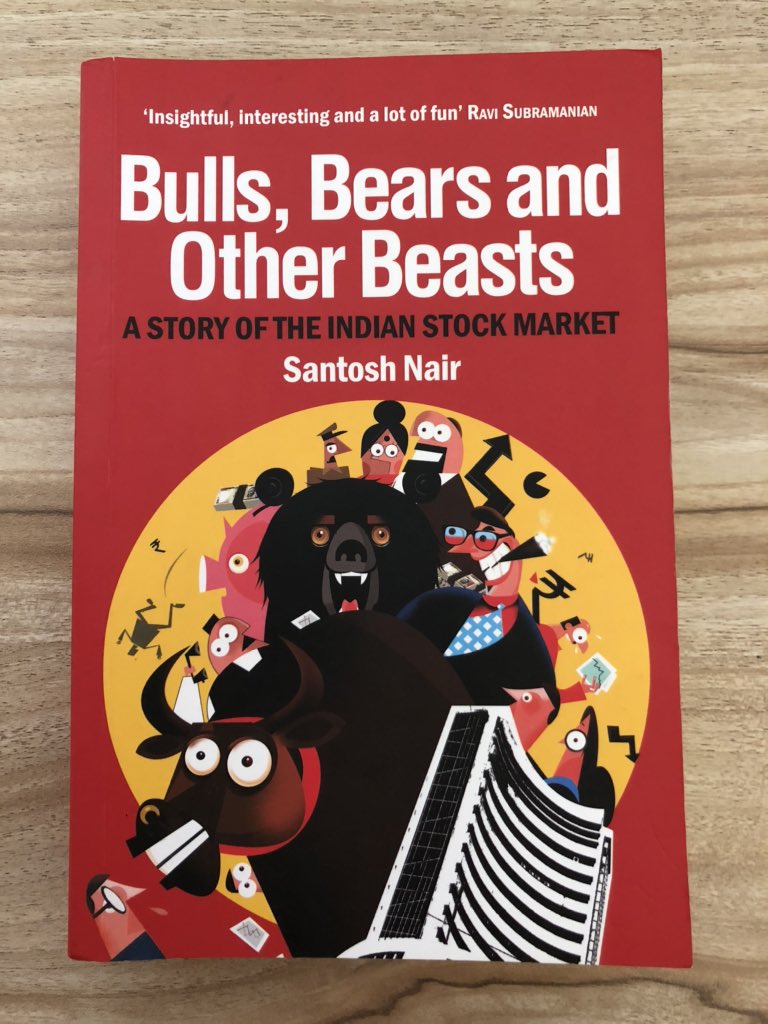

Book with very valuable insights of the evolution of the Indian stock markets.

A thread -

No matter how big or accomplished a player is, nobody can correctly predict the top or bottom of a stock.

Stock market history is replete with players who went bankrupt after having made the error of thinking they had become bigger than the market.

There may be plenty of fundamentally sound companies. But you can’t make big money by investing in their shares unless you’re able to buy them cheap.

Never take huge bets on political events.

Markets may be irrational, but are far more predictable than politicians.

It’s easier to convince a professional stock trader than an amateur who mistook luck for skill.

The stock prices may have been hammered or stagnant, but that doesn’t mean the companies’ customers will stop giving them business.

When you’re buying a stock you’re buying an ownership in a business & good businesses take time to create wealth.

Buy right, sit right.

Never judge a company by its stock price movements. A company which have strong fundamentals & efficient management always ends up creating shareholders wealth. Just try and avoid stock market noises.

Ex- ITC @dmuthuk

As stock market history shows, steep climbs are often followed by equally steep declines.

We can’t predict markets but we can learn to ride it well by developing our own set of indicators.

There is never an assured return stock in the market, and everybody is only too aware of it.

But once in a while, players tend to forget this rule and it is then left to the market to harshly remind them about it.

Calamities & deaths mean little to the markets unless it affects the economy & corporate earnings.

And here lies the irony - the market moves on sentiment, and yet is unemotional.

Liquidity has the potential to perpetuate virtuous cycles as well as vicious ones.

The beauty of the stock market is that even in times of utter despair, there is never a dearth of optimists, value buyers or bargain hunters.

Bear markets is pretty good at exposing the fragile business models of many companies.

Bull markets have no tops and bear markets have no bottoms.

@FI_InvestIndia @Invest_Books @RichifyMeClub @ms89_meet @dmuthuk @ipo_mantra @InvestBooks @Atulsingh_Asan @Rishikesh_ADX @adzaware @Vivek_Investor