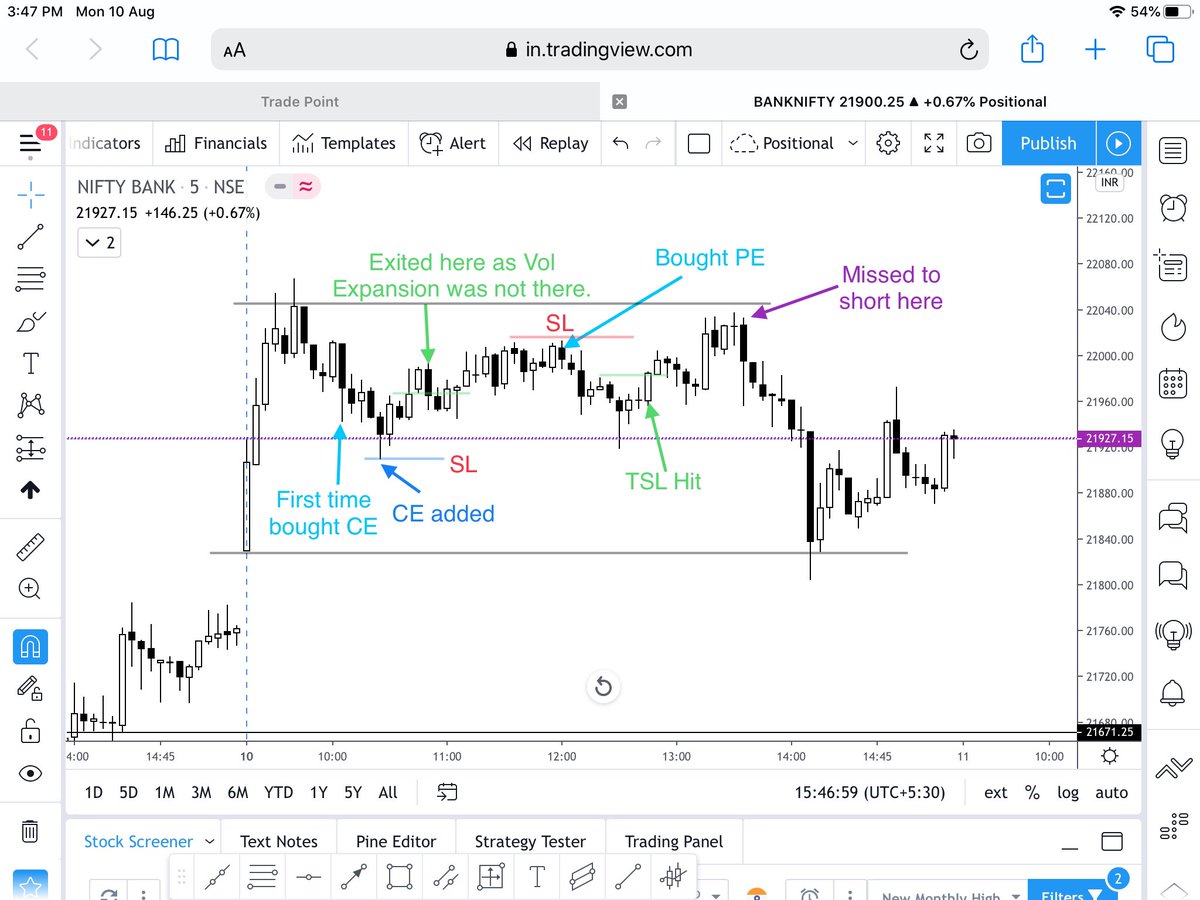

Buy /Long with last 5 minute candle low as SL.

Bn Spot 21965 Sl 21900 Target 22300

Bn Spot 21965 Sl 21900 Target 22300

Sorry Target 22200 typo error

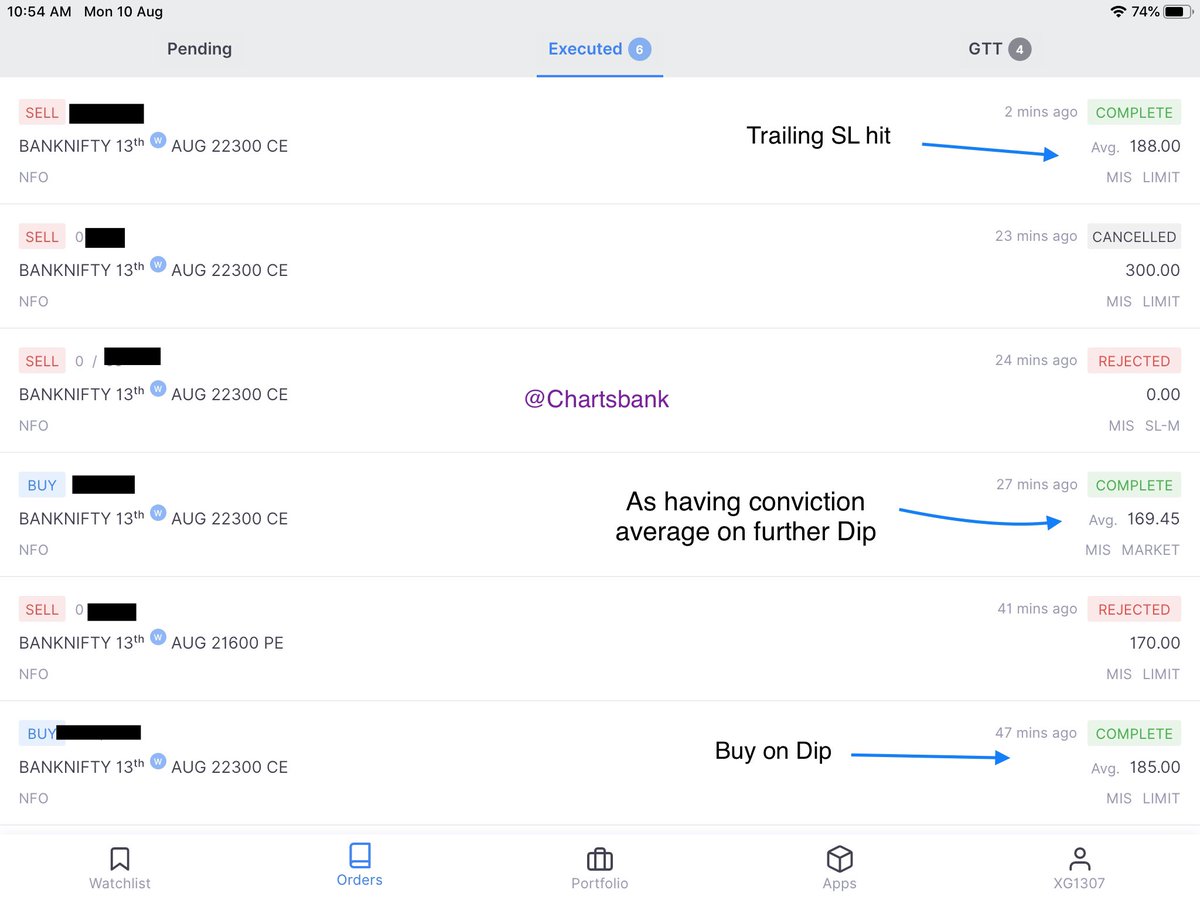

Bought more in last candle fall.

Sl shifted to 21950 now....

Just few 20+ points away.

I m sure...ye b hit na hoga

Sl shifted to 21950 now....

Just few 20+ points away.

I m sure...ye b hit na hoga

Last candle low is 21909

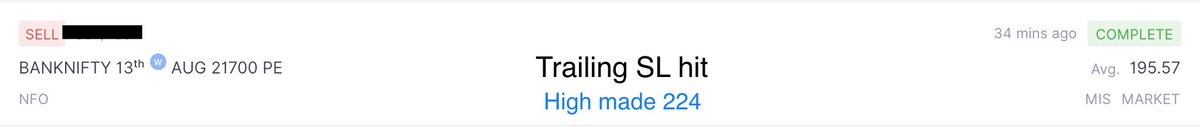

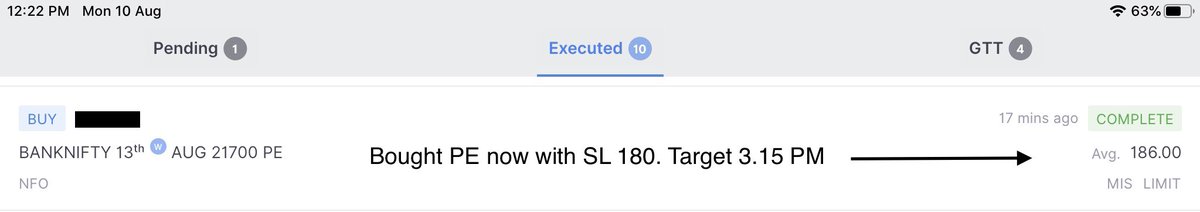

Yeap...As market changes, we should align ourself too. Now bought PE.

Till Wednesday all margin locked then only can go for selling.

Till Wednesday all margin locked then only can go for selling.

I was not having margin to sit in trade long via hedging else could b a good day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh