1/ Thread: Upside-down markets

@Jesse_Livermore recently wrote an intriguing piece on "upside-down markets. It's essentially a book (94 pages).

What is the upside-down market?

It is when good news works as bad news, and bad news works as good news for the market.

@Jesse_Livermore recently wrote an intriguing piece on "upside-down markets. It's essentially a book (94 pages).

What is the upside-down market?

It is when good news works as bad news, and bad news works as good news for the market.

2/ In monetary policy context, if bad news lets central banks lower interest rate and if it is lowered more than the severity of the situation at hand, overall impact on market can be positive.

But rate cuts usually don't outweigh the situation at hand.

But rate cuts usually don't outweigh the situation at hand.

3/ Fiscal policy, on the other hand, is the "cheat code".

As long as you are willing to tolerate inflation risk, if you are motivated enough, you can achieve any level of nominal growth you want.

As long as you are willing to tolerate inflation risk, if you are motivated enough, you can achieve any level of nominal growth you want.

4/ When both monetary+fiscal policy have "whatever it takes" approach, you have foundation for the upside-down market.

Let's run through what happened in the virus hit economy to explain further.

Let's run through what happened in the virus hit economy to explain further.

5/ Fed cuts interest rate to zero. Your cash/bonds earn almost or literally nothing. Stocks appear more attractive.

Ungodly amount of govt securities is issued to fund spending. Relative supply of equities in the broader investment basket appears scarce.

Ungodly amount of govt securities is issued to fund spending. Relative supply of equities in the broader investment basket appears scarce.

6/ Virus also gives good excuse for companies to cut fat and improve productivity. So margins improve.

The lost income from household gets replenished from the govt through stimulus.

Overall, if you are an equity investor, it's a bonanza!

The lost income from household gets replenished from the govt through stimulus.

Overall, if you are an equity investor, it's a bonanza!

7/ At the end of 2019, investor allocation to equities was 46.2% of total portfolio wealth.

After $7.5 Tn issuance of zero yielding bonds, this allocation dropped by 4% to 42.2%.

After $7.5 Tn issuance of zero yielding bonds, this allocation dropped by 4% to 42.2%.

8/ If investors want to have the same portfolio exposure to equity, $SPY has to reach 3900 assuming no equity issuance.

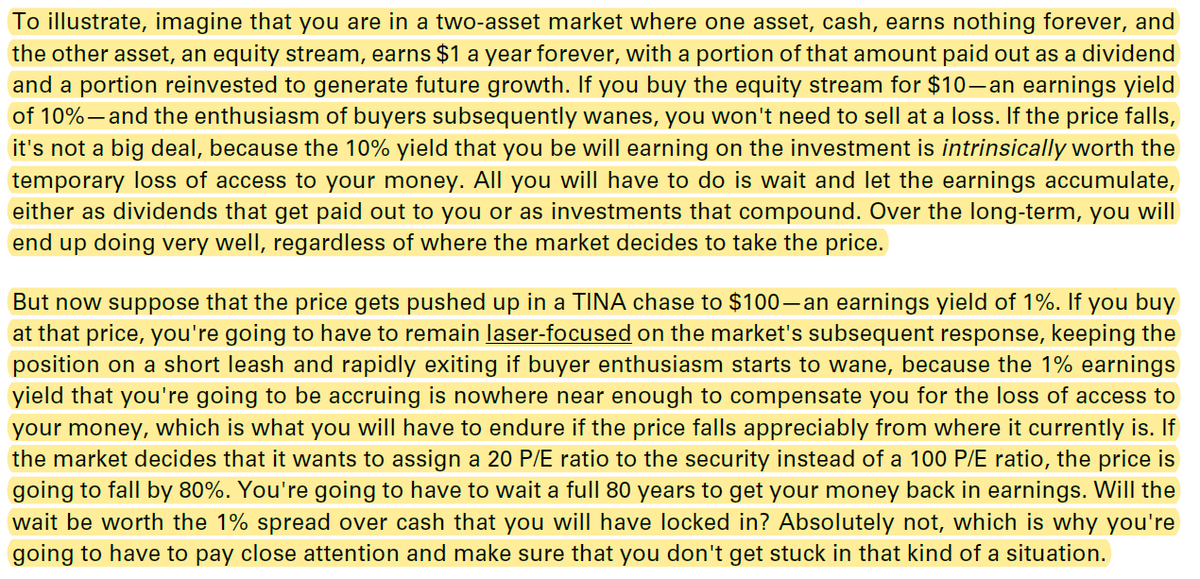

In a ZIRP world, the logic of TINA is sound, but not without inherent limitations.

In a ZIRP world, the logic of TINA is sound, but not without inherent limitations.

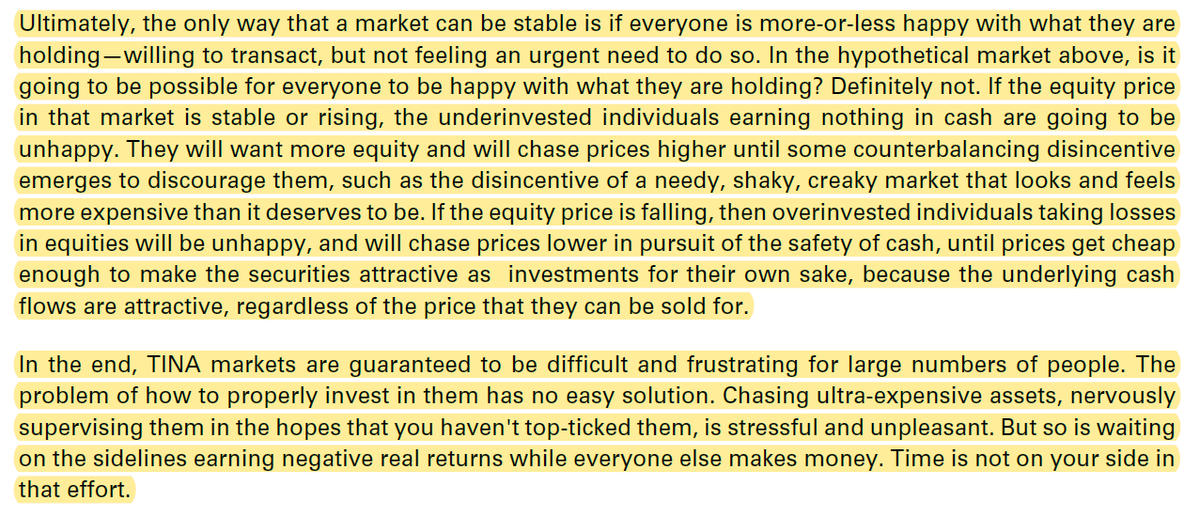

9/ TINA makes life difficult for both bulls and bears as bulls fear the music might stop anytime whereas bears suffer from FOMO.

The whole thing makes sensitive to new information.

More explanation in the images here.

The whole thing makes sensitive to new information.

More explanation in the images here.

End/ If you want to read the whole thing, you can go here: osam.com/Commentary/ups…

All my twitter threads: mbi-deepdives.com/twitter-thread…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh