We’ve just published some new research, supported by Amazon, on shopping habits during the pandemic. It corrects some of the myths and misinformation about how retail is changing. Here are ten highlights...

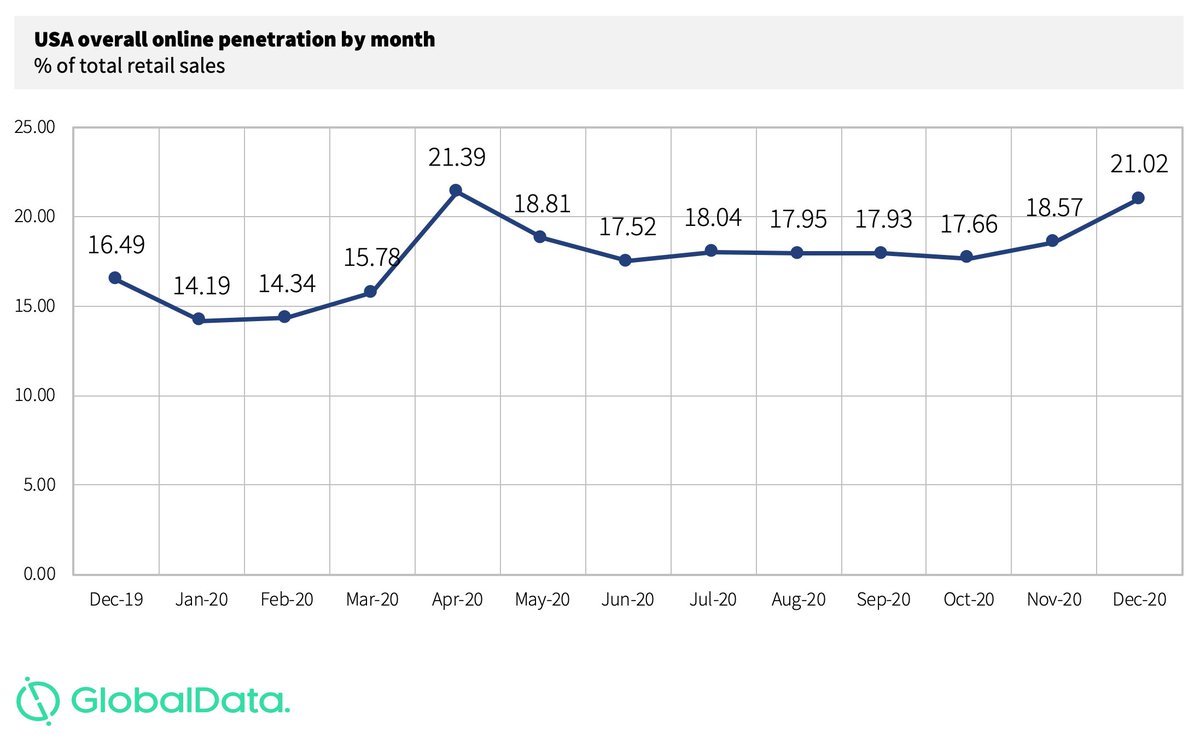

First, online sales rose sharply during the pandemic. But the channel did not dominate. Most sales during the peak of lockdown were still made at those physical stores that remained open (September onward are forecasts).

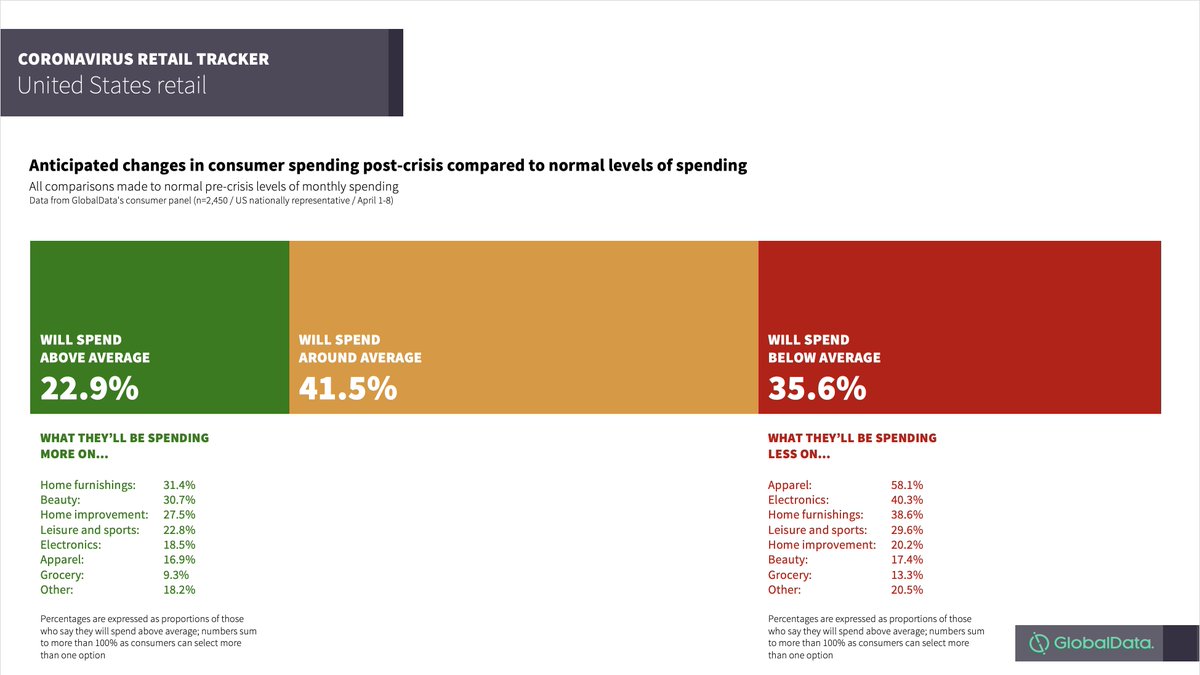

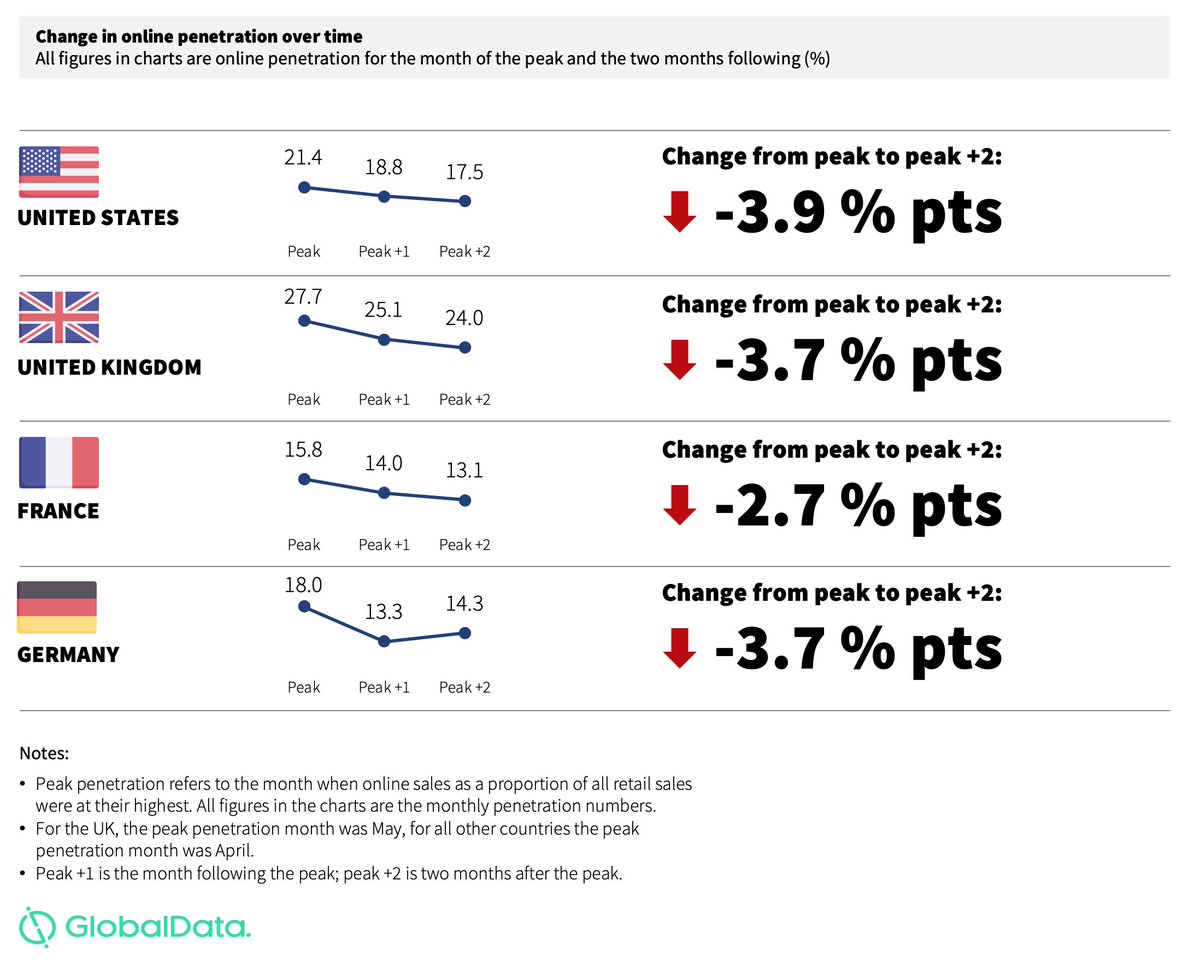

Second, the penetration rate for online is coming down as consumers resume physical shopping. Sure, penetration will remain elevated compared to 2019 but the peaks seen during lockdown were exceptional, not a new normal.

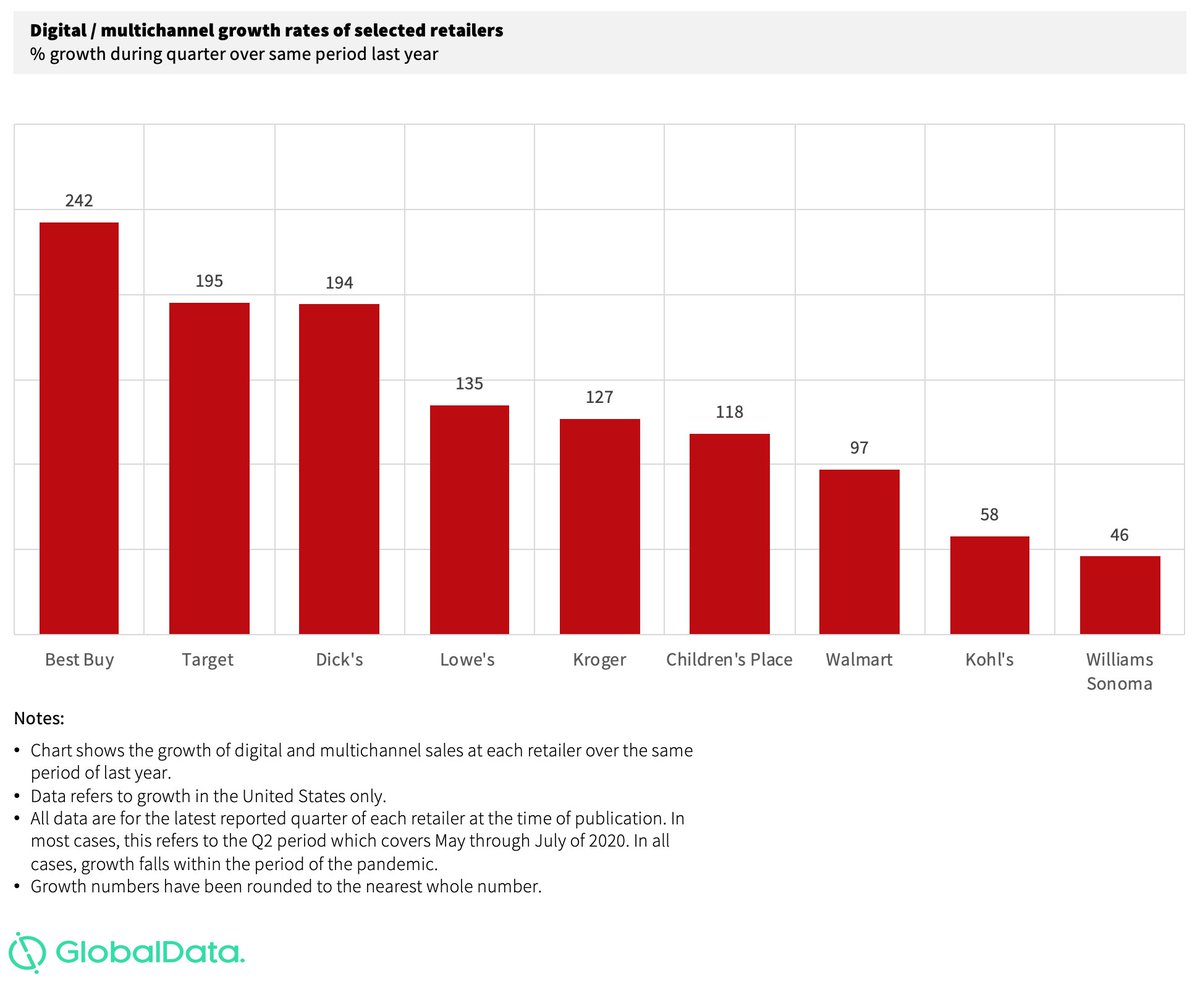

Third, the highest growth rates over the past few months have come from multichannel retailers, not from pure-play online retailers. In the US, many traditional retailers have been very innovative in using their stores to offer services like curbside pickup.

Fourth, a lot of consumers really like these new services. In the US, almost 68% of consumers say they will use curbside collection more even when the pandemic has subsided. These ‘temporary’ solutions will become permanent.

Fifth, what this means is that the role of the physical store is actually being strengthened. In the US, we project that, this year, around 35.7% of non-food sales transacted online will be supported by a physical store. This is more than in 2019.

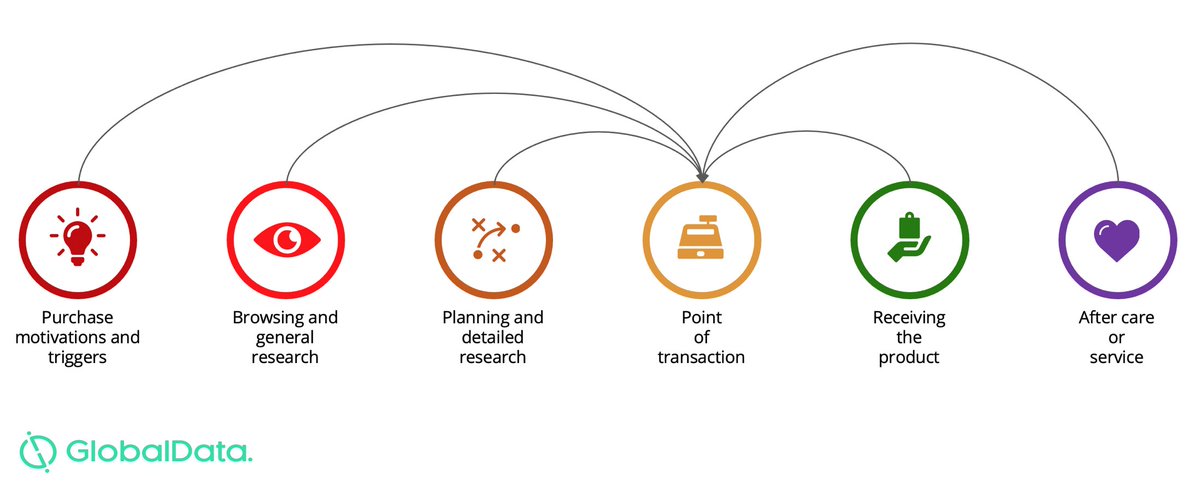

Sixth, this dynamic underlines that the idea of channels, as far as the customer is concerned, is a redundant concept. People shop seamlessly across online and physical, using both to meet their needs.

Seventh, the fact that retail is more seamless than ever presents traditional retailers with an enormous opportunity. Those that are using their physical assets to create strong multichannel offers are securing great growth.

Eighth, this should end the lie that ‘online destroyed…”. Online isn’t destroying physical retail and it never has. Most retail casualties during the pandemic (and outside of it) are because of a failure to offer consumers what they want – i.e. not getting the basics right!

Ninth, none of this means that the pandemic and online are not causing disruption. They are! And retailers need to adapt to this, including by optimizing store fleets. But narratives that this is a battle between online and stores are very wide of the mark. It's way more nuanced.

Tenth, well there isn’t really a tenth point – but you can read lots of other points and data in the full report. Download it here: bit.ly/mcretail2

• • •

Missing some Tweet in this thread? You can try to

force a refresh