Making $50,000 in sales & $30,000 in expenses

is BETTER THAN

Making $1 million sales & $990,000 expenses

The 1st scenario gives $20,000 profit, while the 2nd made HALF of what the 1st got ($10k profit)

Money Lesson: it‘s not just about what you make, it’s about what you KEEP

is BETTER THAN

Making $1 million sales & $990,000 expenses

The 1st scenario gives $20,000 profit, while the 2nd made HALF of what the 1st got ($10k profit)

Money Lesson: it‘s not just about what you make, it’s about what you KEEP

Also, you shouldn’t just get excited when people show you sales of $1m or when these YouTube ads and drop shippers tell you they’ve made $5m in sales. Sales is NOT the same as profit. Sales is NOT the amount business owners keep for themselves.

Someone making N100,000 every month and spending N80,000 every month

is financially BETTER off than

someone making N1m every month and spending N995,000 every month

Again, when it comes to money, IT’S NOT JUST ABOUT WHAT YOU MAKE, IT’S ABOUT WHAT YOU KEEP.

is financially BETTER off than

someone making N1m every month and spending N995,000 every month

Again, when it comes to money, IT’S NOT JUST ABOUT WHAT YOU MAKE, IT’S ABOUT WHAT YOU KEEP.

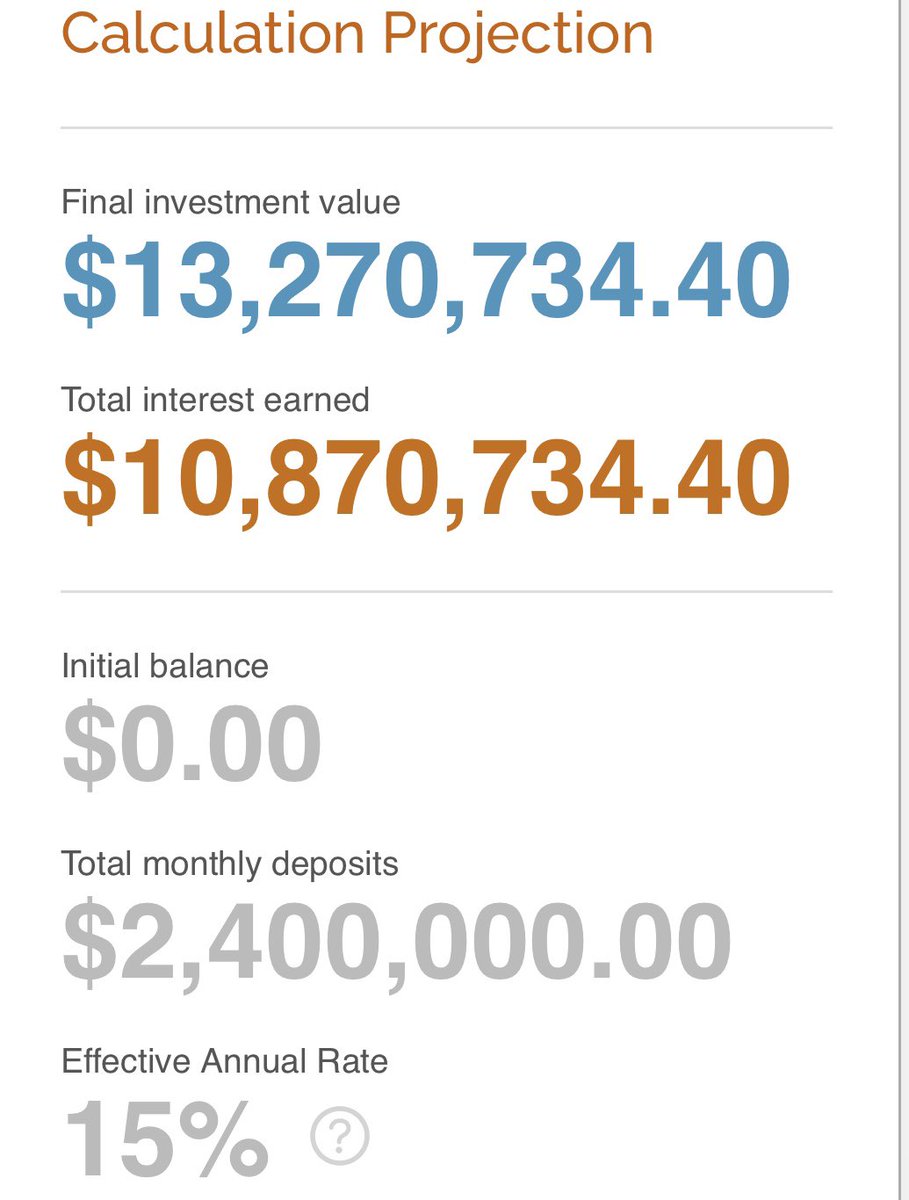

Someone INVESTING 10,000 consistently every month

in the long run, is going to be FINANCIALLY better off than

someone SAVING 50,000 every month

If you invest 10k every month for 20 years @ 15% average yearly return & reinvesting profits, you’ll have approximately 13.3m while

in the long run, is going to be FINANCIALLY better off than

someone SAVING 50,000 every month

If you invest 10k every month for 20 years @ 15% average yearly return & reinvesting profits, you’ll have approximately 13.3m while

if you save 50k every month in a safe or bank with 0 interest, you’ll have 12 million after the same 20 years.

PS: ignore the dollar sign in the screenshot. The numbers are the same irrespective of the currency you use

PS: ignore the dollar sign in the screenshot. The numbers are the same irrespective of the currency you use

Money lesson: it’s not just about how much you KEEP, it’s about how much what you keep can make you. Don’t just store, plant. Don’t just save, invest.

If you invest 100,000 in something that gives you 400% return in 2 months/years, at the end of the 2 months/years, you’ll have 500,000.

If you continue with the “something” and in the 3rd month/year, the “something” goes under, you’re 500,000 goes to 0

If you invest 100,000 in

If you continue with the “something” and in the 3rd month/year, the “something” goes under, you’re 500,000 goes to 0

If you invest 100,000 in

another something that gives 10% returns every year, by year 2, you’d have 121,000.

If by year 3, the economy goes bad and the investment gives -5% return, you’d have 114,950. Still better than where you started 3 years ago and better than 0

If by year 3, the economy goes bad and the investment gives -5% return, you’d have 114,950. Still better than where you started 3 years ago and better than 0

Money lesson: it’s not just about investing, it’s about investing wisely. Not every thing that shines is good for you to get involved in. If you shine light at the right angle on a metal trash can, it’d glitter. Doesn’t make it any less a trash can.

• • •

Missing some Tweet in this thread? You can try to

force a refresh