@retheauditors @premnsikka @alexralph 1/ The High Court case (CR-2019-001949) at the centre of the curious case of “Game On” in the mysterious world of corporate insolvency

https://twitter.com/ianbeckett/status/1296553286997352450?s=20that saw tens of £millions allegedly end up transferred to the LCF crew …

2/ (a large part allegedly directly from LCF’s payment institution account) is over. Judge Mullen found FOR the LOG administrators(Applicants)/AGAINST the #LCF crew(Respondents)+ concluded he was satisfied that the novation agreements were void (entered into without authority).

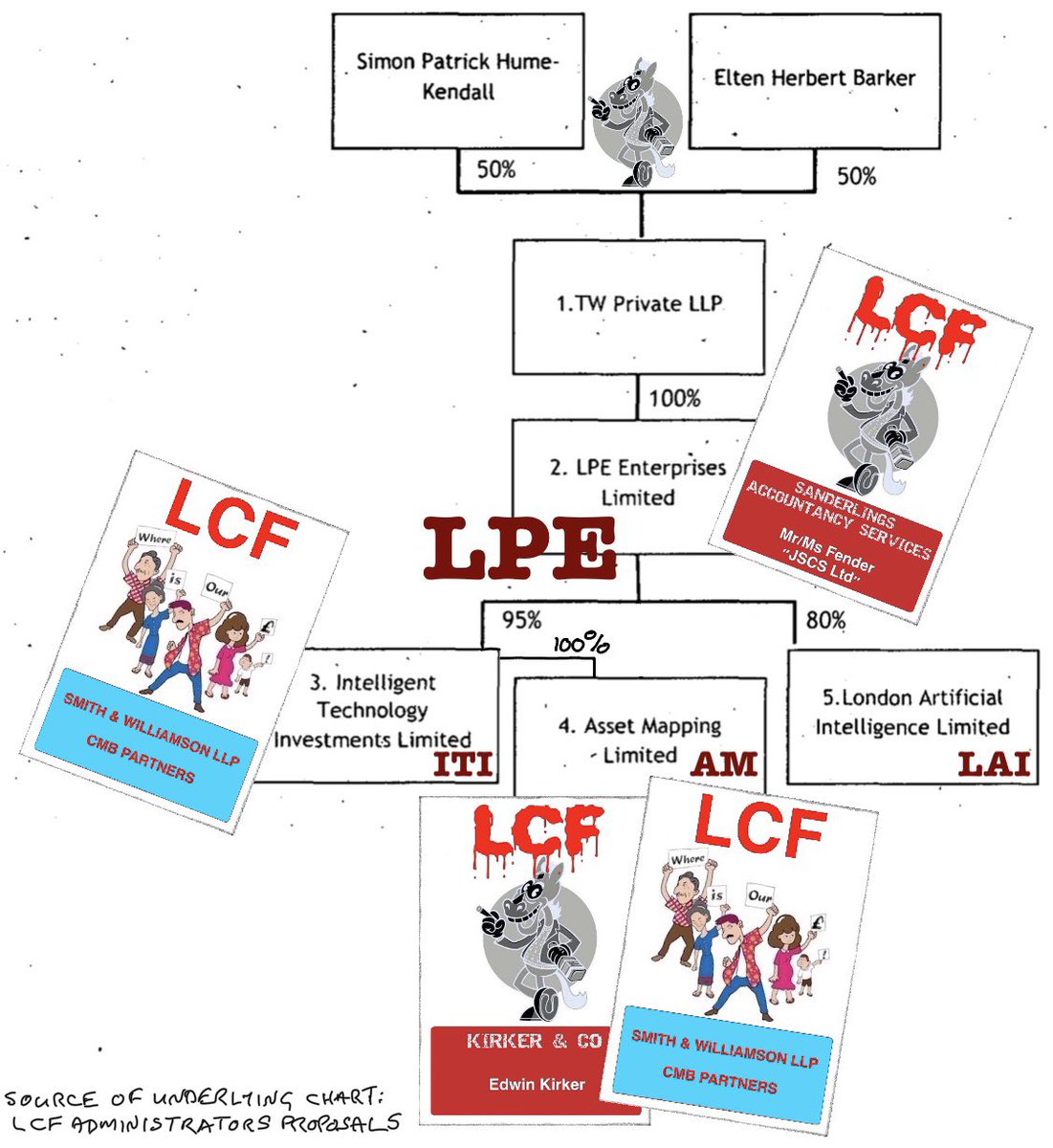

3/ Alternatively, the Judge would set them aside (transactions at undervalue). The case gives further insight in to unanswered questions: 1. [s3] LOG administrators allege most of £32.6m (LPC pref shares SPA aka “Mazars Step Plan”/“Technology assets” plan) was transferred to

