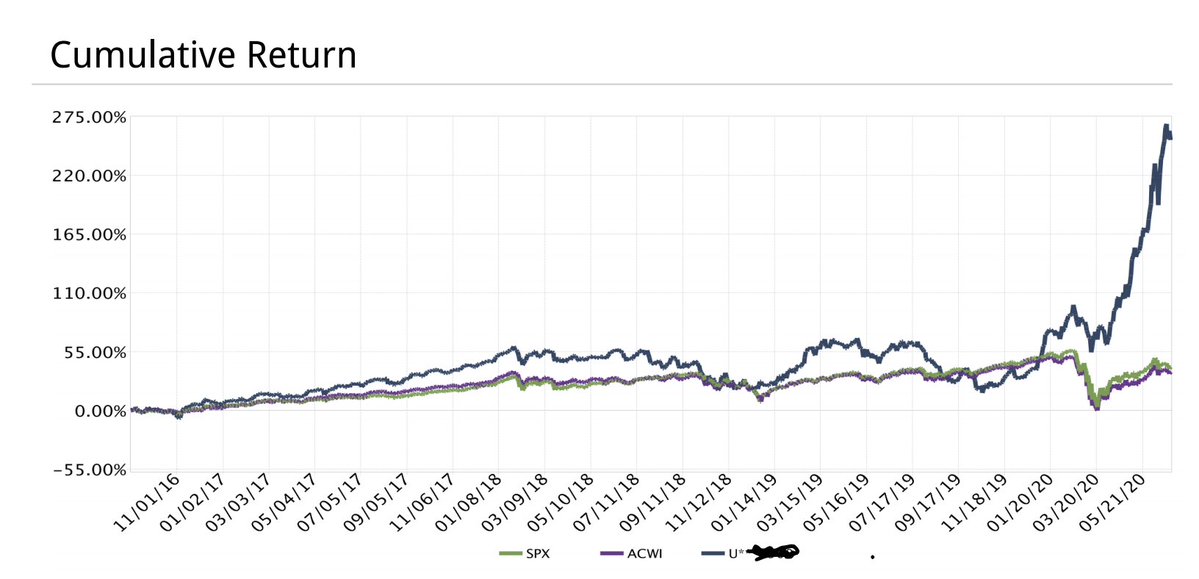

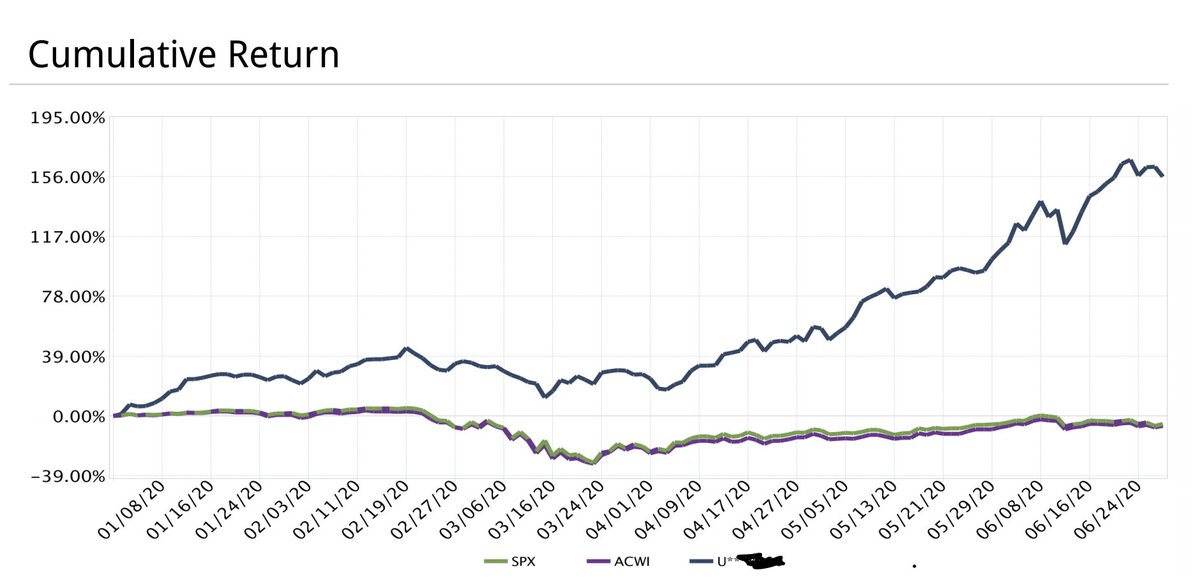

Since the beginning of this year, my entire portfolio has appreciated by 212.21% and the run is showing no signs of stopping...

I am obviously thrilled with these returns but credit for...

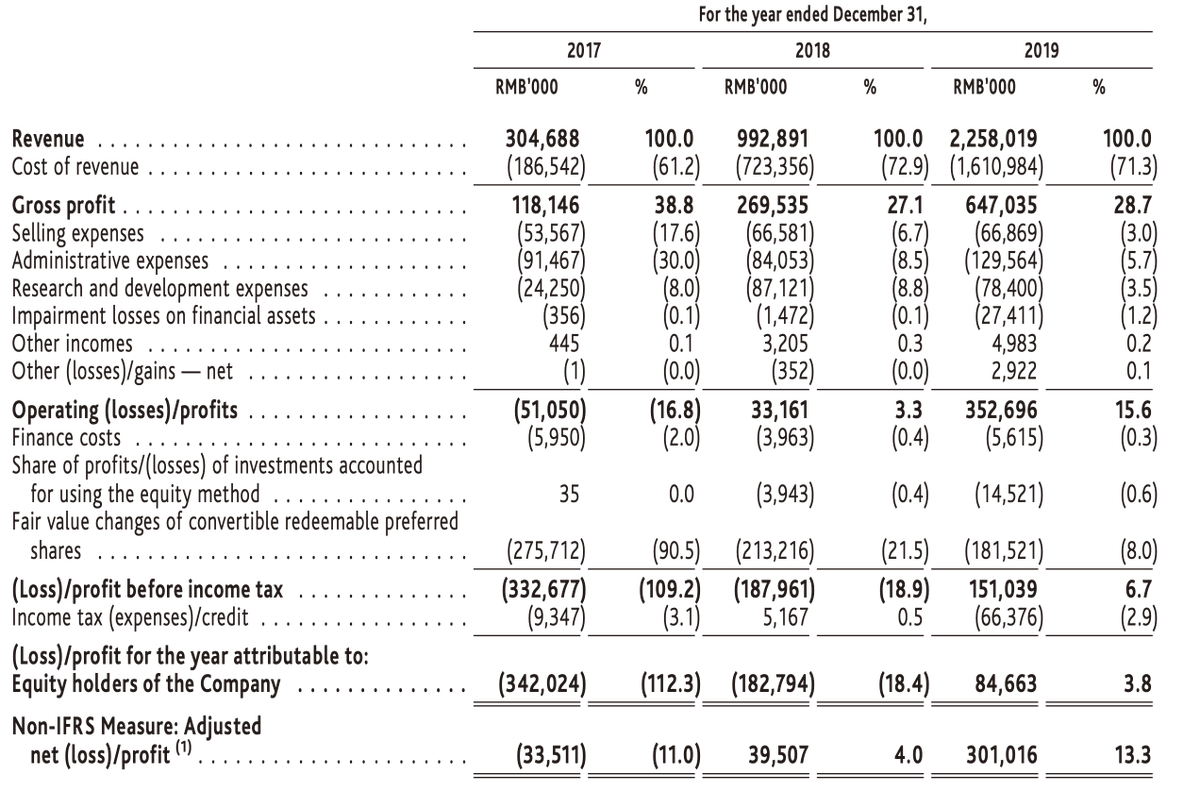

Running a business is no easy feat (speaking from personal experience) and I am very fortunate to have found such amazing businesses which have allowed me to enjoy...

What can I say? Apart from the fact that investing in outstanding growth businesses works and since I am no genius, anybody can do this.

Since posting on FinTwit (Feb 2019), I have repeatedly been criticised for running a 'momo' portfolio,...

Well, all I will say is that since I have a brain, I use it and whenever I am in doubt, I get out. Protection of my capital is my primary concern and my goal is to...

After studying market history and personally investing for 22 years, I can unequivocally say that investing in high growth, disruptive companies works and provides life altering returns. This is not to say...

Turning to the current environment, recent data has shown that the coronavirus isn't going away and it is likely that things may deteriorate with cooler weather.

So, there is a real risk that parts of...

Recently, we have seen blowout numbers from...

The Fed is likely to remain in the "pedal to the metal" mode until a vaccine is shown to be effective and that may take a year...

For my part, I am planning to remain fully invested.

For sure, there will be pullbacks and the ride will not be smooth (it never is!) but I'm fairly certain that the incredible businesses in my portfolio will continue to thrive.

Hope this has been helpful 🙏