Grab your hobnobs, time for my second “Behind the City Curtain” thread. This time we’ll move on to something more interesting. “Sell Side Research – What It Really Means”.

1/

1/

Buffett/Munger quotes are cheesy but this one is particularly relevant - "Show me the incentive and I will show you the outcome". Everyone alters their work/view to get themselves the best possible outcome and City analysts are no exception. So, how do they get paid?

2/

2/

Firstly, analysts are NOT paid for being right / accurate. They'll get a base salary and then bonus (which can be 100%+ of base) will be determined on their yearly ranking in various surveys and the number of interactions they have with fund managers (FM’s)

3/

3/

So, to earn more money an analyst needs fund managers to vote for them and to have a lot of conversations. You get fund manager votes and conversations by covering stuff that is relevant to them, giving them views they don't get from everyone else, and being interesting

4/

4/

The key word in the last tweet is relevant. FM's want to hear about stocks they own or want to own. FM's can't realistically invest too much in micro cap stocks so analysts will rarely dedicate much time to tiny companies (sub £100m typically).

5/

5/

Analysts also have to cover (positively) any companies which use their firm as a retained broker (more on this later), but will often just do "maintenance coverage", i.e. a 1 page summary of results / RNSs rather than any real work on the business prospects

6/

6/

Analysts are NOT paid for being right, will do real research on companies that are interesting to FM's. Tiny companies are not interesting to them, so little work will be done. Excluding the F100, this means companies from say £250-5,000m. This is where research is useful

7/

7/

So, moving on to forecasts. Analysts typically forecast numbers for the next 3 years. Aggregating all the forecasts of all analysts gives an average number called 'consensus'. It doesn't matter if consensus is right or wrong, it's what the market uses.

8/

8/

Companies and investors watch consensus, particularly for key items. Company performance is assessed, rightly or wrongly, against consensus. However.... markets are forward looking. Whether co's beat this year is less important than what happens to the outlook

9/

9/

In order to come up with forecasts, analysts have a long discussion with management and set out what they think is appropriate. Management will nudge them up or down (without being explicit). This is why forecasts are usually in a similar place across the market

10/

10/

This is why you often see companies report good numbers but the share price tanks (and vice versa). Those numbers are historic, don't matter any more. What does the next 2-3 years now look like? This is what drives share prices, as well as the trajectory of consensus

11/

11/

Analysts will periodically 'upgrade' or 'downgrade' future earnings. This is really important and moves share prices. Basically do things look better or worse now than they did before? Companies will carefully manage when analysts change their forecasts

12/

12/

Before an analyst decides to change forecasts, he will discuss this with company management who will nudge them a) in the right direction and b) whether they want that to happen or not. This is far more common for upgrades than downgrades

13/

13/

It is VERY common for management to tell an analyst to hold off upgrading their forecasts so as to give them an easier time hitting consensus. They'll say things like "lack of visibility", "high value contracts still to come in" etc etc

14/

14/

So, which analysts' numbers should you pay most attention to? The analyst who works at the retained broker will essentially put out the numbers that management has approved. Their numbers are closest to what management are forecasting. Look at these first.

15/

15/

Finally on forecasts, you may think that analysts build out huge Excel models with all 3 statements integrated, 500+ lines, multiple tabs etc. The reality is actually it's a few key line items, some hardcoded numbers and a load of irrelevant stuff. Its not rocket science!

16/

16/

Now, onto those price targets and buy/sell ratings that all analysts put out. What do these mean? NOTHING. Price targets are based on a 12 month view and are no more than an indicative of under/over valued in the short term. The valuation methodology is the useful part

17/

17/

Buy/sell ratings? An analyst who puts a Sell rating on a company will get an angry phone call from management and FM's who hold it, and probably be shunned by management and lose valuable access.

18/

18/

A Sell rating is a HUGE public commitment by an analyst which real negative connotations. As a result, these are must-read. You should always understand the bear case on a company. Lots of the points will be legitimate - is it a ST trading sell or LT business model problem?

19/

19/

I mentioned retained broker analysts before - these guys almost HAVE to maintain a Buy rating. If the house analyst has a Hold rating, you can basically read that as a Sell. Main point is that 80%+ of ratings are Buys for political reasons and Sell notes can be very valuable

20/

20/

Anyway, this has been a bit of a long winded thread. What is the real value of sell-side research? It's in the detailed notes where they discuss the business model, key drivers, SWOT, risks, what are the crucial numbers etc.

21/

21/

The PRIMARY value in research is that the analysts have access to management (so get far more background info that you'll get from RNS's) and fund managers (so understand market sentiment). You cannot get this as a retail investor, and its HUGELY valuable

22/

22/

Notes typically fall into 2 categories - maintenance and detailed. Maintenance are 1 pagers published around results / trading updates that basically summarise the information and, if relevant update forecasts. These are limited value - see @rhomboid1MF's #UPGS example below

23/

23/

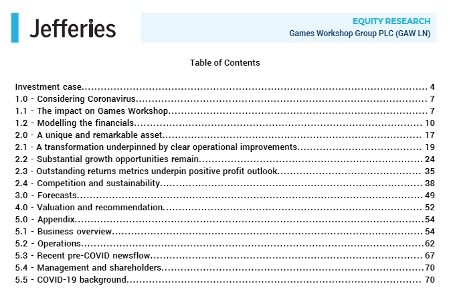

Here is another example of a detailed note that is actually useful on FinTwits darling #GAW. Contents page only but you can see the depth of analysis it goes into. Initiation notes are the best place to start to get to know a business.

24/

24/

Finally on value of research notes - most small cap brokers do "paid for" research where the Company pays them to put it out. These have some value, but big conflict of interest. Houses like Equity Development and Edison are just marketing docs from the company - zero value

25/

25/

Ideally you want notes from the proper research houses - Numis, Peel Hunt, Jefferies, Investec, Liberum, maybe Canaccord and N+1 Singers, and the global bulge bracket banks. I wouldn't place much value in Shore Capital, Cenkos, finnCap etc either (not slander, just opinion!)

26/

26/

That probably covers everything I thought would be useful/interesting on sell side research for now. Hope you found it interesting! Happy to take any questions, answer thoughts etc. Look out for my next thread which will probably be on what makes share prices move

End/

End/

• • •

Missing some Tweet in this thread? You can try to

force a refresh