The evolution of crypto primitives is happening at breakneck speed. Primitives like liquidity mining & social tokens – representing individuals and human capital – are now converging.

One social token, WHALE now has a market cap of $16m backed by a $1m portfolio of NFTs.🧵

One social token, WHALE now has a market cap of $16m backed by a $1m portfolio of NFTs.🧵

Dive deeper into WHALE and NFT liquidity mining in the full piece! messari.io/article/whale-…

tokens are indirectly underpinned by all of @WhaleShark_Pro's NFT assets, held in an address known as “The Vault” and are actively managed by WhaleShark.

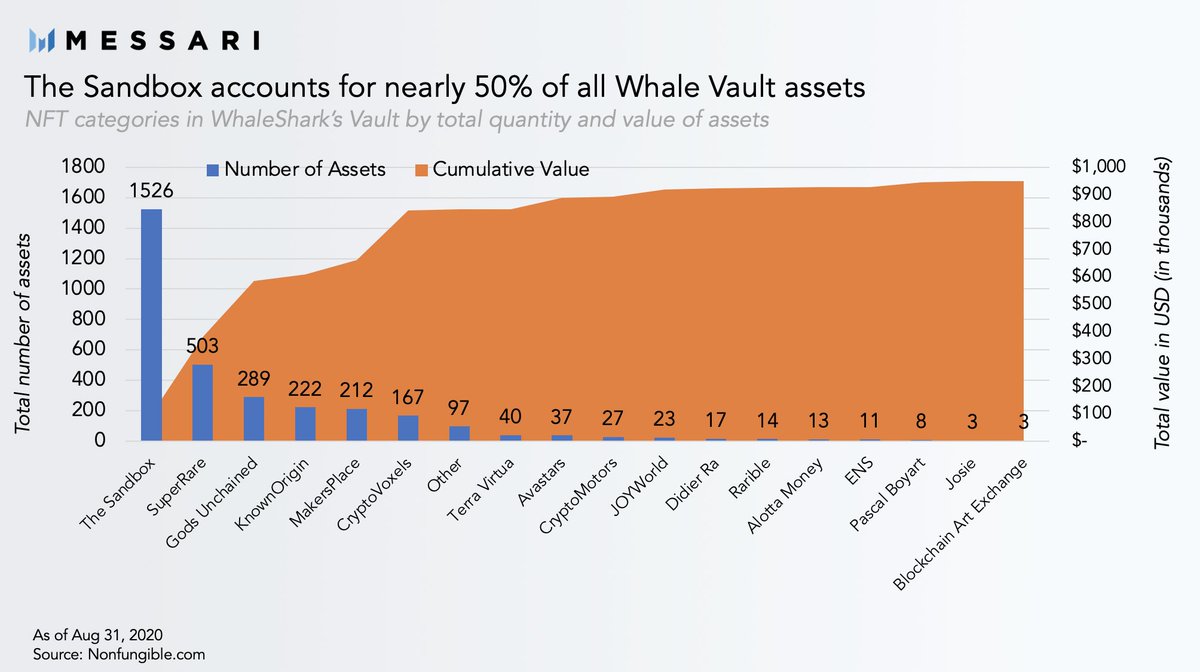

@TheSandboxGame NFTs account for about 50% of all assets in the Vault. Next, are SuperRare(15%) and Gods Unchained(9%)

@TheSandboxGame NFTs account for about 50% of all assets in the Vault. Next, are SuperRare(15%) and Gods Unchained(9%)

More importantly, four NFT projects – SuperRare, Gods Unchained, CryptoVoxels, and The Sandbox – make up over 80% of the portfolio’s value.

NFT Liquidity Mining

In order to incentivize the growth of the Whale Vault, the WHALE community has launched an NFT liquidity mining program.

In the program, creators can stake NFTs that they create or whole portfolios in order to earn more WHALE.

In order to incentivize the growth of the Whale Vault, the WHALE community has launched an NFT liquidity mining program.

In the program, creators can stake NFTs that they create or whole portfolios in order to earn more WHALE.

NFT liquidity mining has the potential to be stickier than standard DeFi liquidity mining.

Rather than requiring mercenary capital which flows to the best APY, NFTs from creators will be exclusive and therefore unable to flow to other similar style NFT programs that arise.

Rather than requiring mercenary capital which flows to the best APY, NFTs from creators will be exclusive and therefore unable to flow to other similar style NFT programs that arise.

NFT liquidity mining and social tokens are here to stay so check out the full analysis to stay up to date on this interesting trend.

messari.io/article/whale-…

messari.io/article/whale-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh