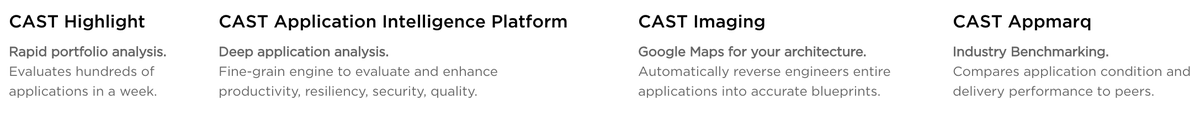

1/ New holding: Cast SA ( $cas.pa ). CAST is leader in software intelligence. Their software products represent what MRI does in healthcare. It gives visibility into code architecture, flaws, system health, cloud readiness etc. Over $160M R&D has been invested in their products.

2/ They did 33.2M € in revenue and 5.4M € in EBITDA in 2014 when they made a plan to accelerate their growth by investing heavily in their workforce and R&D, introducing a SaaS approach and indirect sales through partners.

3/ At the same time they took on board two new shareholders in CM-CIC and DevFactory (Joe Liemandt). Read more about Joe Liemandt in this Q1 2017 @greenhavenroad letter: static1.squarespace.com/static/5498841…. They bought more shares in a placing in 2018 at € 3,80 per share.

4/ Unfortunately acceleration of growth takes longer than expected, but I think we ware now close to the tipping point. After some heavy investment years with operating losses they are (again) guiding to profitability in 2020, 20% growth in 2021-2023 and sharp increase in margin.

5/Their SaaS Highlight product grew 90% to 2.37M € in 2019, 80% in H1 2020 and I think they are on track for 100% growth for FY 2020.

6/ I expect a decent part of the growth in revenue to fall straight to the bottom line. If we go with management guidance 2023 revenue would be about €75M. A conservative 15% EBIT margin gets you to €11M+ in EBIT in 2023. Shares are currently trading for 1x EV/ltm sales (€40M)

7/ For me it's hard to think of scenario's where you lose money here and a lot of reasonable scenario's where you make 5+ times your money. We have DevFactory on the board with a 28% stake and an incentivized 10% founder/CEO.

8/ If DevFactory decides it wants to acquire the company I don't think they will be able to pull it off with a lowball offer. The shareholder base is very balanced with investors CM-CIC and Long Path Partners owning 30% in total. Free float is only 7%, so only suitable for retail

• • •

Missing some Tweet in this thread? You can try to

force a refresh