Beware China conspiracy theorists who source everything from Jeff Snider.

I was pointed at this thread earlier.

I am now blocked. Took two responses with actual data, so you'll have to click in.

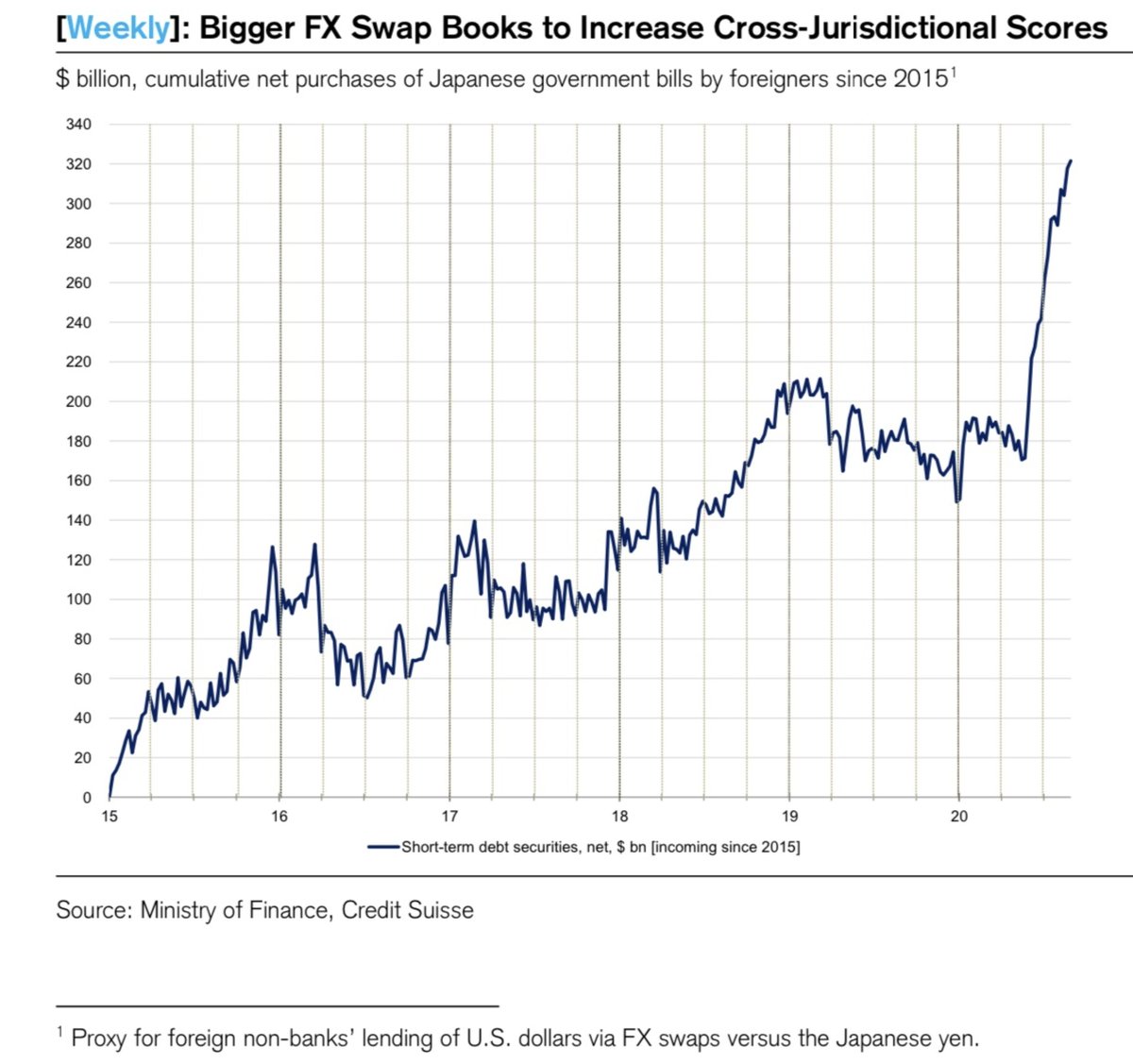

This chart is Zoltan. He knows plumbing.

I was pointed at this thread earlier.

I am now blocked. Took two responses with actual data, so you'll have to click in.

This chart is Zoltan. He knows plumbing.

https://twitter.com/matrbk/status/1303155731840020481?s=20

Mostly he knows his US plumbing.

The mechanism for foreign ownership of Japanese t-bills is that Japanese investors, corporations, and banks use yen assets to fund foreign asset purchases. Do an FX swap with a foreign bank to get USD, use the USD to fund purchases of assets.

The mechanism for foreign ownership of Japanese t-bills is that Japanese investors, corporations, and banks use yen assets to fund foreign asset purchases. Do an FX swap with a foreign bank to get USD, use the USD to fund purchases of assets.

The foreign banks will put the resulting yen into t-bills. That's how cross-currency swap plumbing works. So demand? Japanese banks know there is no growth. Japanese corps are relatively cash-rich, and Japanese banks have fewer and fewer customers for Japanese yen loans. For a

long time, yen asset balance sheet growth has been growth in mortgages, but that goes in waves with fiscal policy to incentivize home building. Declining population keeps any upward drift capped.

The problem is that most use short-term swaps then roll them. When the basis goes

The problem is that most use short-term swaps then roll them. When the basis goes

wide, borrowing money this way is expensive, so banks figure out other ways to source funding, or they recycle assets and reduce new asset acquisition. This is a problem for them because it is the only place they can grow.

The chart above has a footnote saying foreign ownership

The chart above has a footnote saying foreign ownership

of JTBs is a proxy for foreign non-banks' lending of USD via FX swap vs JPY.

One has to be careful there. Japanese banks and major corps funding in yen into USD via swap will really only deal with major players. It *could* be "non-banks" such as Citi Global Markets Japan and

One has to be careful there. Japanese banks and major corps funding in yen into USD via swap will really only deal with major players. It *could* be "non-banks" such as Citi Global Markets Japan and

UBS Japan and similar, but one could consider those to be banks just as easily. Why do Japanese banks want foreign assets? Spread. Hedged back into yen, USTs sometimes give a positive return where JGBs have a negative return. Until they don't because of swap basis widening.

Why do Japanese banks and companies want USD?

J banks run large asset books in USD, and Japanese investors (fund business, life insurers, etc) run large asset books in USD.

Recall the US$140bn of AAA CLOs which got people's knickers twisted. There's more other stuff too.

J banks run large asset books in USD, and Japanese investors (fund business, life insurers, etc) run large asset books in USD.

Recall the US$140bn of AAA CLOs which got people's knickers twisted. There's more other stuff too.

All those hedged foreign bonds in the GPIF's new policy to treat hedged foreign bonds as domestic bonds? Swapped. Life insurers buying FX collars against their foreign bond positions? Swapped. Norinchukin with $70bn of CLOs all by itself? Swapped. And where do we think Japanese

banks lending USD to fund working capital and supplier payments for Japanese auto mfrs manufacturing in US, Mexico, France, Germany, UK, Brazil, Canada, etc get their dollars? Other than MUFG's Union Bank, they basically don't have a natural FX funding source. So it's swaps.

What happened in April to cause that pop in chart 1? Fed opened the taps on swap funding. Basis spreads went to zero. Suddenly, FX swaps was a great new source of USD funding.

And guess what. That's what banks everywhere do. They look to lower their cost of funding assets every

And guess what. That's what banks everywhere do. They look to lower their cost of funding assets every

day and every way. That's literally the job of whole departments. They are pros as it.

So the first chart is OK.

The problem is the tweet text.

It tells you nothing of the sort.

1) It does not show a chart topping out.

2) It literally says NOTHING about China intervening

So the first chart is OK.

The problem is the tweet text.

It tells you nothing of the sort.

1) It does not show a chart topping out.

2) It literally says NOTHING about China intervening

to sell US TSYs.

3) It says NOTHING about "further selling" by China of US Treasuries. China, and USTs, are not a party to those swaps which are imputed to have grown because of the growth in available funding.

Next tweet ↓ says...

3) It says NOTHING about "further selling" by China of US Treasuries. China, and USTs, are not a party to those swaps which are imputed to have grown because of the growth in available funding.

Next tweet ↓ says...

That's not how things work.

China has a massive trade surplus. Onshore profit margins may be low but buy iron ore in USD, make steel using some USD coal, some RMB coal, in RMB factories with RMB workers, ship by RMB rail to RMB port, send steel FOB in USD, dollars fall out.

China has a massive trade surplus. Onshore profit margins may be low but buy iron ore in USD, make steel using some USD coal, some RMB coal, in RMB factories with RMB workers, ship by RMB rail to RMB port, send steel FOB in USD, dollars fall out.

China gets USD from foreigners buying Ch portfolio assets. Foreigners have bn buying CGBs for a couple of years in size. It's big.

Cuts in RRR are not undercut by banks reluctance to lend and propensity to hoard. That quote is made up out of whole cloth.

Loan growth? ~13%yoy.

Cuts in RRR are not undercut by banks reluctance to lend and propensity to hoard. That quote is made up out of whole cloth.

Loan growth? ~13%yoy.

"See? I told you so, growth is lower now!"

Take a look at the bond market. Rule changes allow Chinese banks to hold more local govt bonds at zero weight. So they do. Maybe because they are told to, but if loans have a capital cost and bonds don't, buy bonds.

Take a look at the bond market. Rule changes allow Chinese banks to hold more local govt bonds at zero weight. So they do. Maybe because they are told to, but if loans have a capital cost and bonds don't, buy bonds.

1) That's not the way capital surcharges work.

2) Any fool could see why China expects to sell Treasuries. a) they've been selling for years, b) they fear sanctions.

(note: if they were r-e-a-l-l-y starved for USD, China wouldn't block TikTok US from getting sold)

2) Any fool could see why China expects to sell Treasuries. a) they've been selling for years, b) they fear sanctions.

(note: if they were r-e-a-l-l-y starved for USD, China wouldn't block TikTok US from getting sold)

Yes. There is a huge hole in this picture if dealers pull back. It is the same with any system of plumbing interdependency. Repo? We saw that a year ago. UST market? It had holes in March. Some may have noticed.

But...

But...

https://twitter.com/matrbk/status/1303160218487005186

In short, any system will break... if you break it.

China is "short" USD here in much the same way that the US is "short" RMB b/c it buys TVs from China. Oh. But the US buys its TVs and Apple iPhones and PCs and towels and rubber buckets in USD you say.... think on that a sec.

China is "short" USD here in much the same way that the US is "short" RMB b/c it buys TVs from China. Oh. But the US buys its TVs and Apple iPhones and PCs and towels and rubber buckets in USD you say.... think on that a sec.

"If China has truly maxed out available FX swap funding". Yes, a problem. It is predicated on the first chart showing exploding imputed USD/yen swaps and suggesting it means Japanese banks lending to China. First chart says neither maxed out, nor China link.

But yes if funding is capped, it caps other things. Unless asset turnover speeds up, which tends to uncap things.

Zoltan points out JPM's FX swap book expansion has pushed it to the next surcharge bucket, making it likely Q4 will see a pullback.

OK. But original take was off.

Zoltan points out JPM's FX swap book expansion has pushed it to the next surcharge bucket, making it likely Q4 will see a pullback.

OK. But original take was off.

People lending to China do so on credit (buying Evergrande bonds at 12%) or on collateral (ore and oil shipped FOB from elsewhere).

The only use of FX swaps for J banks to lend to China would show up in J bank balance sheet. The entirety of the Japanese banking system has $66bn

The only use of FX swaps for J banks to lend to China would show up in J bank balance sheet. The entirety of the Japanese banking system has $66bn

in China assets, and $140bn in HK assets (against US$3.25trln in FX assets. A LOT of that is to lend to Japanese businesses in Asia and China. For MUFG, China assets are 45% to Japanese businesses.

And total US$66bn? Norinchukin by itself has more than that in the form of CLOs.

And total US$66bn? Norinchukin by itself has more than that in the form of CLOs.

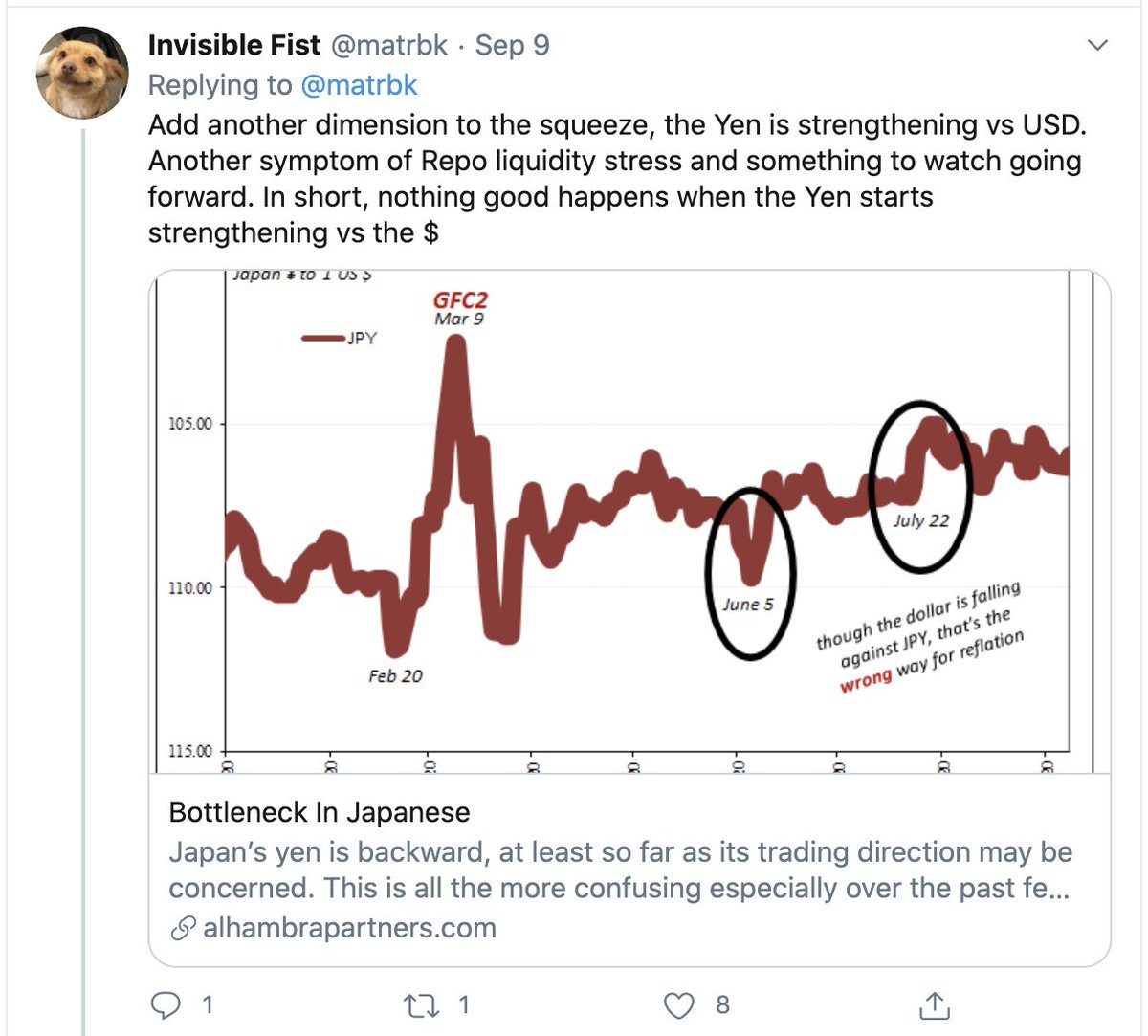

When you start talking USD/yen to talk about stress, you better make sure it is stressful.

LT volatility is extraordinarily low. The whole "move" recently is constrained.

Anyone who follows Japan knows current FX markets not showing any real yen stress at all.

LT volatility is extraordinarily low. The whole "move" recently is constrained.

Anyone who follows Japan knows current FX markets not showing any real yen stress at all.

"Eurodollar funding superhighway into China that is Japanese banks" does not exist.

I asked for one data point, got none. Showed actual data points, then got blocked.

Why? "The challenge with depicting any of this is that it’s very obscure."

Not... really. Ask the banks.

I asked for one data point, got none. Showed actual data points, then got blocked.

Why? "The challenge with depicting any of this is that it’s very obscure."

Not... really. Ask the banks.

The chain continues from that tweet with me providing some data.

Then I was blocked.

