This is a feature of the system, not a bug.

Time for a thread 👇🏽👇🏽👇🏽

The monetary policy governing the US dollar revolves around a single idea — inflation drives economic activity.

The current view is that if consumers know their dollars will be less valuable in the future, they will be financially incentivized to spend money today.

Don’t hold your dollars. You’ll need more in the future to buy the same product or service.

Spend! Spend! Spend!

Absolutely not.

Nearly 50% of Americans can’t come up with $400 for an emergency payment.

These people historically live paycheck-to-paycheck and hold 100% of their wealth in US dollars.

No one is seizing their dollars.

Instead, the purchasing power of the bottom 50%’s wealth continues to be eroded.

They hold no investable assets and barely make enough money to pay their bills.

They believe they are being paid the same amount, but actually they’re being paid less and less on a purchasing power basis.

They don’t have an inflation-adjusted wage contract.

But that money is losing purchasing power every year also.

Not only is the person earning less each year, but they’re losing their savings slowly too.

When academics claim inflation drives economic growth, they forget to mention that the poorest of our population foot the bill.

Wait till you understand that each socioeconomic class experiences a different rate of inflation.

The poorer you are, the higher inflation you deal with.

If official numbers claim 2% inflation, the bottom 20-40% of Americans may experience 6-10%.

Inflation ensures they are paid less each year, that their savings will be devalued, and that they’ll consume the most inflationary goods.

The system steals the wealth of those that have none.

Because it makes rich people richer, duh!

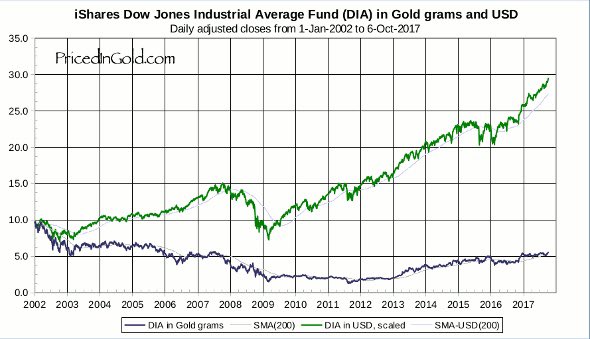

They know that their wealth will increase significantly if they move their dollars into real assets.

Dollars go down in value. Asset prices go up.

I don’t think the system is going to change unfortunately.

The only solution is to get more people educated about how money and the economic system works.

Those that are educated benefit from inflation and those that aren’t educated get decimated.

We have to drastically increase the percentage of Americans who are financially literate.

1. Spend less than you make

2 Have multiple streams of income

3. Invest, don’t save

4. Be patient and disciplined

Easy to say, hard to execute.

pompletter.com