$CVNA could easily be using their relationship with DriveTime to offload their Financing products at Premium prices and their Financing Margins improved bc they started securitizing their own loans in 2019 and have since plateaued

VSCs = Vehicle Servicing Contracts = Extended Warranties

GAP Waiver Coverage = Coverage in case the car is totaled

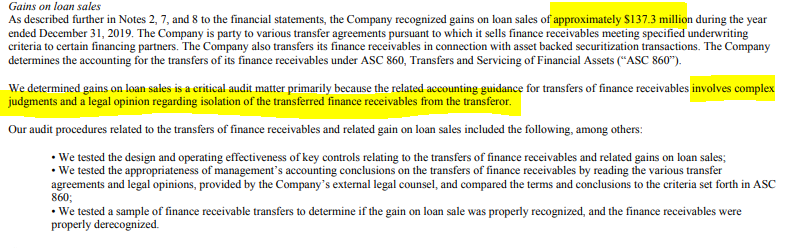

Loan Receivables

-a one time shift in Gross Profit Unit

-they had to retain 5% of their loan balances to comply with Risk Retention Rules

-uncertainty who the buyers were

That is the million dollar question.

Sure. Actually I would say its pretty likely they are involved somehow.

Why are VIE investors willing to pay above "Premium Pricing" for Loan Receivables?

Maybe they own 38% of $CVNA?

These off balance sheet VIEs happen all the time, and can make sense, but are less transparent

-GPU from Financing is not going up any more from here

-There clearly some advantages that $CVNA has that other competitors don't, (ie Relationship with DriveTime)

-The ability to inflate GPU Financing is there if they want to use it or not