@retheauditors @premnsikka @alexralph 1/ The curious case of “Game On” in the mysterious world of corporate insolvency. Following on from the appointment of I.P.’s Mr/Ms Fender as administrators to key SPVs LPE & LPT in the #LCF crew’s “implementation” of their “Mazars step” & ..

2/ “technology assets” plans, administrators proposals were filed recently scribd.com/document/47270… AND scribd.com/document/47271…. Setting the scene, LCF crew appointments: 1. LPC/AM administrator/liquidator Edwin Kirker (LPC along with associate & Simon Hume-Kendall’s …

3/ ex Moore Stephens I.P. mucker Simon Paterson)

https://twitter.com/ianbeckett/status/1265933361647927296?s=20. 2. LPT/LPE administrator Andrew Fender (along with associate & legal advisor, the mysterious “JSCS Ltd”)

https://twitter.com/ianbeckett/status/1288853839148457984?s=20. 3. LOG/LPC Company Secretary/alleged CFO David Elliott (allegedly …

4/ Simon Hume-Kendall’s old mucker & ex colleague of Simon Paterson at Moore Stephens

https://twitter.com/ianbeckett/status/1282036250447417346?s=20). 4. LOG/LPC auditors BDO

https://twitter.com/ianbeckett/status/1217135570943692800?s=20. 5. LCF Plc administrators appointments - administrators at LG & LOG. 6. LOG administrator appointments - liquidator ..

5/ at ITI, it’s subsidiary AM seeing the replacement of the LCF crew’s administrator/liquidator with LOG administrator appointed liquidator before AM could be put in the ground (liquidated). 7. By an amazing coincidence LG joint administrator Asher Miller (David Rubin & Co) is..

6/ also an administrator/liquidator of notorious minibond outfits #AssetLife & #MJSCapital

From administrators proposals the “Mazars Step Plan” seemingly aimed to create a new holding company (LPT) for a “cleaned up” …

https://twitter.com/ianbeckett/status/1290690601768427520?s=20, both connected to the #LCF crew.

From administrators proposals the “Mazars Step Plan” seemingly aimed to create a new holding company (LPT) for a “cleaned up” …

7/ LPC group along the way spurting out tens of £m’s to the ultimate beneficiaries of LG (allegedly the LCF crew) from the purchase of LPC pref. shares by LPT. The “technology assets” (purportedly LAI,ITI,AM) plan allegedly aimed for the LPC group (subsequently LPE) to …

8/ purchase the “technology assets” (allegedly owned substantially by the LCF crew/family), spurting out tens of £m’s allegedly to the LCF crew/family. The result of both unsurprisingly was tens of £m’s allegedly transferred to the LCF crew (incl. substantial bank transfers …

9/ from LCF) with LCF bondholders in effect substantially picking up the tab. This tab LCF bondholders ended up picking up along with a pair of the LCF crews shiny “novation agreements” (purportedly re-spinning original transactions) are at the centre of a High Court case …

10/ between LOG administrators + LPT/LPE/LG, judgement from which is due imminently + no doubt if/when the court documents are released will likely avoid the need for Ex-Lax for ultimate beneficiaries/directors/officers/auditors/banks/payment institutions/lawyers/accountants ..

11/ etc, particularly in relation to the source & destinations of large bank/payment institution transfers + the substance over purported form of the associated transactions underlying them. It will be very interesting to see who likely did (or didn’t do) what + when. It’s ..

12/ interesting to note taking together LPE/LPT administrator proposals: 1. LPT only incorporated in 07/2018 + having no bank account (superficially its only material transaction a paper transaction for the purchase of LPC pref. shares) should command a similar administrator ..

13/ fee estimate to LPE (circa £102k), albeit again with no bank account. By comparison Mr Fender’s recent administrator fee for the complex + notorious FCA IFA Blackstar Wealth Management Ltd “Blackstar WM” was ~£50k. 2. in both proposals we see the same 3rd party …

14/ “legal/agents costs” estimate of £50k(Blackstar WM was £10k) with the mysterious “JSCS Ltd” named in both, just as in Mr Fender’s administration of Blackstar WM where we noted that the mysterious “JSCS Ltd” didn’t appear to be on either the Law Society(SRA)/Companies House..

15/ registers?. 3. both proposals note the imminent high court judgment (LOG vs LPT/LPE/LG) in which LOG administrators seek to have the LCF crews shiny novation agreements + associated purported transactions “declared a sham & void/void/set aside/transactions at undervalue”.

16/ 4. In both proposals (5.6) the Fenders declared that the LPE/LPT administrators had taken a “neutral stance” on the LOG vs LPT/LPE/LG high court action although the Fenders didn’t declare whether this applied to their advisor, the mysterious “JSCS Ltd”, whoever that is.

17/ 5. The ultimate beneficiaries of LPT were not reported (it’s been alleged Simon Hume-Kendall holds the only share in LPT purportedly on trust for LG). In (LPT 2.4) It was reported LPC/LOG auditors BDO reduced the valuation (price to be paid) of the LPC pref. shares from ..

18/ £30m to £13.4m (reported in LPT 2.8/5.1 as £16.7m) + in LPT 5.8 as LCF making the payment transfers to the sellers. Also reported in LPT 2.3 was that the LPC pref. shares were “held by the members of LG”, and in LPT 2.4 it was reported ..

19/ that the LPC pref. shares were “purchased from Simon Hume-Kendall/Elten Barker” + “they held the shares in LPC”. The ultimate beneficiaries of LPC pref. shares were not reported + the destinations of the reported (LPT 5.8) £13.4m(£16.7m) associated bank ..

20/ transfers from LCF to sellers were not reported. If the owner of LPT is LG, then the ultimate beneficiaries of LG have in effect sold the LPC pref. shares directly/indirectly to themselves with LCF bondholders substantially picking up the tab.

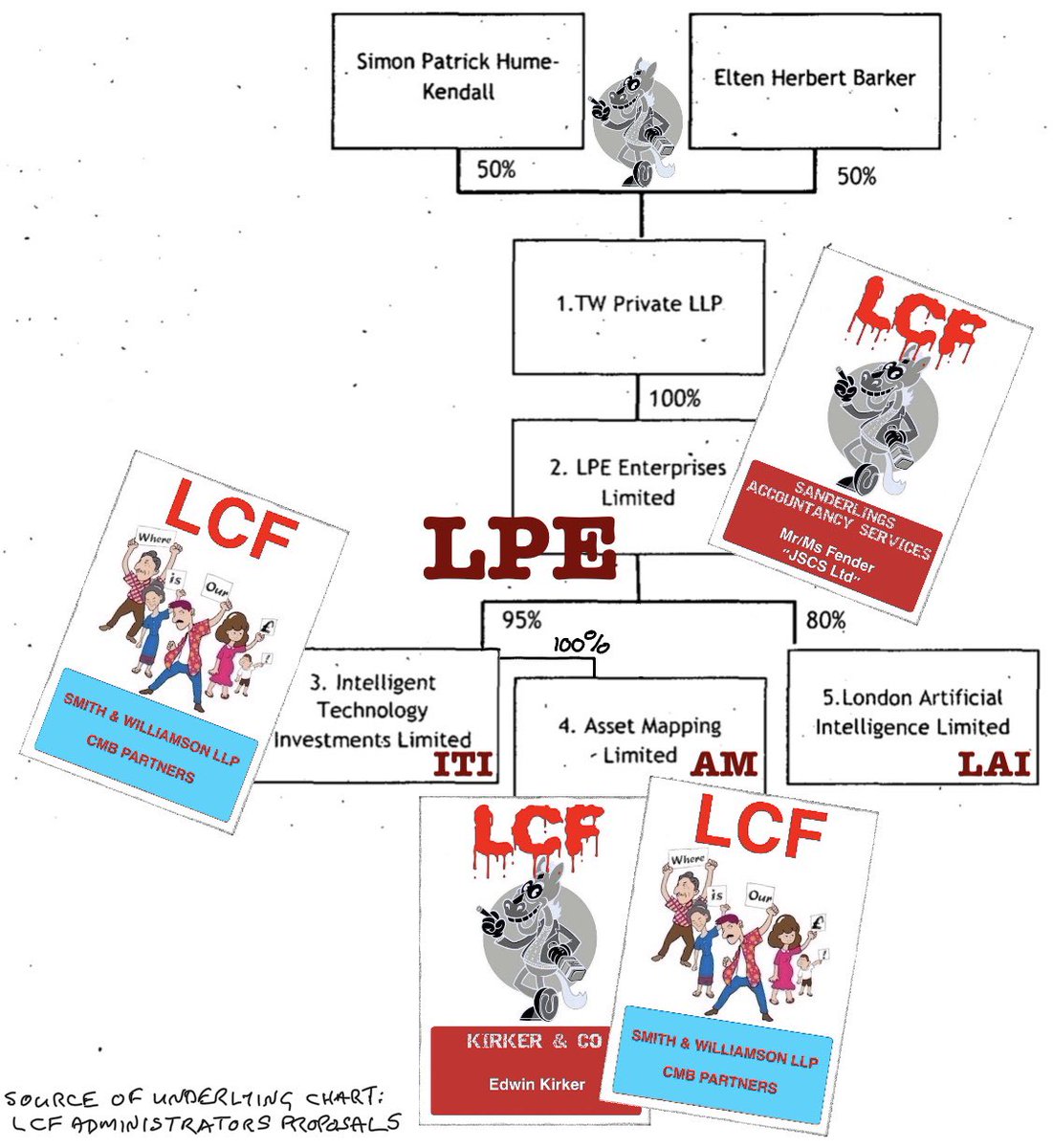

21/ 6. The ultimate beneficiaries of LPE were not reported, but it was reported (LPE 2.3) that LPE (owned by TW Private LLP whose members were Simon Hume-Kendall/Elten Barker/LG) was dormant until 06/2018 when it entered in to a contract to purchase “technology assets” …

22/ (purportedly ITI/AM + LAI) for £20m “from Simon Hume-Kendall/Elten Barker”, however, it was also reported (LPE 5.2) that “the shares were acquired from related parties”. It was further reported (LPE 5.12) that payments for these shares were “made by LCF”.

23/ In effect LPE allegedly purchased “technology assets” substantially from its owner’s (TW Private LLP) members (+PSC-Simon Hume-Kendall/Elten Barker) and/or family, with LCF bondholders substantially picking up the tab. Also not reported was the destination(s)/ultimate …

24/ beneficiaries of the associated bank transfer(s) from LCF to the sellers.

7. Not reported was that Simon Hume-Kendall/Elten Barker had allegedly only held the shares in ITI for 1 day before the sale of the “technology assets”, also not reported was that its prior 100% …

7. Not reported was that Simon Hume-Kendall/Elten Barker had allegedly only held the shares in ITI for 1 day before the sale of the “technology assets”, also not reported was that its prior 100% …

25/ shareholder was LCF crew-mate Mark Ingham

https://twitter.com/ianbeckett/status/1149258514008854528?s=20AND

https://twitter.com/ianbeckett/status/1265949362229850112?s=20. Also not reported was that prior to the sale of the “technology assets”, ITI/AM were allegedly recipients of £m’s in LCF bondholder funds (via LOG).

26/ 8. It was reported (LPE 5.8) that AM was placed in administration/liquidation by its directors (+the assets of AM sold for £150k + “earn-out”), not reported was that administrator/liquidator Mr Kirker was replaced by a “LOG” administrator appointed liquidator.

27/ Also not reported was that AM had allegedly been in receipt of >£3m of LCF bondholder funds (via LOG/ITI).

9. It was reported in respect of LAI “for reasons we are not prepared to go in to, trade is temporarily suspended”. Not reported was that LPE bought the shares in LAI..

9. It was reported in respect of LAI “for reasons we are not prepared to go in to, trade is temporarily suspended”. Not reported was that LPE bought the shares in LAI..

28/ allegedly from Henry Hume-Kendall/Ashdown Acquisitions Ltd(allegedly Elten Barker). Also not reported was that LAI was in-fact previously owned by LPC (perverse as the reason allegedly originally cited for the “technology assets” plan was to “bring them in to the LPC Group”).

29/ After all of this we are left pondering the tens of £m’s the LPT/LPE administrators report that were transferred from LCF Plc bank/payment institution accounts to the sellers of the LPC pref. shares & “technology assets” and amongst so many, the simplest of questions - …

30/30 who authorised those alleged multi-£m transfers from LCF Plc & who were the ultimate beneficiaries of those transfers?.

“recycle & respin”, the #LCF crew mantra.

A looksie at the “technology assets”, Reserec Ltd, “accounting”, “valuations” + much more are for another day.

“recycle & respin”, the #LCF crew mantra.

A looksie at the “technology assets”, Reserec Ltd, “accounting”, “valuations” + much more are for another day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh