Mr. Anand Deshpande (@anandesh), after completing his Ph. D. in Computer Science, quit his job at HP Labs in the USA. He returned to India in 1990.

And from there started a 30 Year Transformational Journey of Persistent Systems

A thread

And from there started a 30 Year Transformational Journey of Persistent Systems

A thread

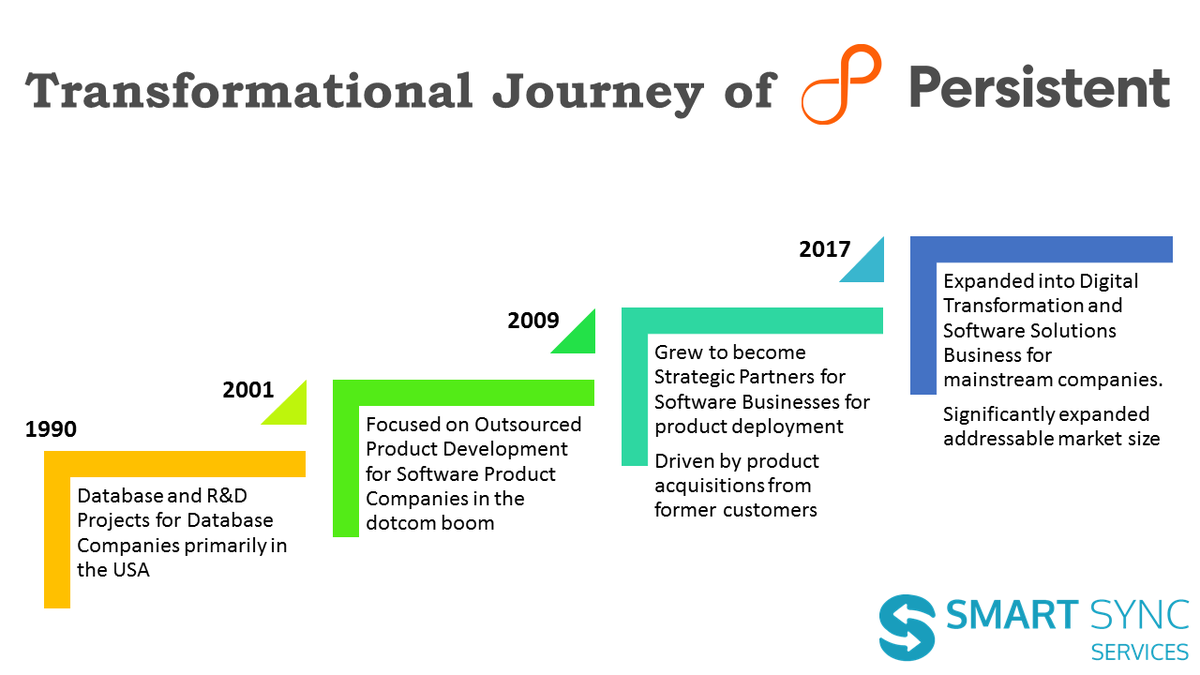

1990- 2001

Persistent at that time was a technology provider for database product companies primarily in the USA and other western countries.

Milestones in 1999

~Reached 100 employees in

~Got 1st external investor in Intel 64 Fund

~Revenue crossed 10 Cr

(1/5)

Persistent at that time was a technology provider for database product companies primarily in the USA and other western countries.

Milestones in 1999

~Reached 100 employees in

~Got 1st external investor in Intel 64 Fund

~Revenue crossed 10 Cr

(1/5)

2001-2008

~Innovation partner for software product companies

~Stayed away from the IT outsourcing services wave

~Focused on Outsourced Product Development

~Became a leader in this space

~Employees 1000

~Revenue crosses 100 Cr

~$18.8 Mn funding from Norwest & Gabriel

(2/5)

~Innovation partner for software product companies

~Stayed away from the IT outsourcing services wave

~Focused on Outsourced Product Development

~Became a leader in this space

~Employees 1000

~Revenue crosses 100 Cr

~$18.8 Mn funding from Norwest & Gabriel

(2/5)

2009-2016

~Strategic partner to leading technology companies.

~Partnerships with IBM & Salesforce

~Product development to implementing Tech solution

~2010 IPO oversubscribed 93 times

~37 offices across 17 countries & 5 continents

~Employees 5000

~Revenue crosses 1000 Cr

(3/5)

~Strategic partner to leading technology companies.

~Partnerships with IBM & Salesforce

~Product development to implementing Tech solution

~2010 IPO oversubscribed 93 times

~37 offices across 17 countries & 5 continents

~Employees 5000

~Revenue crosses 1000 Cr

(3/5)

2017 & Beyond

Digital Transformation: From helping software product or service companies, Persistent shifted to enterprises building software-driven business

~Significantly expanded the addressable market size.

~Employees 10000

~Revenues ~ USD 0.5 Billion

(4/5)

Digital Transformation: From helping software product or service companies, Persistent shifted to enterprises building software-driven business

~Significantly expanded the addressable market size.

~Employees 10000

~Revenues ~ USD 0.5 Billion

(4/5)

Of all the interviews we watched of Mr. Deshpande, this quote is our favorite:

"When you are building products, decide first on the shipping date, then on spending. The other machinery and sales will work automatically."

More to come soon on Persistent Systems!

End

(5/5)

"When you are building products, decide first on the shipping date, then on spending. The other machinery and sales will work automatically."

More to come soon on Persistent Systems!

End

(5/5)

• • •

Missing some Tweet in this thread? You can try to

force a refresh