Tl,dr: The stuff you thought was settled fact is wrong. There is a lot to unlearn about the recession in order to learn what needs to be learned.

Thread....

mercatus.org/publications/m…

1-

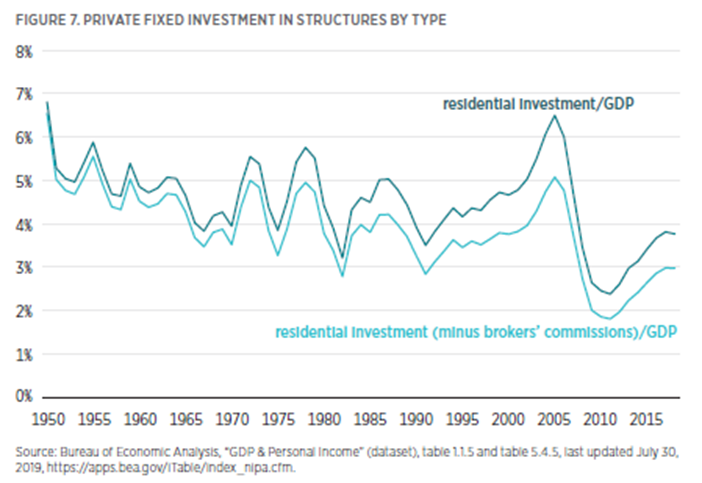

Wrong Lesson: Too much money and credit led to too many overpriced homes.

Right Lesson: Prices were high during the bubble because we lack adequate housing in some important places. We needed more homes, not fewer.

Wrong Lesson: A mortgage crackdown was necessary to bust a housing bubble.

Right Lesson: Lending policy should be countercyclical. Lending regulations have been pro-cyclical, employment killing, and wealth destroying.

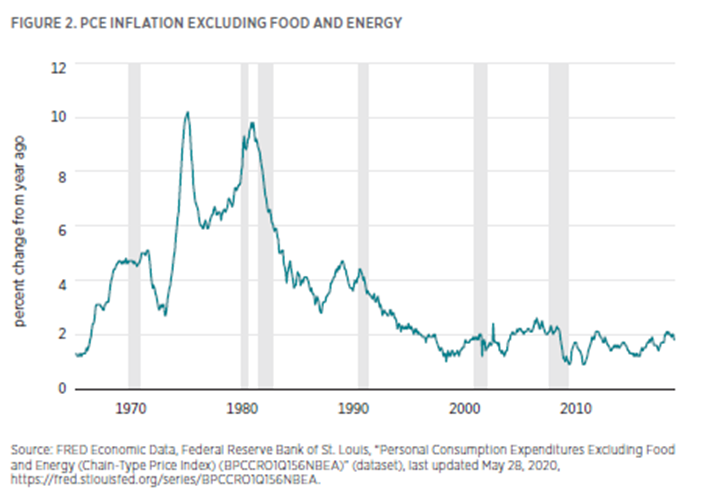

Wrong Lesson: The Fed should be in the business of keeping asset prices low because low interest rates are creating financial bubbles.

Right Lesson: This mindset caused the Great Recession. The Fed should target stable NGDP growth.

Scott will have a book soon that goes into more details on the monetary side of this.

I have a book out now that goes into more details on the housing side of this.

amazon.com/Shut-Out-Short…