1/ Notes from @mwseibel episode at @InvestLikeBest

It's the BEST episode I have listened to in 2020.

Just read the notes to get a sense why I am saying that, but better yet, just give it a listen to get the whole thing, not just the tidbits.

It's the BEST episode I have listened to in 2020.

Just read the notes to get a sense why I am saying that, but better yet, just give it a listen to get the whole thing, not just the tidbits.

2/ Seibel is "The man who gets to see the future".

So what does he see?

Today's Founders are braver. They want to attack problems that have deeper and more positive impact on society.

So what does he see?

Today's Founders are braver. They want to attack problems that have deeper and more positive impact on society.

3/ More and more founders are coming from outside the US.

I know it in my bones that talent is far from centralized in any particular region of the world. It's everywhere.

It's inevitable capitalism will find its way to get to them. It may be slow, but inevitable.

I know it in my bones that talent is far from centralized in any particular region of the world. It's everywhere.

It's inevitable capitalism will find its way to get to them. It may be slow, but inevitable.

5/ Trying to predict successful startups is a futile idea, so don't even try.

Look for: teams that can launch an MVP, have momentum, and have a camaraderie.

Look for: teams that can launch an MVP, have momentum, and have a camaraderie.

6/ Founders should be able to explain their idea to laymen. They should definitely know more about what they're building than investors.

Also, co-founders should not hate each other.

Also, co-founders should not hate each other.

7/ Once upon a time, YC also had to start from scratch. It's not just the size of check that increased, it's the YC alumni network that probably adds a lot more value than the check they sign for the startups.

8/ Silicon Valley is built to fund software companies. Sounds like an opportunity for some region to really hone their focus on non-software businesses.

Caveat: Non-software businesses are harder to build than software businesses.

Caveat: Non-software businesses are harder to build than software businesses.

9/ Ask these three questions to realize whether these problems are worth solving

I. How frequent is the problem?

II. How intense is the problem for those experiencing it?

III. Are customers willing to pay to fix it?

I. How frequent is the problem?

II. How intense is the problem for those experiencing it?

III. Are customers willing to pay to fix it?

13/ Interesting differences between first-time founders and second-time founders.

@mgirdley, you probably already listened to this, but if not, you will find it interesting.

@mgirdley, you probably already listened to this, but if not, you will find it interesting.

14/ How difficult is startup?

"Imagine if the first day you went to Yale Law School, the professor told you like only one or two of you are going to become lawyers. You'd be like, "Wait, why am I paying all this? Like, ooh, this is not what I signed up for!"

"Imagine if the first day you went to Yale Law School, the professor told you like only one or two of you are going to become lawyers. You'd be like, "Wait, why am I paying all this? Like, ooh, this is not what I signed up for!"

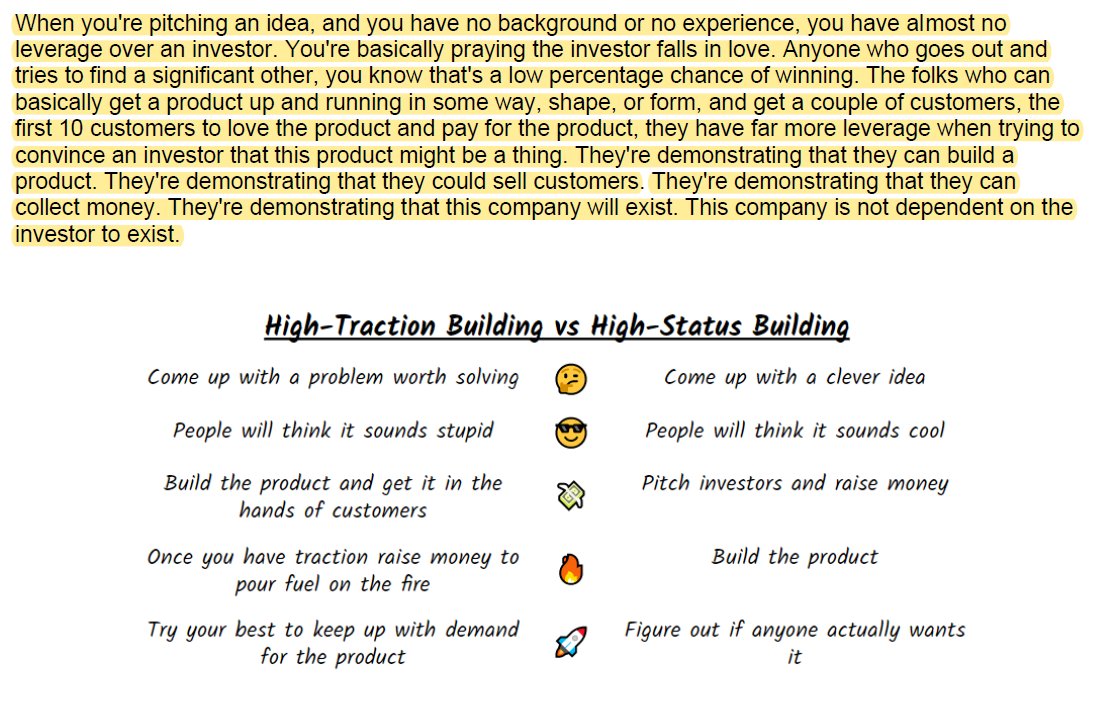

15/ "folks who can basically get a product up and running in some way, shape, or form, and get a couple of customers, the first 10 customers to love the product and pay for the product, they have far more leverage when trying to convince an investor that this might be a thing."

16/ How do you know whether you have product-market-fit?

It's not a philosophical question. If it's a fit, it will probably scream.

It's not a philosophical question. If it's a fit, it will probably scream.

End/ Episode link: investorfieldguide.com/michael-seibel…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh