Interesting new paper on IFC equity investments (they're profitable!).

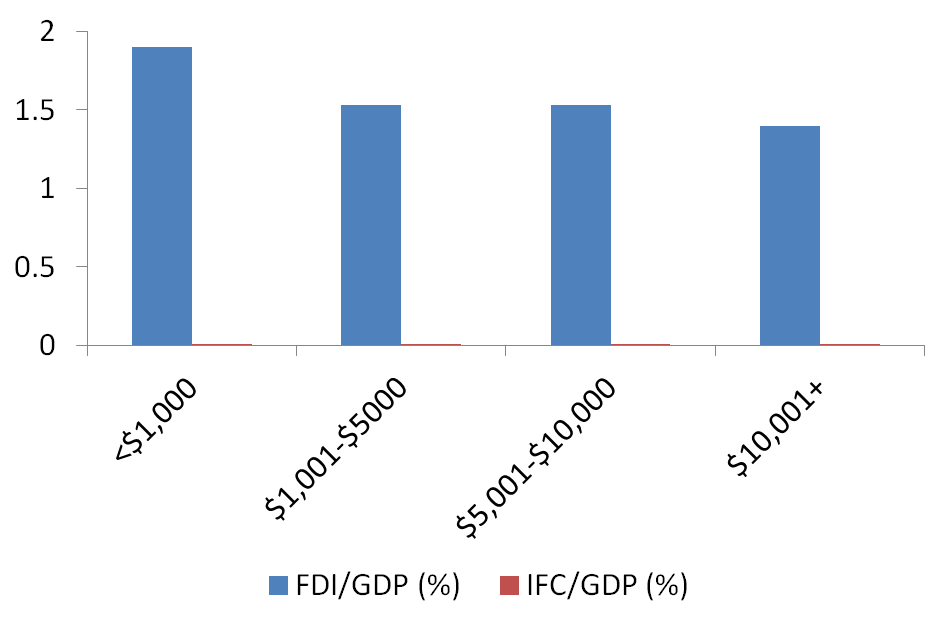

Chart from paper shows FDI investments/GDP & IFC equity/GDP. Paper says shows IFC investments more focused in (poorer) developing countries than FDI or CAPM would predict...

(1/n)

documents1.worldbank.org/curated/en/425…

Chart from paper shows FDI investments/GDP & IFC equity/GDP. Paper says shows IFC investments more focused in (poorer) developing countries than FDI or CAPM would predict...

(1/n)

documents1.worldbank.org/curated/en/425…

...yes, as a development finance institution they invest less in high income (official cutoff $12.5k GDP/capita) countries than CAPM would predict. Given how much said about a focus on poorer countries, though, one might be disappointed they don't do better at the <$1k end...

...of course, deals hard to find in low income countries, but here's where putting the data in the same graph on the same scale helps. FDI/GDP is in blue, IFC equity/GDP red.

(Honestly, the red is there)...

(Honestly, the red is there)...

...there are lots of foreign private equity investments going on in the poorest countries. Only a tiny fraction involve IFC. For lots of reasons (many of them good ones) IFC can't be involved in lots of the deals going on, but the excuse 'there simply aren't the deals' isn't true

The *only* way IFC is going to be more than a very marginal investor (and a red bar on the chart will be visible without aid of a microscope) is if it focuses on deals in <$1k per capita economies. If it can't do that (again, possibly for good reason)...

... then it should embrace the marginal, profit making model mostly in richer developing countries and go back to handing money over to the World Bank's soft lending arm IDA.

See: cgdev.org/blog/time-newo…

See: cgdev.org/blog/time-newo…

(though btw, that might involve some pain: 2010 IFC's net income $1,746m, non-interest expenses $664m, 2019 net income $93m, non-interest expenses $1,355m).

• • •

Missing some Tweet in this thread? You can try to

force a refresh