I read King of Capital years ago and thoroughly enjoyed the story of Blackstone/Schwarzman.

Excited to hear it directly from the man himself. #SundayRead

Excited to hear it directly from the man himself. #SundayRead

“Couldn’t believe I was rejected by Harvard. I called the dean myself and demanded he let me in because I was going to be a super star. He declined. I was on the verge of tears at the prospect of settling for Yale”

Few pages in, dude already sounding like Patrick Bateman lmao.

Few pages in, dude already sounding like Patrick Bateman lmao.

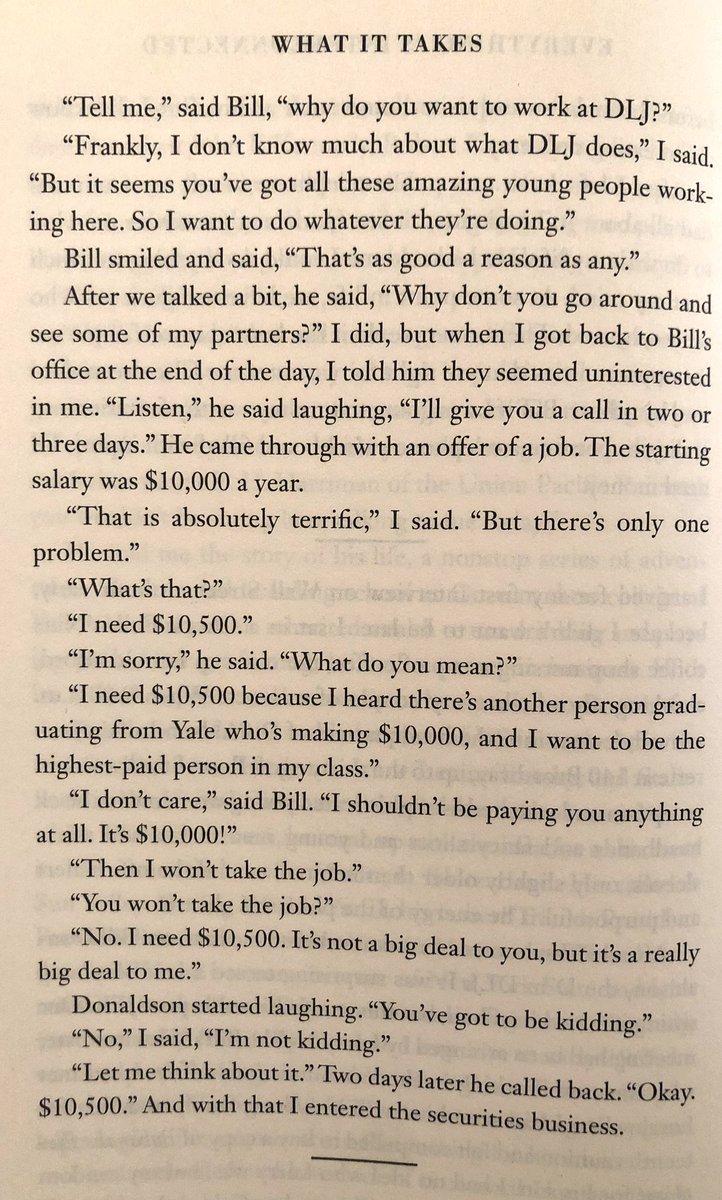

Schwarzman recalling how he got his first job on Wall Street.

Privilege, there’s levels to this shit lol.

Privilege, there’s levels to this shit lol.

@WhatBookIsIt search

• • •

Missing some Tweet in this thread? You can try to

force a refresh