Full disclosure: I own some shares of $TCEHY after doing this research.

notboring.substack.com/p/tencent-the-…

Luckily, no one bid that high. Today, it’s worth 1,454,929x its 3 million yuan asking price.

Then it lost its lawsuit with AOL, changed the name to QQ, and crossed 100 million users. With no revenue and growing costs, Tencent was back on the market.

Today, its stake is worth $205bn!

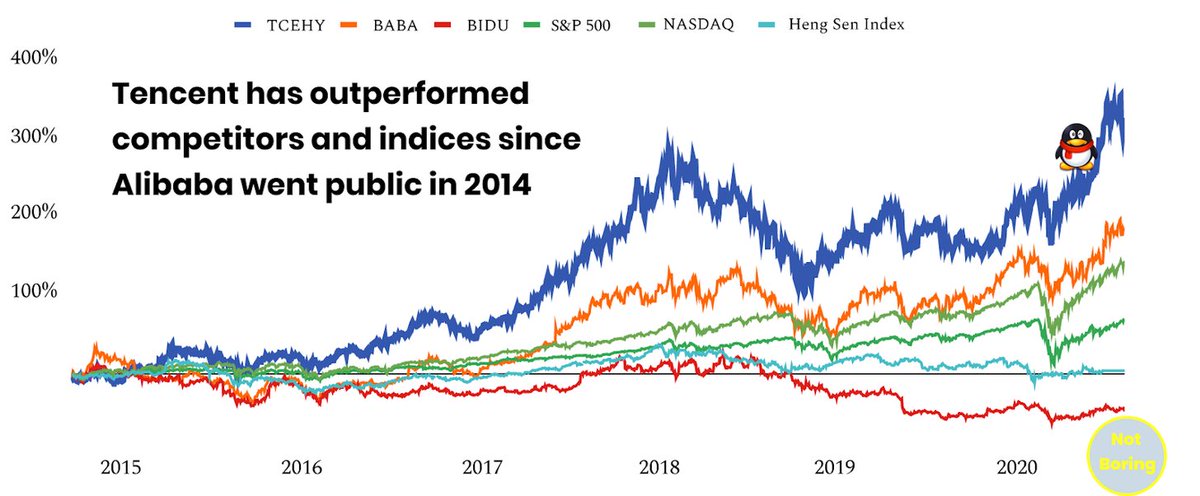

Cue Motley Fool headline: if you had invested $10,000 in Tencent at its IPO in 2004, you would have $7.9 million today!

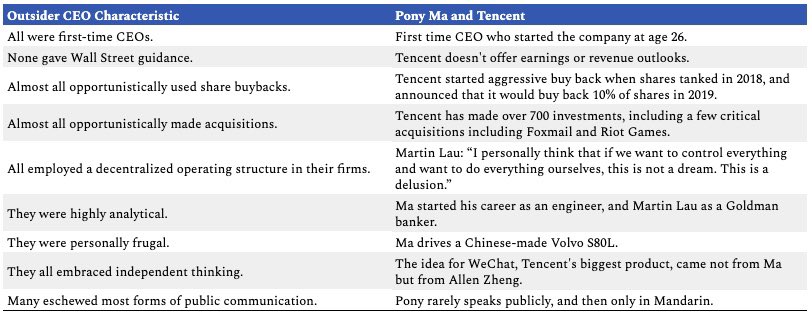

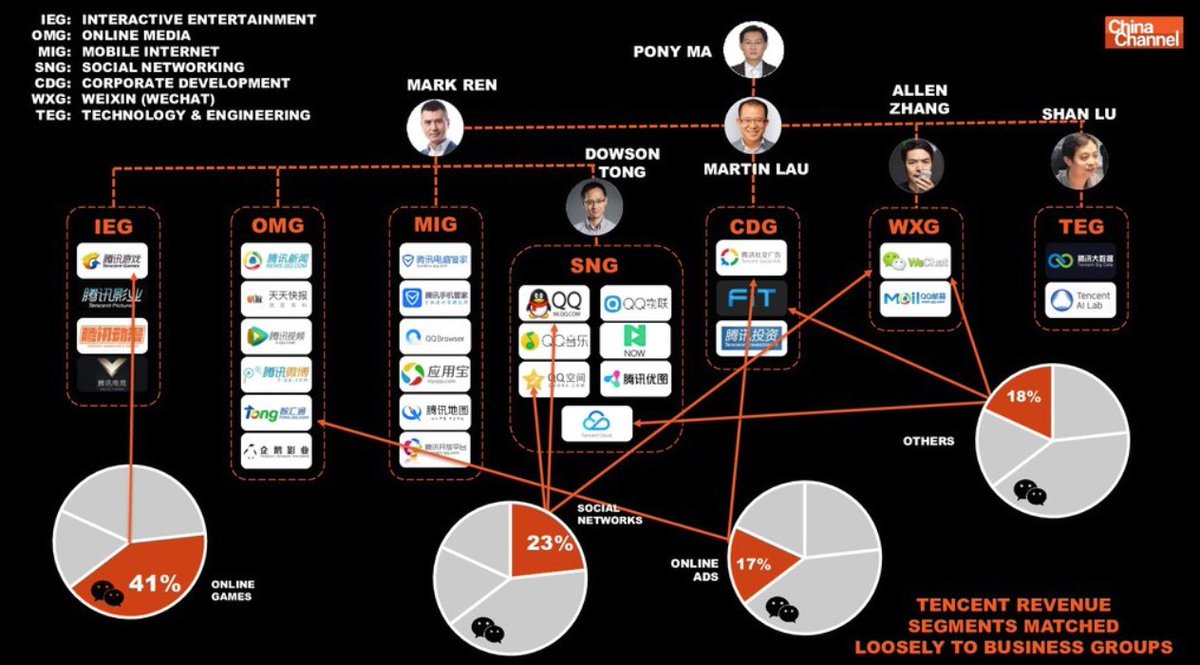

- Martin Lau, its IPO banker from Goldman, as Chief Strategy Officer

- Allen Zhang, when they acquired his company, Foxmail.

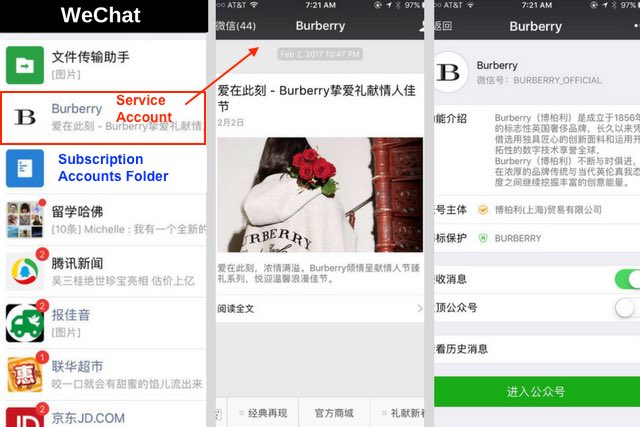

Chat with friends, co-workers, & clients.

Biz communicate with customers and sell things through Official Accounts.

Thousands of biz, including Didi and Meituan Dianping launched on WeChat.

Monetize mainly through transactions, not ads

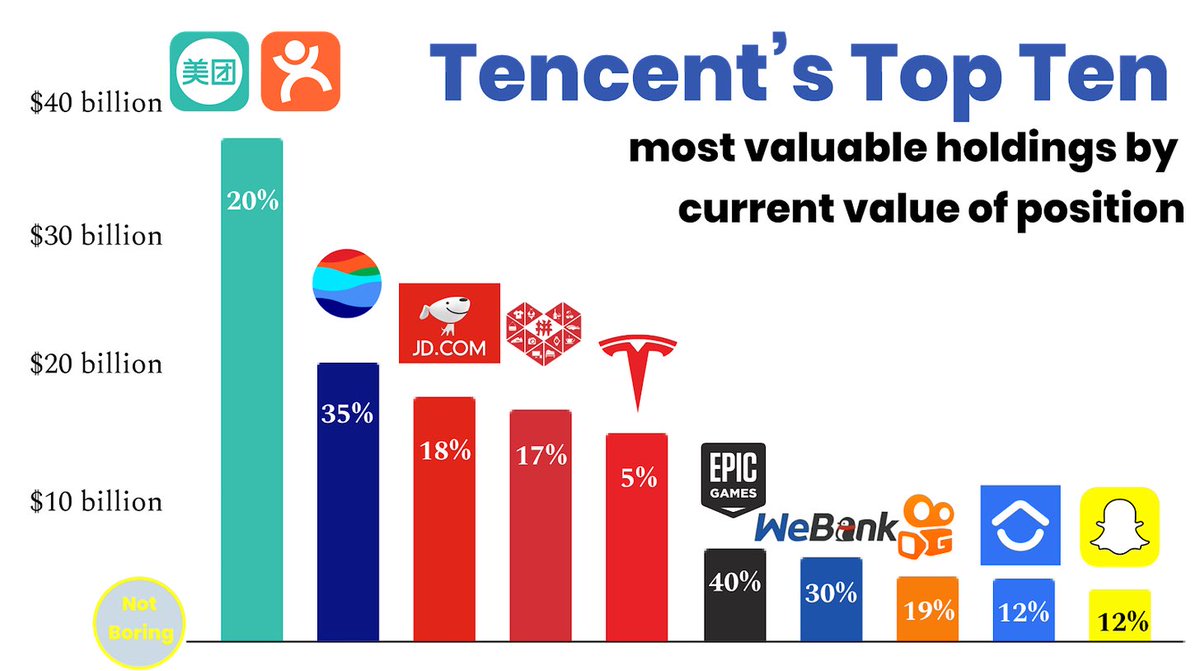

2011: bought 92.8% of Riot Games (League of Legends)

2012: bought 40% of Epic Games (Fortnite and Unreal Engine)

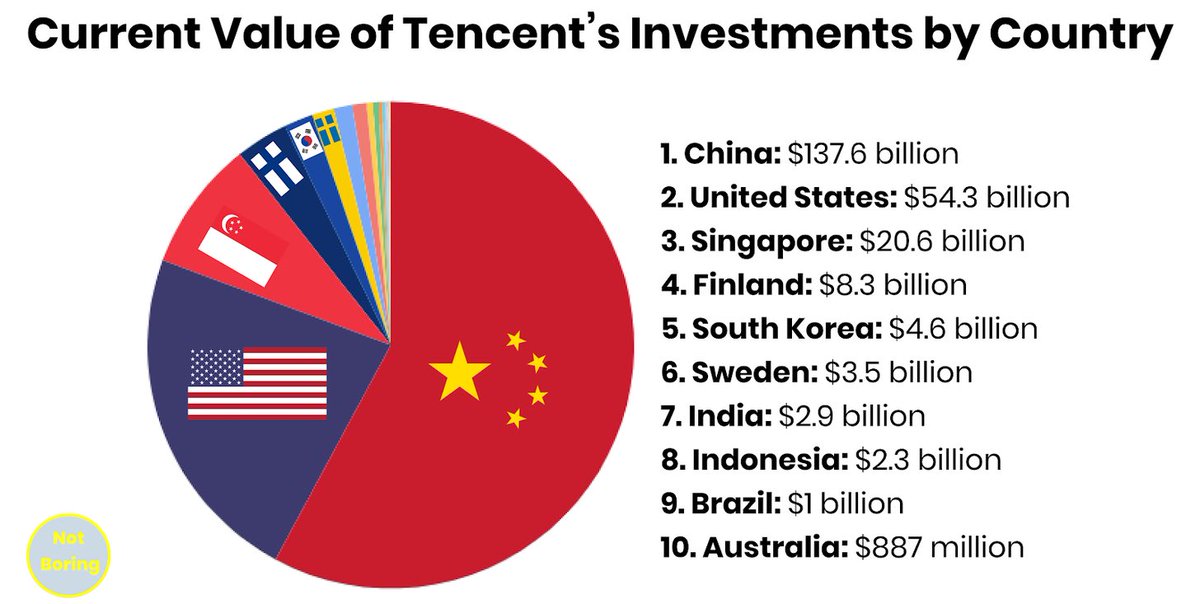

Over the past decade, Lau and his team have acquired or invested in over 700 companies.

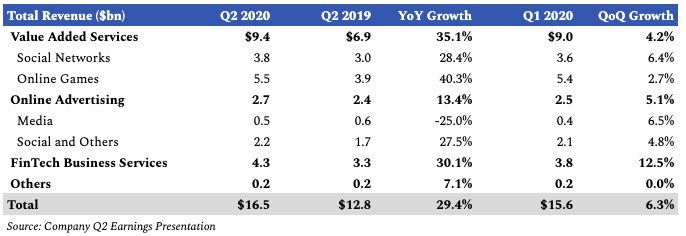

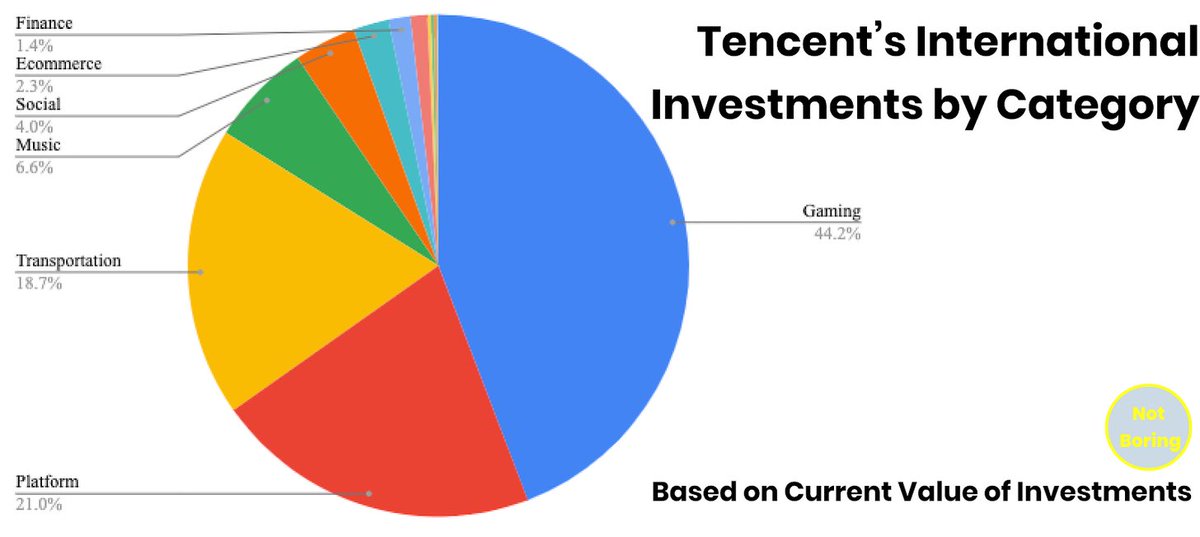

Tencent is a Chinese holding company, world leader in gaming, runs the largest messaging, social networking, and mobile payments platform in China. It uses the cash flow from those businesses to invest in the next generation of massive companies.

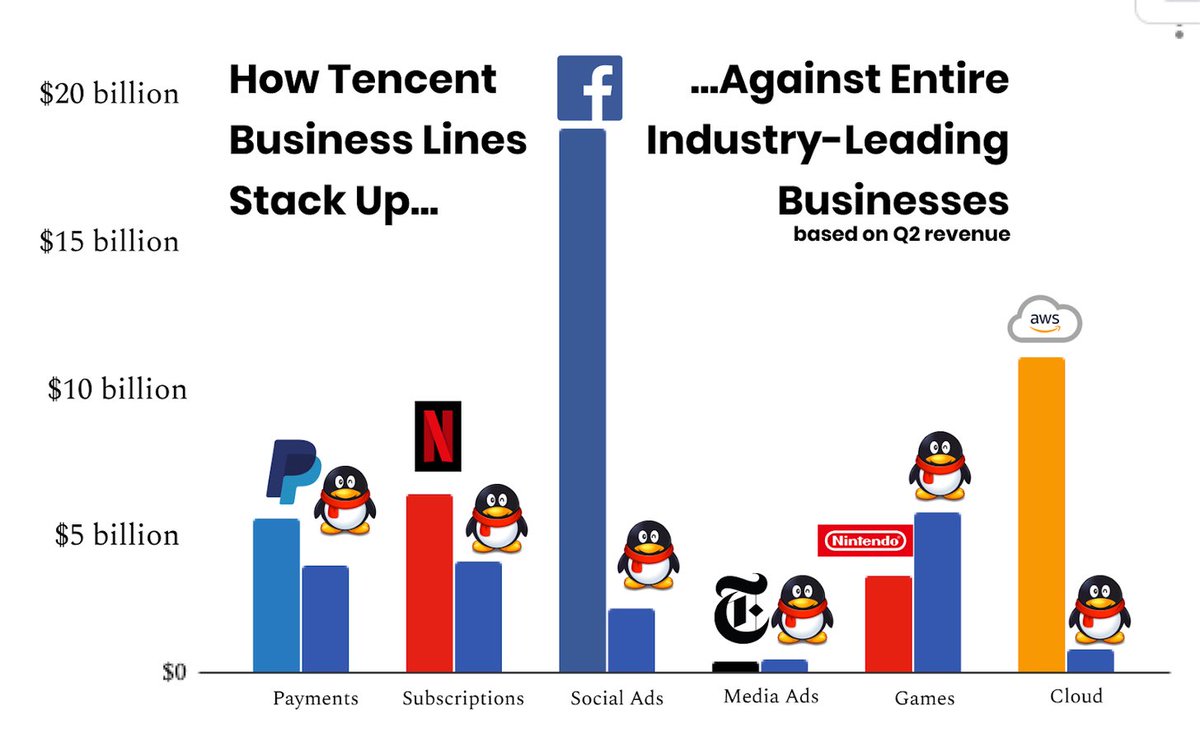

•Payments

•Subscriptions (video & music)

•Social ads

•Media ads

•Games

•Cloud

@mbrennanchina broke down where revenue streams live in 2017.

- Games bigger than Nintendo

- Payments & biz services almost as big as $PYPL and 5x $SHOP

- Small media ads biz bigger than the @nytimes 🤯

docs.google.com/spreadsheets/d…

Hint: it rhymes with petaberse.

Subscribe now to get it delivered to your inbox in the morning 🥳

notboring.substack.com/subscribe

notboring.substack.com/p/tencents-dre…

Learn about the Metaverse and why Tencent is best positioned to play it.