A thread on Sept slide and how it's come when several cycles turn weaker:

Options appear to be part of the trigger. The equity P/C ratio fell to a 20-yr low on 9/2 but the index P/C was near its 20-yr avg. @NDR_Research 1/x

Options appear to be part of the trigger. The equity P/C ratio fell to a 20-yr low on 9/2 but the index P/C was near its 20-yr avg. @NDR_Research 1/x

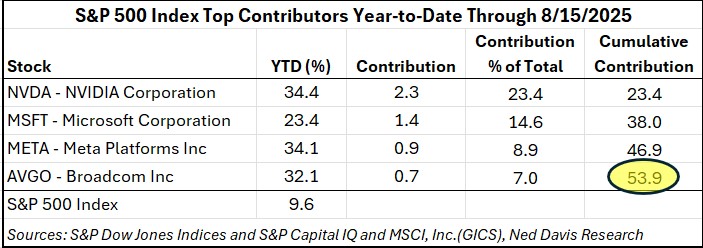

Equity/index P/C difference likely due to out-of-money call buying of mega-cap Growth stocks. Market makers hedged, partly at index level. The result was a spike in the $VXN.

Spread between implied vol (VXN) and realized $NDX vol was highest since 2015. 2/x

Spread between implied vol (VXN) and realized $NDX vol was highest since 2015. 2/x

Implied/realized vol spikes usually comes after DECLINES, not rallies.

Chart shows $NDX returns before & after implied/realized vol >20. Only time NDX up more 6M prior was in 1999.

I'm not saying this is a 1999 replay, but it shows how weird the action was. 3/x

Chart shows $NDX returns before & after implied/realized vol >20. Only time NDX up more 6M prior was in 1999.

I'm not saying this is a 1999 replay, but it shows how weird the action was. 3/x

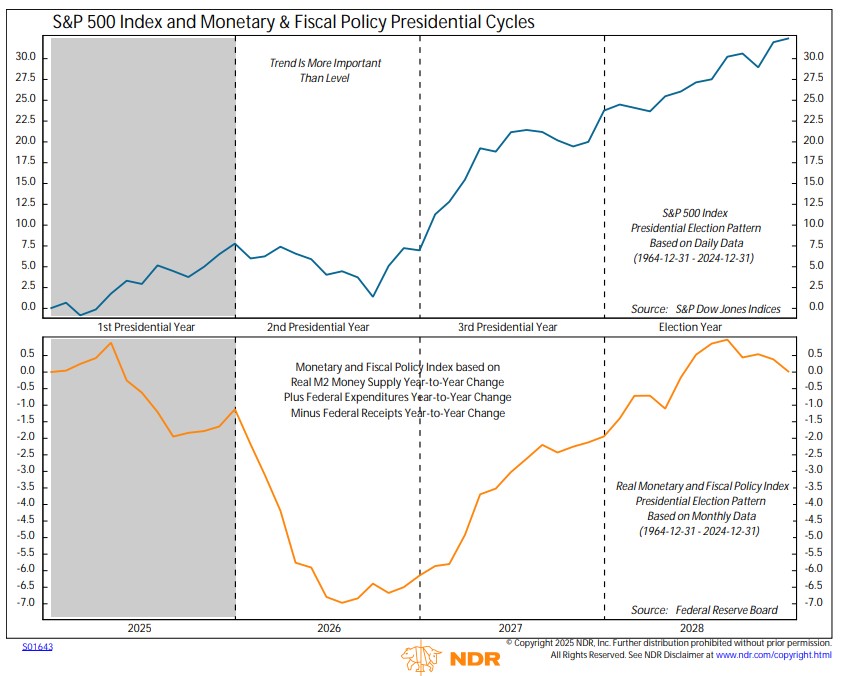

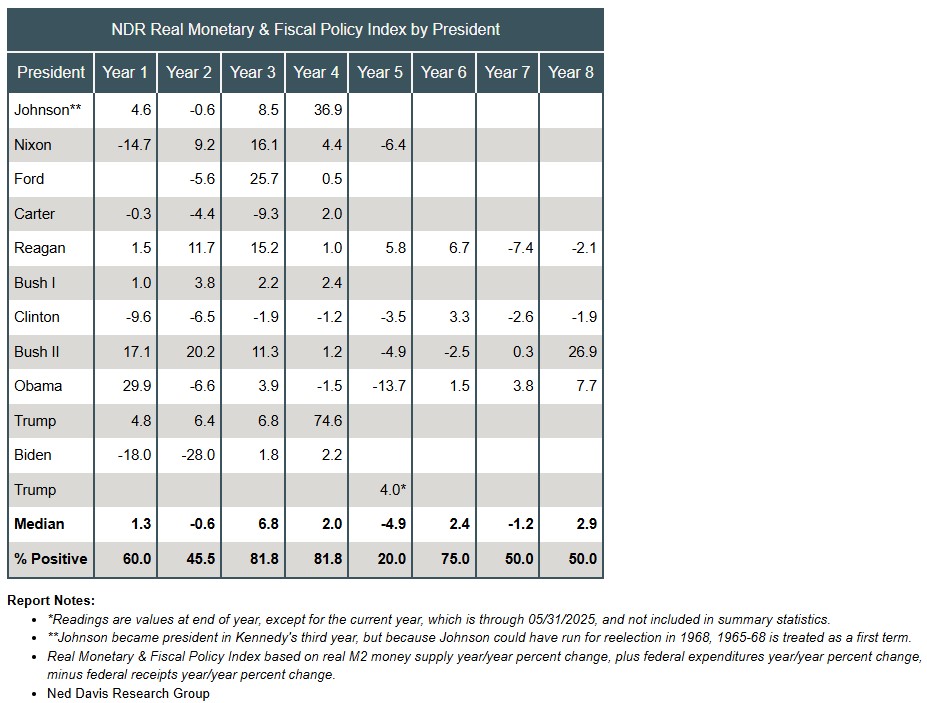

Regardless of the catalyst, several cycles were at points when stocks usually pause.

1st, rallies coming out of recessions are similar (on avg!) for first few months. Around months 4-5, gains slow in U recoveries vs Vs. Our macro team thinks it's a U that ended in April 4/x

1st, rallies coming out of recessions are similar (on avg!) for first few months. Around months 4-5, gains slow in U recoveries vs Vs. Our macro team thinks it's a U that ended in April 4/x

2nd, the biggest correction in the first 9 months of a cyclical bull market comes around the 4.5-month mark (on avg!). That puts the pullback a little behind schedule. 5/x.

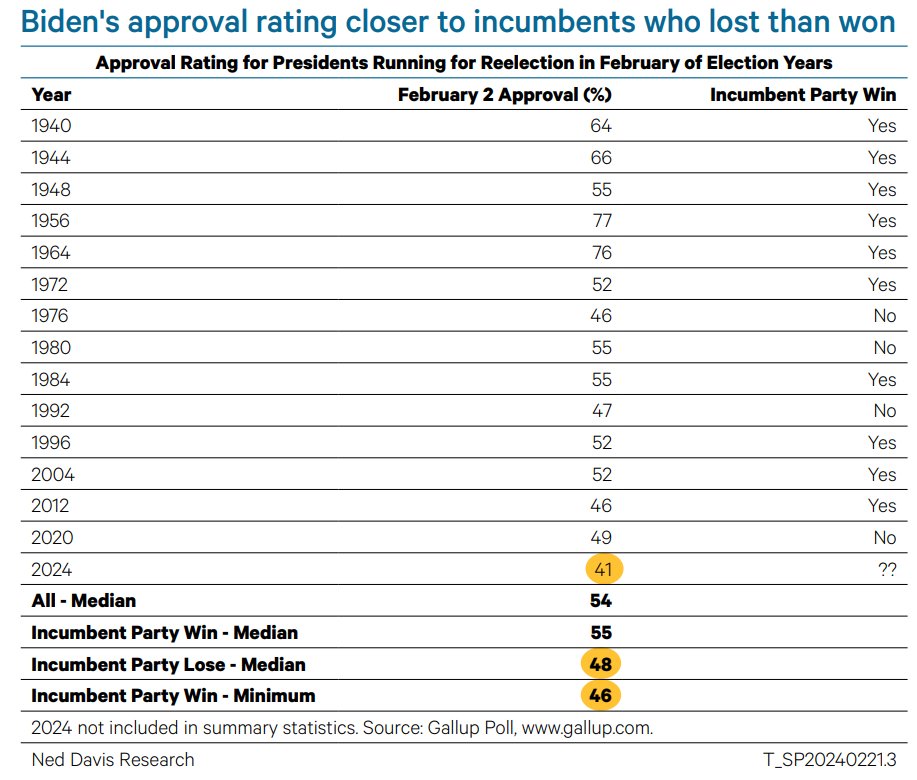

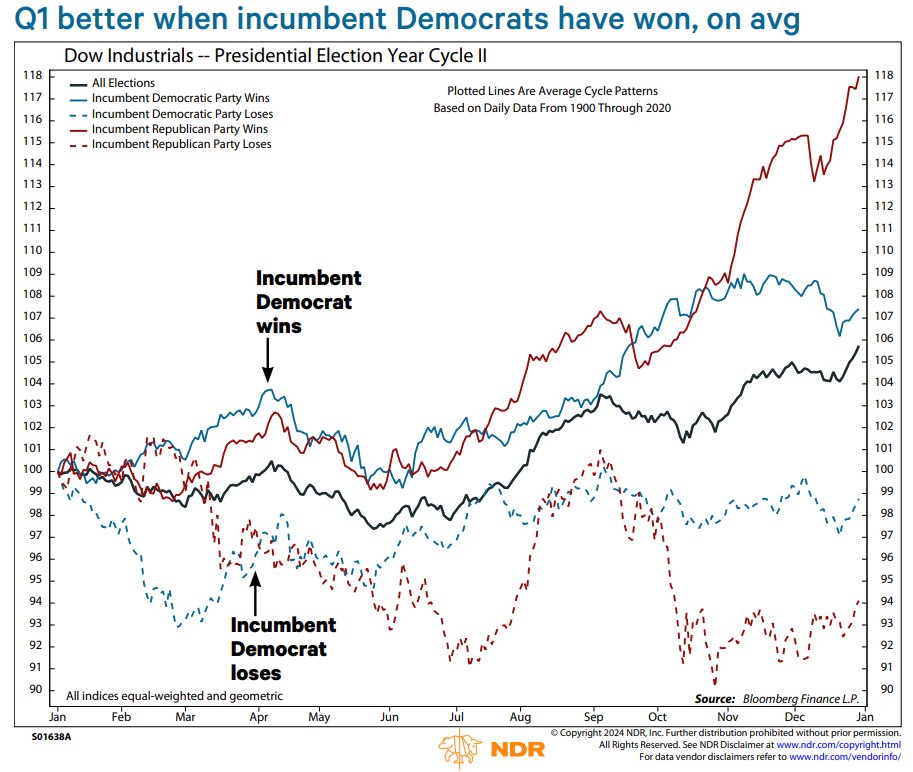

3rd, stocks tend to be weak in the two months before presidential elections. Uncertainty increases as the election comes into focus. Pullbacks tend to be stronger when the incumbent party has lost. 6/x

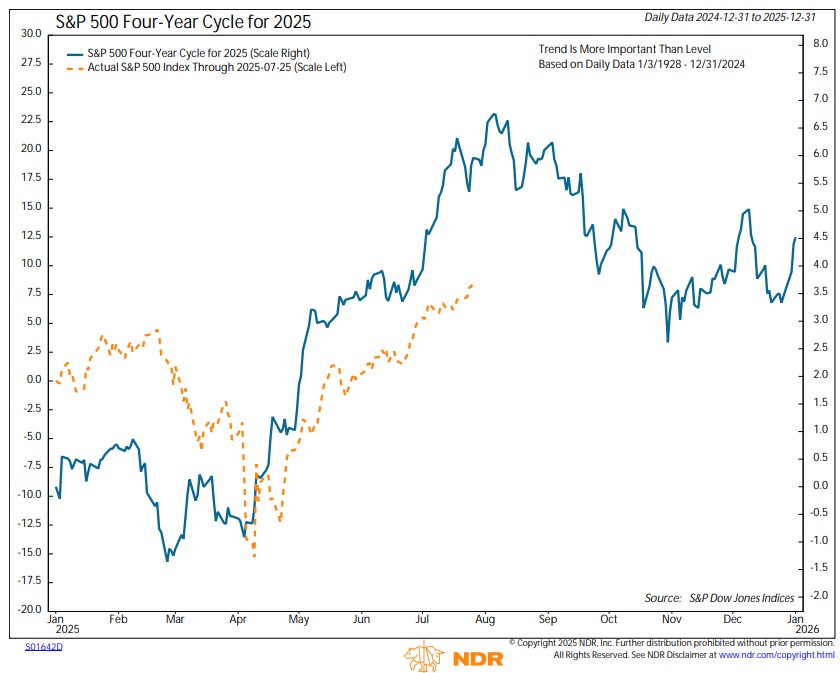

4th, our $SPX Cycle Composite peaked on Sept. 8. It combines the 1-, 4-, and 10-yr cycles.

Don't focus too much on the exact date, but seasonality is becoming a headwind. 7/x

Don't focus too much on the exact date, but seasonality is becoming a headwind. 7/x

Our sentiment composite hit its highest level since Jan 31 on Sept 2. It's now in its neutral zone.

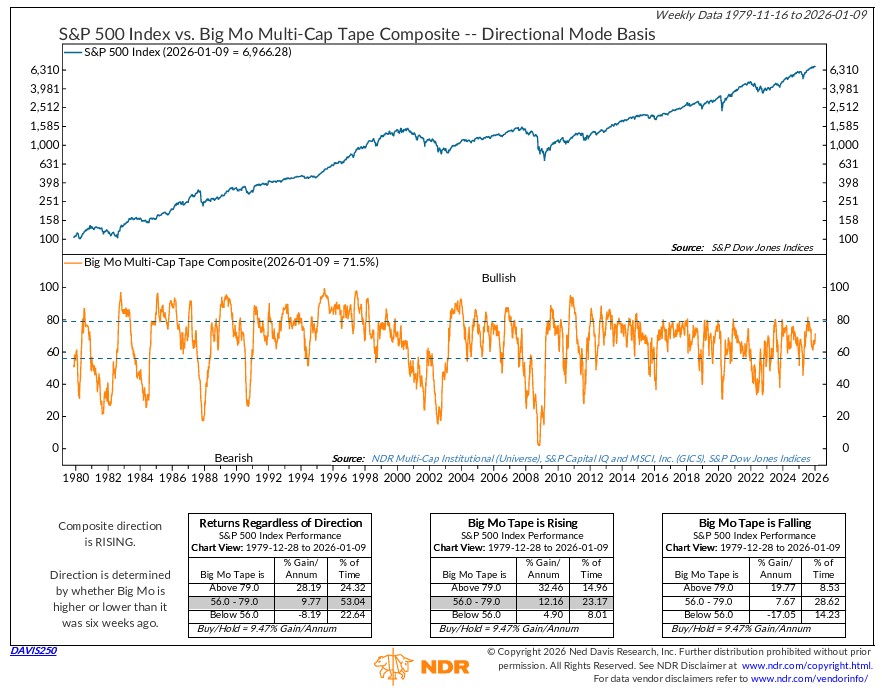

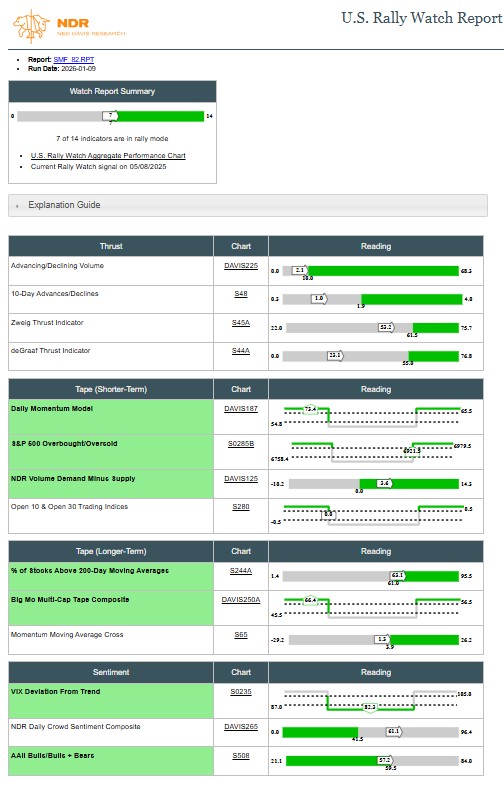

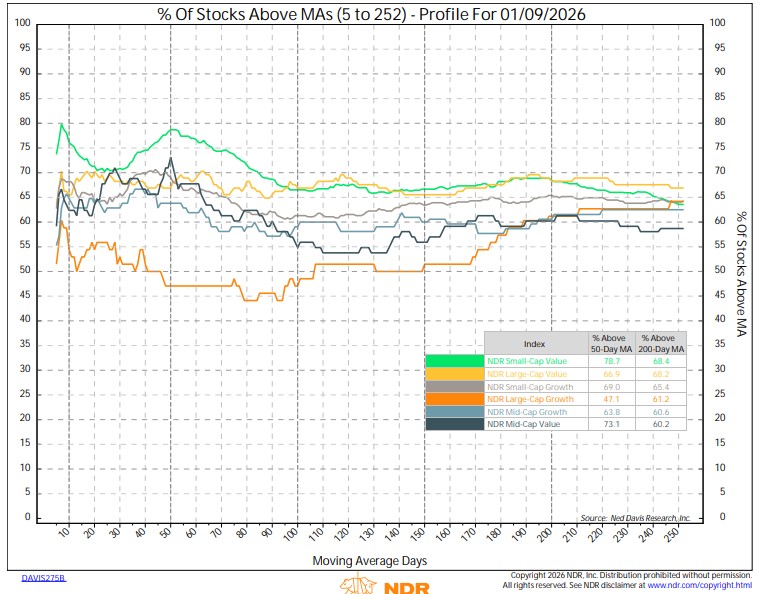

From here, watch the technical damage as the extreme optimism of early Sept is worked off. If technicals contained, it will likely be a bull correction, as the four cycles imply.

From here, watch the technical damage as the extreme optimism of early Sept is worked off. If technicals contained, it will likely be a bull correction, as the four cycles imply.

• • •

Missing some Tweet in this thread? You can try to

force a refresh