“Amazon, as far as I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers”: Matthew Yglesias (2013)

No, my friend. Here's what AMZN is: It's a $1.6 Trillion startup.

Jeff told us in Q1 "If you’re a shareowner in Amazon, you may want to take a seat.”

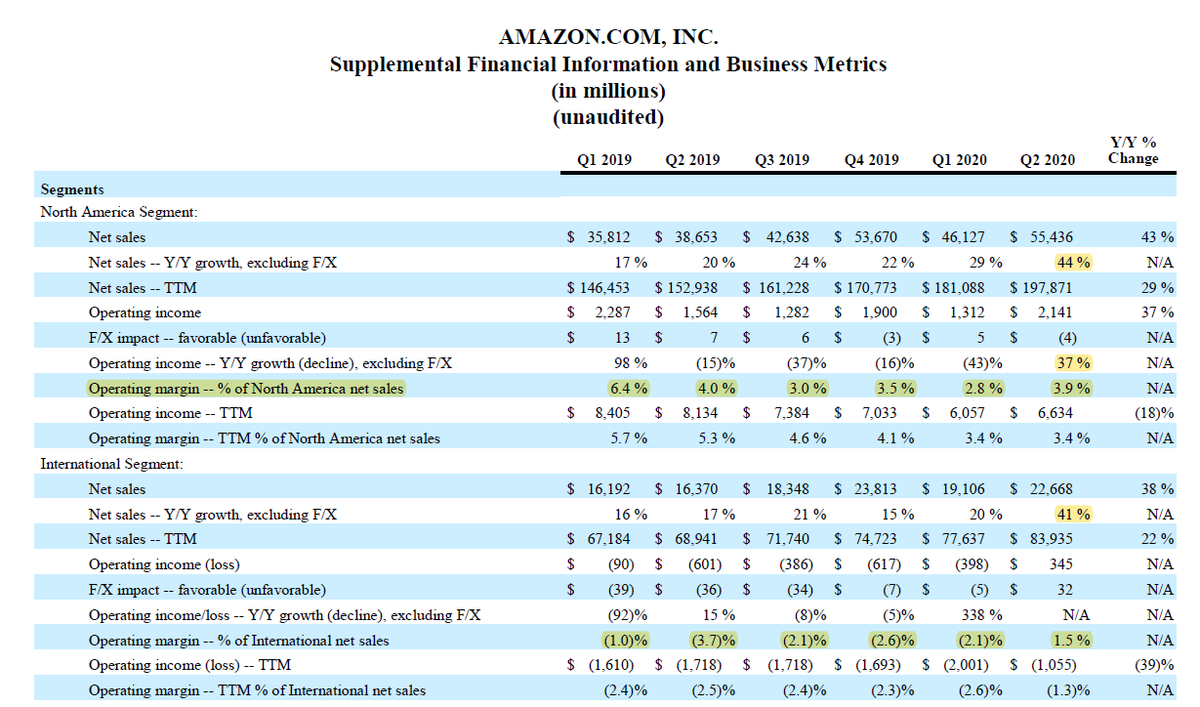

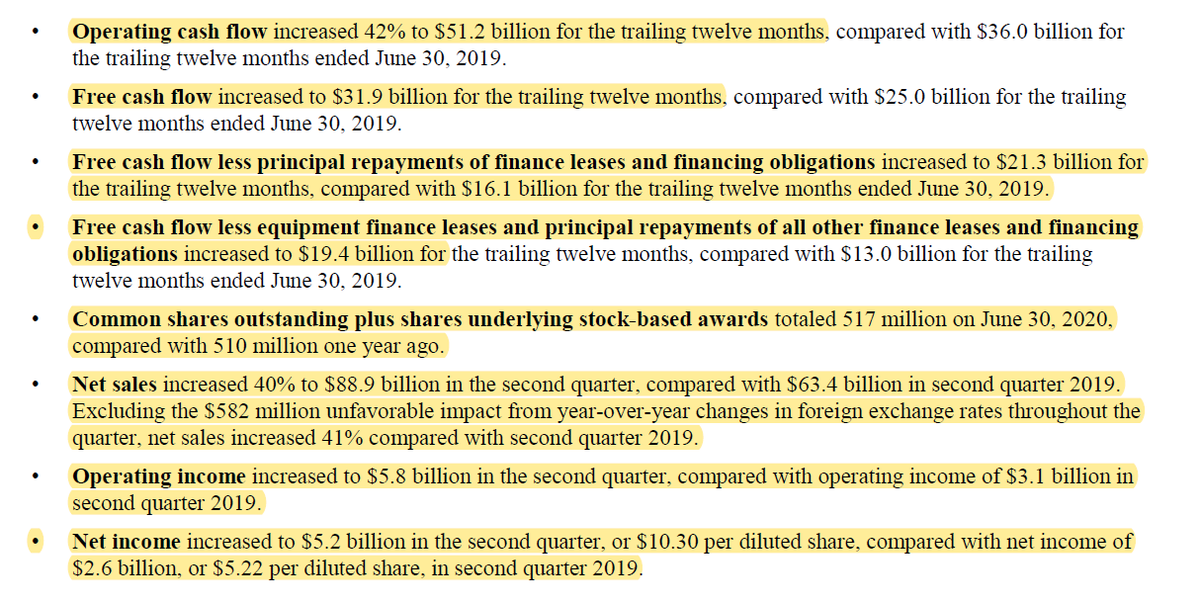

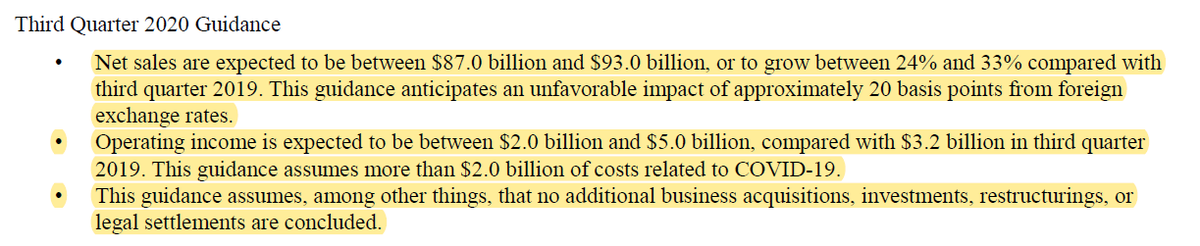

I didn't need a seat then, but I had to sit for a while after looking at ~40% growth in a company that generated $280 Bn sales in 2019.

I chuckled after hearing RBC's Mahaney's question. Also asked a good q at $GOOG

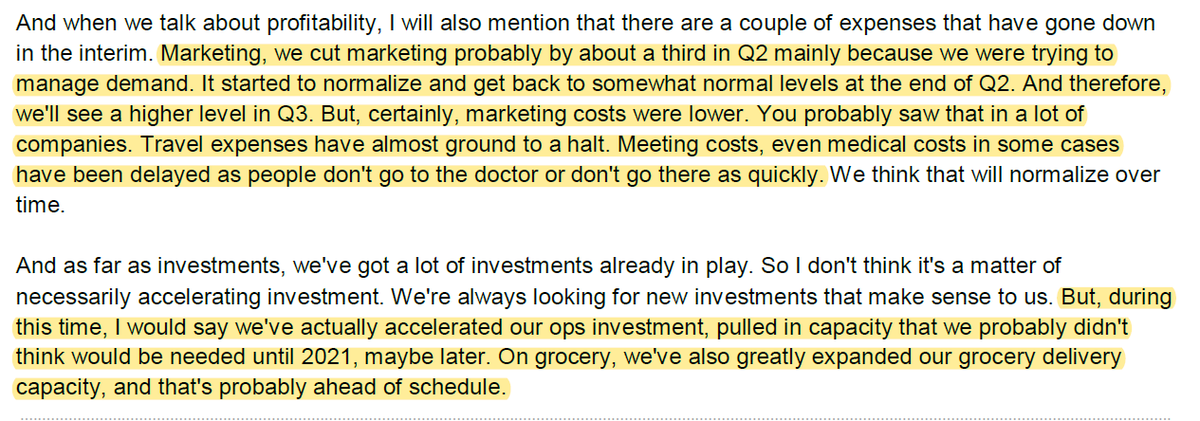

What drove such astonishing numbers?

Prime members. Higher renewal rate, higher new membership growth, larger basket size.

Win. Win. Win.

Streaming video hours 2x, online groceries 3x YoY

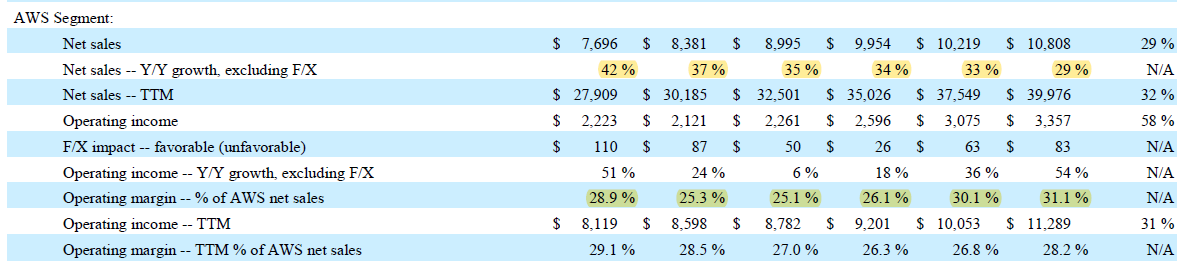

That would make AWS a ~$850 Bn market cap company.

AWS had $1.8 Bn revenue in 2012.

Valuing these companies is just like the Petersburg Paradox, as I have explained recently.

borrowedideas.substack.com/p/is-valuing-s…

In case you are curious, you can read my mega-thread on $AMZN posted back in March. +75% since then.

So Mr. Market probably already gets it. No easy money.