Time for a thread

👇

Thus, suppliers could build direct relationships with consumers cheaply. Consumer choice exploded, necessitating the rise of aggregators

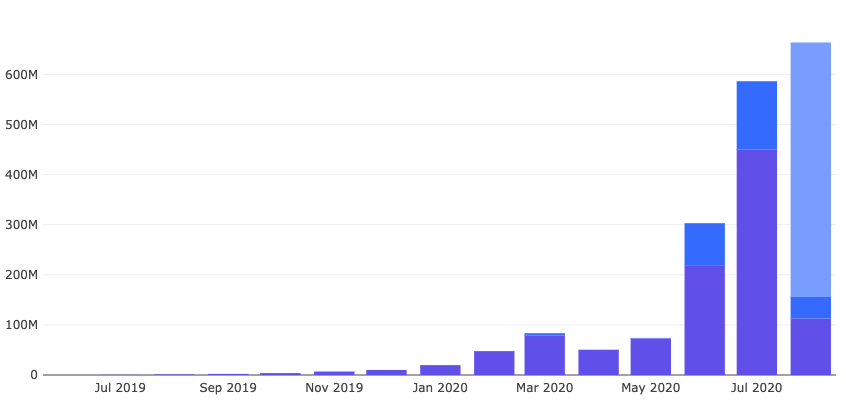

While initially users interacted with their favourite DEX directly, aggregators such as 1inchexchange, DEX.AG and others have emerged allowing users to get best execution on trades across all active DEXes

We thus expect the demand side of the DEX market to be mostly commoditised, with consumers interacting via aggregators vs single DEXes

This being the case, in order to differentiate themselves, build a moat 🏰, and win their markets, DEXes must focus on owning their supply-side

In addition, liquidity mining will be table stakes for new DEXes launching and is thus unlikely to provide an enduring moat

These include: cross-chain capabilities, mitigating impermanent loss, algorithm optimisations, flexibility & features, token economics and UX

By consequence, the ability for leaders to exert market power will remain low

Even if all fee income were redirected to CRV governance as per @Rewkang's proposal, this would represent a 0.073% yield

a) proposals like this are only possible because LPs are currently subsidised by 35%-90% APYs, a practice unlikely to be sustainable

b) the increased value extraction opens up opportunities for lower-cost competitors to gain market share

However, it’s important to keep in mind the long-term dynamics and these projects’ ability to establish defensible moats

"DEX Wars and Aggregation Theory": delphidigital.io/reports/dex-wa…

"Are AMMs the Airlines of Crypto?": delphidigital.io/reports/are-am…

In case you haven't, subscribe to @Delphi_Digital daily for only $10/month to get content like this in your inbox every day