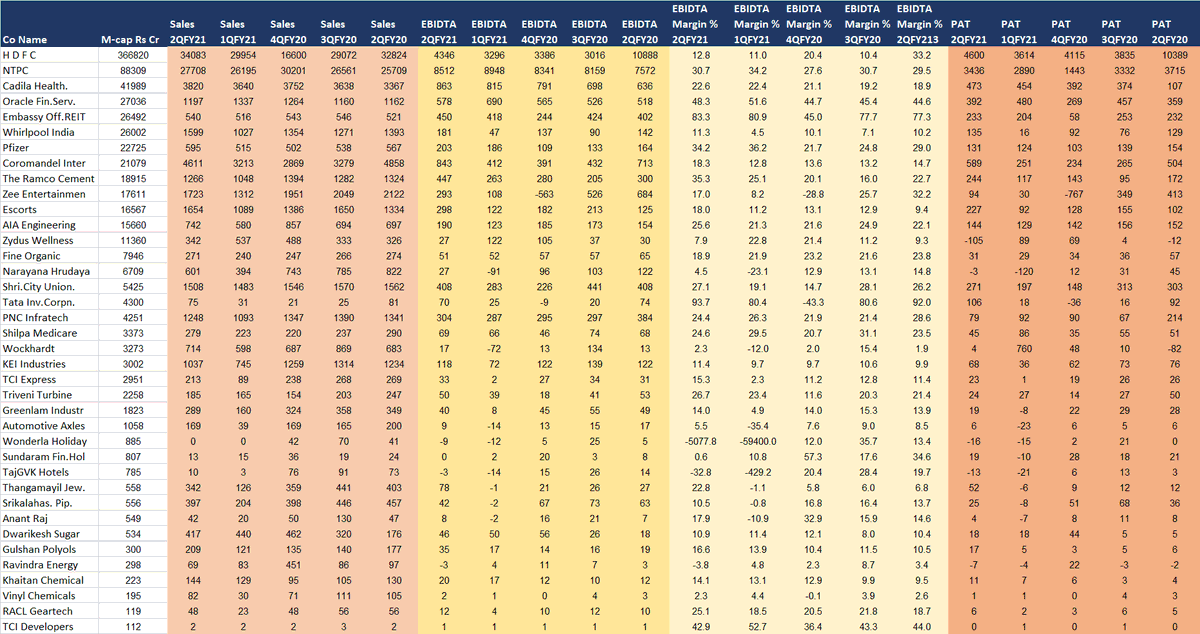

Just checking MF holdings in API basket

Laurus

M-cap 13483 cr

TTM P/E 32x

3 Years sales, pat growth >10%

Motilal: Rs 65 EPS in FY21

MF holding at 4.15% (SBI, Kotak)

Granules

M-cap 8522 cr

TTM P/E 24x

3 Years sales, pat growth >20%

Management guidance + 25% growth

MF holding NIL

Laurus

M-cap 13483 cr

TTM P/E 32x

3 Years sales, pat growth >10%

Motilal: Rs 65 EPS in FY21

MF holding at 4.15% (SBI, Kotak)

Granules

M-cap 8522 cr

TTM P/E 24x

3 Years sales, pat growth >20%

Management guidance + 25% growth

MF holding NIL

Just checking MF holdings in API basket

Solara: M-cap 3468 cr

TTM P/E 25x

TTM PAT at 130 cr vs FY19 pat at 60 cr

Rs 50 eps in FY21e?

MF holding at 5.71% (SBI, DSP, UTI)

Solara: M-cap 3468 cr

TTM P/E 25x

TTM PAT at 130 cr vs FY19 pat at 60 cr

Rs 50 eps in FY21e?

MF holding at 5.71% (SBI, DSP, UTI)

Just checking MF holdings in speciality chem co

Fairchem M-cap 2200 cr

TTM P/E 16x

3 years sales growth 40%

V less coverage by brokers despite Prem Watsa co

MF holding at 1.3% (SBI)

D: Invested via PMS and biased

Crux: VVV low MF holding in many API cos

Fairchem M-cap 2200 cr

TTM P/E 16x

3 years sales growth 40%

V less coverage by brokers despite Prem Watsa co

MF holding at 1.3% (SBI)

D: Invested via PMS and biased

Crux: VVV low MF holding in many API cos

• • •

Missing some Tweet in this thread? You can try to

force a refresh