There is always so much interesting stuff in the @bp_plc energy outlook. Some thoughts on my main take-aways for natural gas. 🧵bp.com/en/global/corp…

At first glance, on slide 5, natural gas looks good: it overtakes coal by 2025 and oil by 2035; renewables surpass it in 2040, but even in 2050, gas is the largest fossil fuel. This supports the thesis that gas will do relatively better in the transition.

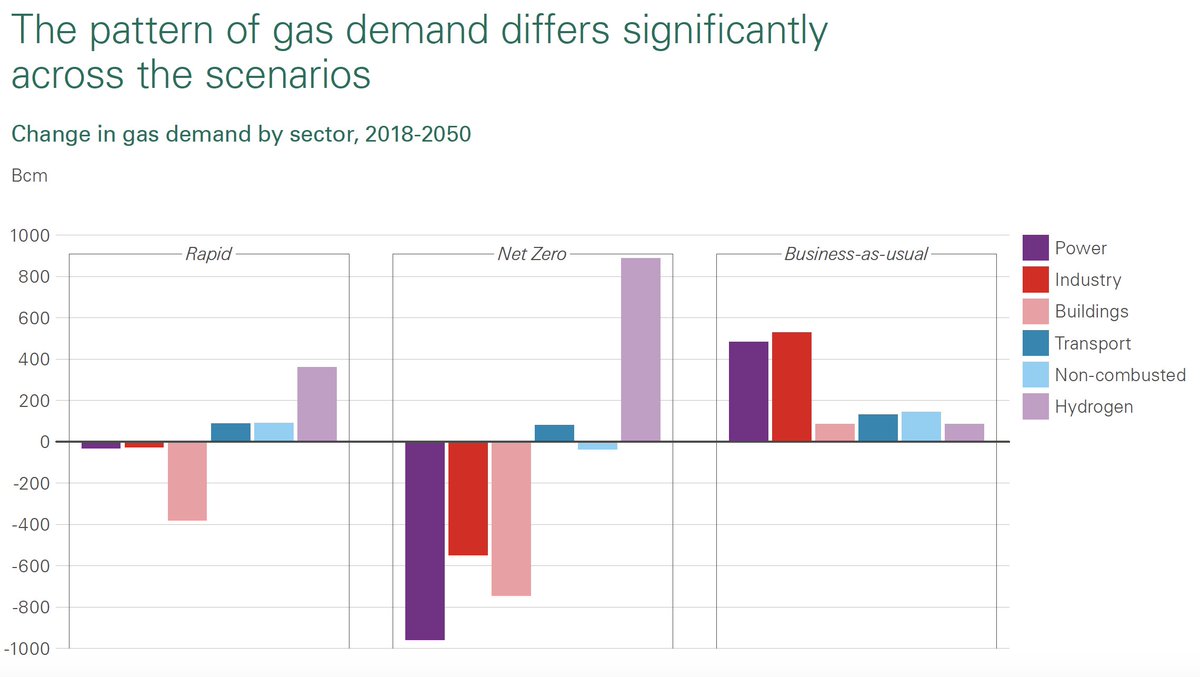

But these are percentages. In total consumption, gas defends its position in a rapid transition—growing a bit, then declining a bit. But in a "net zero" world, gas demand is near its peak already. By 2050, consumption is down by a third.

That "net zero" outlook, however, hinges on carbon capture utilization and storage and/or hydrogen. More than a third of gas used in 2050 is for hydrogen; around 3/4 of gas used is carbon abated in one way or another.

The change in how gas is being used is made clear in this chart too—in systems with very high renewables penetration there is a shrinking, not a growing role, for gas.

There has always been this assumption in the gas industry that gas is most “energy-transition-proof” investment it could make. That’s still true. But between the “rapid transition” and the “net zero” world is a shrinking market eventually. (But one that still needs investment.)

It is also a market where gas must become more expensive—in order for the carbon dioxide to be abated. Gas, which has struggled to compete on a cost basis in the last decade, now needs to become more expensive to survive. That's a tough proposition.

All the more reason to tune in when Spencer Dale comes (virtually) to @CSISEnergy to discuss the outlook with @sladislaw. Sign up here 👇 (fin). csis.org/events/online-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh