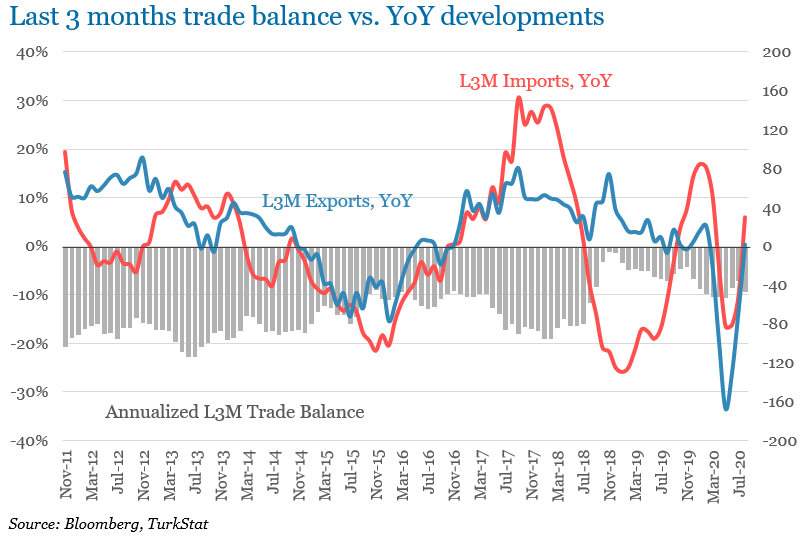

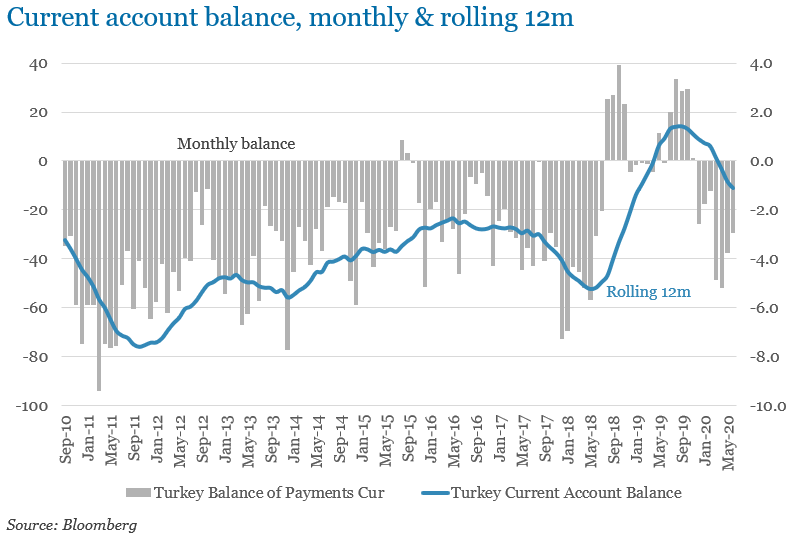

But sugar rush is never good. The credit push once again led to an increase (or prevented a decline) in imports - will elaborate shortly.

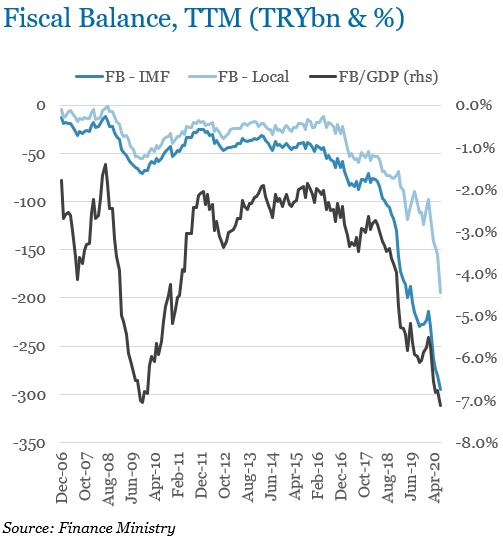

2) Government finances: The momentum is definitely no good, but remains as one of stronger aspects of the Turkish economy +++

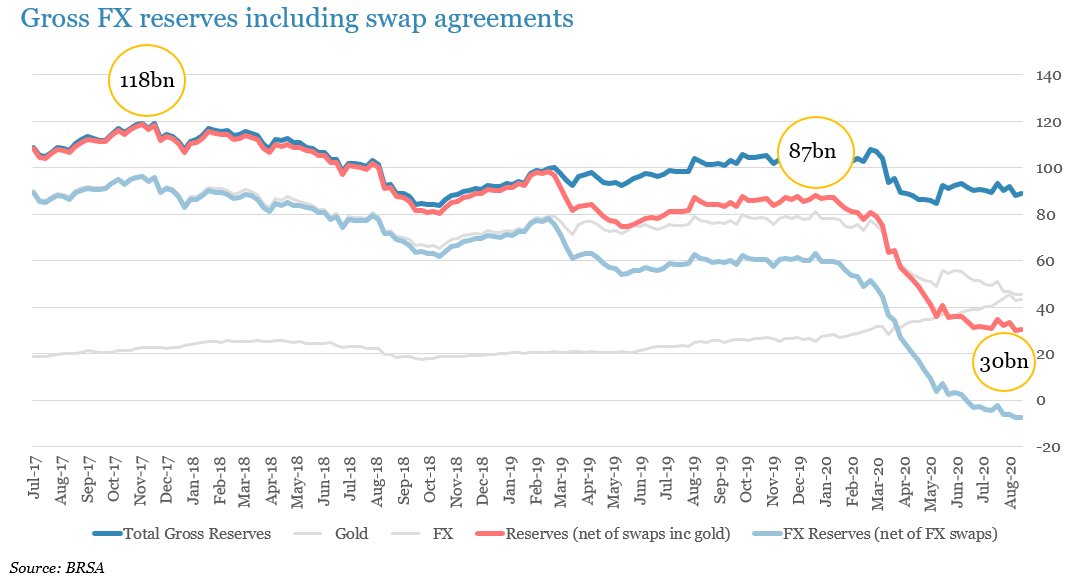

4. Finally, locals... : Locals rushed to gold, adding USD 21bn to their bank deposits. This demand was probably the most unexpected and strongest of all.

As a result, Lira is the second weakest EM currency, losing 20.5% vs. USD so far this year.

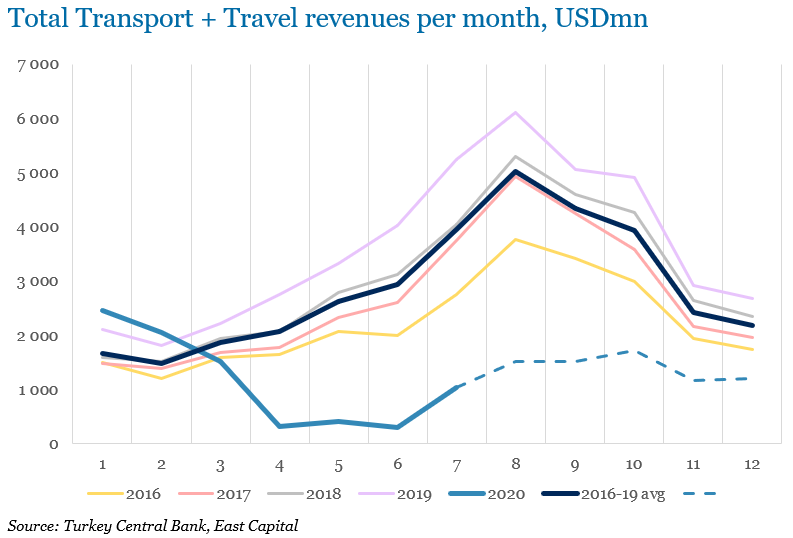

Reversing this trend will not be easy in an environment where market participants show zero tolerance to policy mistakes due to Covid-19 stress (EM-context) and given lack of tourism $$$ (Turkish context).

Going forward,

1) Imports/CA: less imports on weaker Lira and increasing taxes

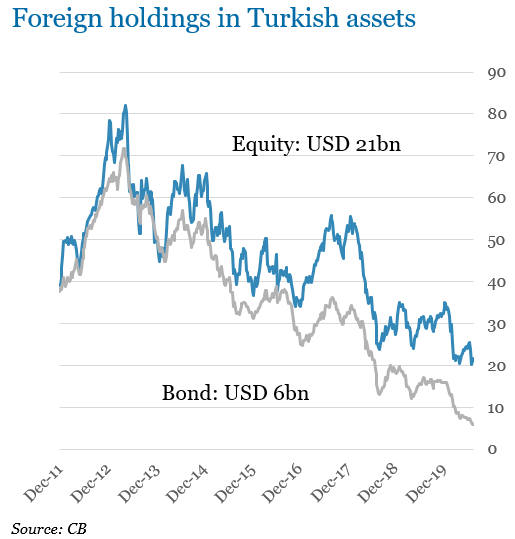

2) Foreign outflows: likely ease bcs foreigners have simply no money left

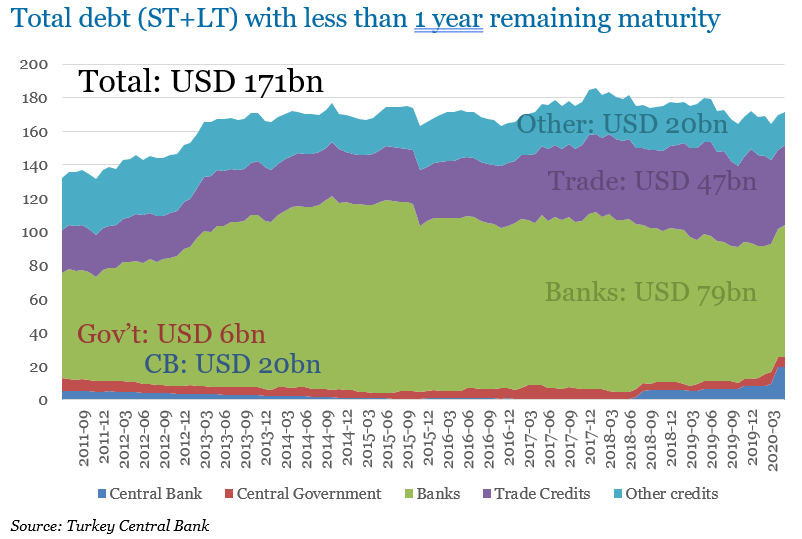

3) Debt repayments: continue, but foreseeable & rolling over

4) Local demand: KEY to determine what happens to Lira