Then I was blocked.

https://twitter.com/matrbk/status/1304788952591855616?s=20

Before he goes, he QTs this beauty.

Yes, Japan lends money to the Caymans. It is an offshore banking center. It is also a place where SPCs are located. This isn't new. J banks are starved for assets. They have deposits out the wazoo.

Yes, Japan lends money to the Caymans. It is an offshore banking center. It is also a place where SPCs are located. This isn't new. J banks are starved for assets. They have deposits out the wazoo.

They create a LOT of structured product for on-syndication. When I was in derivatives banking, I helped create such an SPC which allowed Japanese banks to lend money to allow HFs to credit hedge their Japanese CBs.

Japanese co issues euroyen CB.

IB underwrites it.

HFs buy the CB.

HF wants leverage. Buys ASCOT.

My CB repack gave HFs a securitized ASCOT off a Cayman SPC (means minimal broker credit risk embedded) and J banks bought the credit by lending to the SPC (which held the CB).

IB underwrites it.

HFs buy the CB.

HF wants leverage. Buys ASCOT.

My CB repack gave HFs a securitized ASCOT off a Cayman SPC (means minimal broker credit risk embedded) and J banks bought the credit by lending to the SPC (which held the CB).

It had a few more bells and whistles but you get the gist.

Japanese company. Issuing in yen. Japanese banks. Lending in yen. Asset sits in Caymans. Japan "lends to Caymans." It's a structure. Low risk. No China.

This stuff happens. Why?

Because the SPCs are in the Caymans.

Japanese company. Issuing in yen. Japanese banks. Lending in yen. Asset sits in Caymans. Japan "lends to Caymans." It's a structure. Low risk. No China.

This stuff happens. Why?

Because the SPCs are in the Caymans.

It may be obscure if you don't know how the innards of banks work, but if you do, you know banks are themselves instruments of plumbing.

"A fair chunk" [of the Cayman $] goes to China"? Nah. Some? Maybe. But generally J banks want clarity. And I guarantee the MOF knows all.

"A fair chunk" [of the Cayman $] goes to China"? Nah. Some? Maybe. But generally J banks want clarity. And I guarantee the MOF knows all.

So his penultimate parting shot (I hadn't finished but he blocked)...

but I agree, it is tough to prove a negative through data. Analysis dependent on a LACK of data is trash analysis.

But I say the moon has a core of green cheese. I bet he can't prove me wrong. So I'm right.

but I agree, it is tough to prove a negative through data. Analysis dependent on a LACK of data is trash analysis.

But I say the moon has a core of green cheese. I bet he can't prove me wrong. So I'm right.

Given who he relies upon for his analysis, my assertion may be more trustworthy.

And for the ultimate tweet, because he has slain the ill-mannered bau beast, he has a quote.

"Fire feeds on obstacles."

I agree.

Trash analysis gets you flamed.

And for the ultimate tweet, because he has slain the ill-mannered bau beast, he has a quote.

"Fire feeds on obstacles."

I agree.

Trash analysis gets you flamed.

This is a bad take. @NUMISMATICS9 understands the plumbing. I have not seen a single instance ever where Jeff Snider was right about ZP being wrong. Snider was flat wrong on repo at the time.

Yes GSIBs pulling back would affect liquidity.

Translated: when banks lend less, there is less money lent.

This is not new, or controversial. To anyone.

Translated: when banks lend less, there is less money lent.

This is not new, or controversial. To anyone.

I didn’t lazily do anything. I put down a reasoned refutation of points asserted. I did not do it “in lieu of arguing an opinion of fact” (I’m not sure what that is).

Am I meant to be a “Chinese troll spreading legitimate-sounding disinfo”? EVERY # presented comes from his link

Am I meant to be a “Chinese troll spreading legitimate-sounding disinfo”? EVERY # presented comes from his link

except the Norinchukin number. But that’s public.

This one last bit may be wrong if indeed SAFE is providing dollars into the USDJPY swaps market as has been mentioned. My problem is that I don’t see what they get out of it. It is hard to hide sudden increases in exposures to counterparts. The BOJ and MOF see all.

Did everyone notice how badly Japanese banks did in the GFC? How they almost went under because of their bad assets? Yeah. Me neither.

• • •

Missing some Tweet in this thread? You can try to

force a refresh