A short thread below 👇

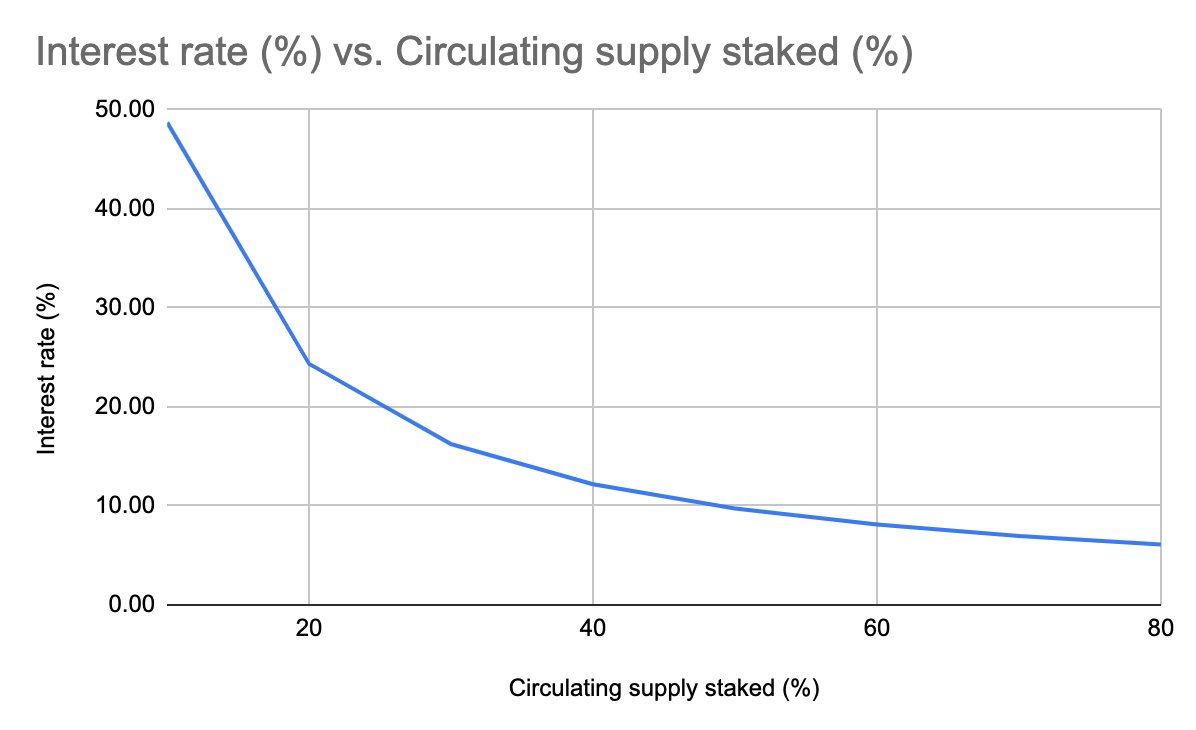

Do note that the @zilliqa reserves (~27% of circulating) continues to be soft-locked and will not be staked in the 1st year.

Hence, we can expect ~23% of circulating supply to float.

- Binance = ~29.4%

- Zilliqa + Anquan = ~27%

- Other exchanges = ~9%

- Cold wallets = 34.6%

This allocation will probably shift dramatically as more token hodlers mirgrate their $ZIL to cold wallets.

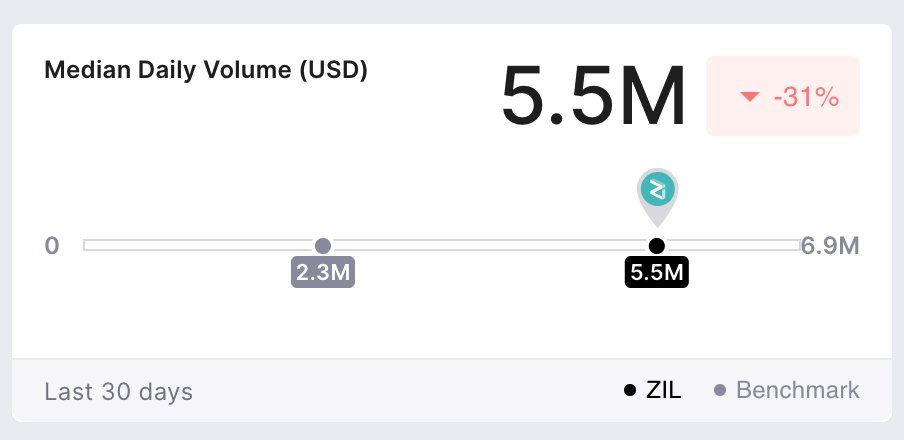

For perspective, $ZIL is currently trading ~$0.0216 on Binance.

We can expect T to increase when blocks are filled with staking and ZilSwap.io DEX txns aft. Q3, which both involves trading high vol. of $ZIL on-chain.

For perspective, the sweet spot for net deflation of M is > 55% avg filled block (or 132TPS for ZRC2 tokens).

TLDR: Long $ZIL. Stake it and use it on Dapps!

Disclaimer: Not financial advice. I held $ZIL since ICO from Dec 2017, so I am naturally a perma-bull.

{Fin}