4/ the (disputed) ultimate beneficiaries of LG [s26/27]. Named individuals/entities allegedly in receipt of this £32.6m were Spencer Golding &/or Trust, LCF CEO Andrew Thomson, Elten Barker, Simon Hume-Kendall &/or Trust [s26/27]. Of this £27k was transferred from LCF to LG, …

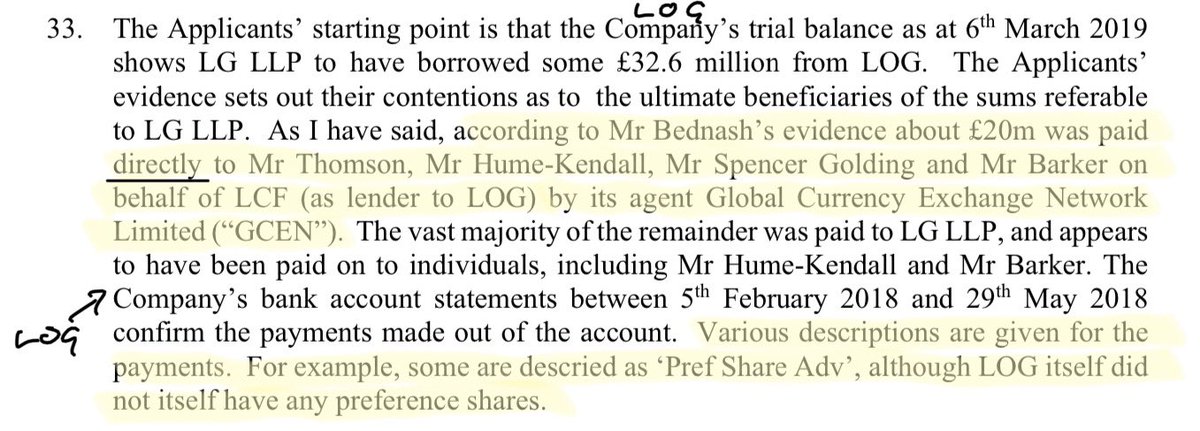

5/ £13m from LOG to LG + £20m was transferred directly from LCF’s FCA authorised payment institution account (named in s33 as GCEN) allegedly to messrs Hume-Kendall, Barker, Golding + LCF CEO Andrew Thomson. The case however doesn’t state who authorised the £20m in transfers ..

6/ from LCF’s GCEN account. We’ve met GCEN before in the curious cases, notable was the “Curious case of yet another of City One Securities A.R.’s - Venture Equity Ltd”

https://twitter.com/ianbeckett/status/1146908156611743749?s=20, a rip roaring tale of FCA(FSA) regulatory failure (we’ll be meeting Messrs King …

7/ & Hyman later again when we look at the networks in the background of minibond ops Asset Life/Anglo Wealth, MJS Capital & LCF). Out of the “schemes” Venture Equity was allegedly involved with came the High Court case of GCEN vs Osage 1 Ltd where GCEN put forward its …

8/ Quincecare

https://twitter.com/ianbeckett/status/1189537030402924544?s=20duty of care up front + centre hsfnotes.com/bankinglitigat… AND 2tg.co.uk/case-reports/g… 2. [s15-21] describes the LCF crew’s (+their agents) pre-trial japery which can’t have gone down well with the judge + notably the judge saw fit to include..

9/ mention [s22] of a Ms Jane Sanders

https://twitter.com/ianbeckett/status/1288872533366845445as ‘apparently “in house counsel” for Mr/Ms Fender’. Which begs the question if Ms Sanders was in house counsel for the Fenders then who was the Fenders mysterious legal advisor “JSCS Ltd”?

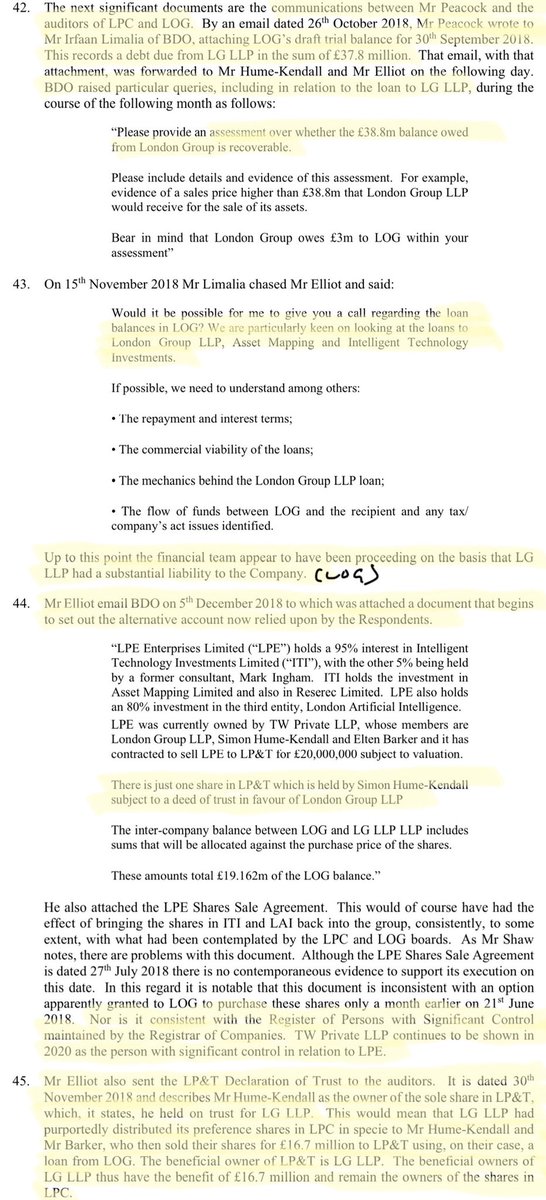

https://twitter.com/ianbeckett/status/1296556300403449856.

10/ 3. in [s23] the judge noted that none of the LCF crew’s witnesses attended to be cross examined + that the LCF crew’s “officers appeared to have entered administration as a tactic to avoid engaging with it”. 4. In [s37] the judge noted in respect of the “technology ..

11/ assets” SPA that the SPA stated £12.9m had “already been paid”, that the ownership of LPE was at odds with that agreed at LPC board meetings, that no proper valuation of the “technology assets” had taken place + that the “technology assets” the board contemplated to …

12/ purchase did not accord with those actually purchased. 5. [s38-41] describes the LPC pref shares SPA (aka “Mazars Step Plan”) & “process”. [s38] notes that the LPC Pref share SPA (+ “technology assets” SPA) were entered in to in advance of LPC/LOG board approval of the ..

13/ restructuring (Mazars Step) plan. 6. In [s42-49] LOG/LPC auditors BDO enter stage right with alleged LOG/LPC CFO David Elliott & LCF crew-mates Michael Peacock

https://twitter.com/ianbeckett/status/1121070560451149824?s=20& Robert Sedgwick to give a fascinating account of “abracadabra” which one would hope ..

14/ would have girded up BDO’s loins + set red flags a fluttering. In [s42] BDO’s question “how are LG going to pay back £38.8m” set the whole “backdating” train in motion which by the time we reach [s45] had allegedly the beneficial owners of LG selling the LPC pref shares ..

15/ to themselves with in effect LCF bondholders picking up the £16.7m tab. By the time we reach [s47] two facility agreements (“technology assets”/LPC pref shares purchase - LOG/LPC & LOG/LPT facilities) had allegedly being “created + backdated” by Mr Sedgwick, ..

16/ [s48-49] describes these in more detail. 7. In [s50] LCF’s newly appointed administrators ramped up the pressure on the LCF crew, Mr Elliott emailing [s51] the LPC/LOG boards talking ongoing viability & responsibilities of directors. The LCF administrator wrote …

17/ [s52] to David Elliott pointing out that LOG had been loaning money to Independent Oil & Gas (IOG) whilst aware of IOG’s insolvent position. 8. in [s53-56] Mr Elliott & LOG board talk “undocumented/unapproved LOG loans to LG related entities” + auditor BDO setting the …

18/ cat amongst the pigeons with “how are LG going to pay back £38.8m”. 9. in [s57] Mr Elliott stated the LOG board didn’t ratify lending to LPT/LPE (LOG/LPT&LPE facilities) & that he had never seen LOG/LPT&LPE loan agreements. 10. in [s58] Mr Elliott’s resignation as …

19/ company secretary was recorded in DRAFT minutes + contained an alleged “quite extraordinary statement from Simon Hume-Kendall. He had within the last month executed the 2 backdated loan agreements”. 11. [s59] talks the LCF crews shiny novation agreements, executed ..

20/ only a month before LOG went in to administration + notes the novation agreements were not even mentioned to the LOG board (never mind being approved), were at odds with the story told by the LCF crew (wot LG loans from LOG, not us guv) + at odds with the suggestion their ..

21/ purpose was to “correct errors”. 12. [s60] takes us to LOG going in to administration. 13. [s61-66] detail legal basis/precedents. 14. in [s67] the judge ruled that Simon Hume-Kendall had no actual/ostensible authority to enter in to on behalf of LOG loan agreements …

22/ with LPT/LPE (LPC pref shares/“technology assets”) + that the associated loans & loan agreements entered in to/executed in 2019 are void. 15. in [s68-70] the judge ruled that Simon Hume-Kendall had no actual/ostensible authority to enter in to the LCF crew’s shiny …

23/ novation agreements + was acting in breach of a directors duty in executing the novation agreements. 16. in [s71-73] the judge noted that Mr Sedgwick stated that the novation agreements were executed to “ensure LG had no debt liability to LOG” (i.e. close off claims ..

24/ against LG). The Judge ruled that it was not an exercise of any proper power Simon Hume-Kendall had to enter the novation agreements and that the novation agreements were not simply an “administrative consequence” of the “backdated” LOG/LPT&LPE facility agreements.

25/ The judge further ruled that the LOG board were misled, were not told about the “backdated” facility agreements, did not appear to be aware of the substance/ultimate beneficiaries of the £20m “technology assets”/£16.7m “LPC pref shares” transactions and were unaware that ..

26/ a significant proportion of the £36.7m had been advanced to the ultimate beneficiaries of LG. The judge ruled that for these reasons the purported ratification by the LOG board of LOG/LPT&LPE loans pursuant to these loan agreements was void. 17. [s74-75] detail legal …

27/ basis/precedents. 18. In [s76] the Judge rejected the LCF crew’s contention that no monies were owed by LG to LOG + was unable to accept Simon Hume-Kendall/Mr Sedgwick’s accounts (in the absence of independent evidence) “given their willingness to produce misleading ..

28/ documents”. The judge stated that the best guide to LG indebtedness to LOG were LOG trial balances prior to LFC’s administration. The judge further stated Simon Hume-Kendall sought to transfer LG’s borrowings to LPT/LPE using the novation agreements, without any …

29/ consideration from LG for its release from the debts + with LPE/LPT payment covenants of no value. The judge concluded that the LPC pref shares had no value, that the “technology assets” value was entirely uncertain + that LPT/LPE seemingly had no cash to repay loans.

30/ The judge ordered that if the novation agreements were found not to be void then he would order them to be set aside as transactions at undervalue. 19. [s78-79] details the legal basis/precedents for the sham element of the case. 20. in [s80-81] the Judge noted that …

31/ the LCF crews position now (LG indebtedness to LOG never existed) is not consistent with the novation agreements + that paradoxically the novation agreements were not a sham as the novation agreements accepted the indebtedness of LG to LOG + sought to remove it from LG.

32/32 21. In [s82] the Judge concluded that he was satisfied that the novation agreements were void (entered into without authority). Alternatively, the Judge would set them aside (transactions at undervalue).

• • •

Missing some Tweet in this thread? You can try to

force a refresh